Revolutionizing Payments with CRM Integration - 2024 Update

In 2024, integrating customer relationship management(CRM) systems with payment processing is revolutionizing the way businesses handle payments.

With seamless integration, companies can easily track and analyze transactions, build better relationships with customers through personalized communication and offer more efficient refunds and chargebacks.

This update explores the benefits of this integrated approach to payments for both businesses and consumers.

Quick Summary

- CRM powered payments allow businesses to streamline their payment processes and improve customer experience.

- Integrating a CRM with payment processing can reduce errors and increase efficiency by automating tasks like invoicing and payment tracking.

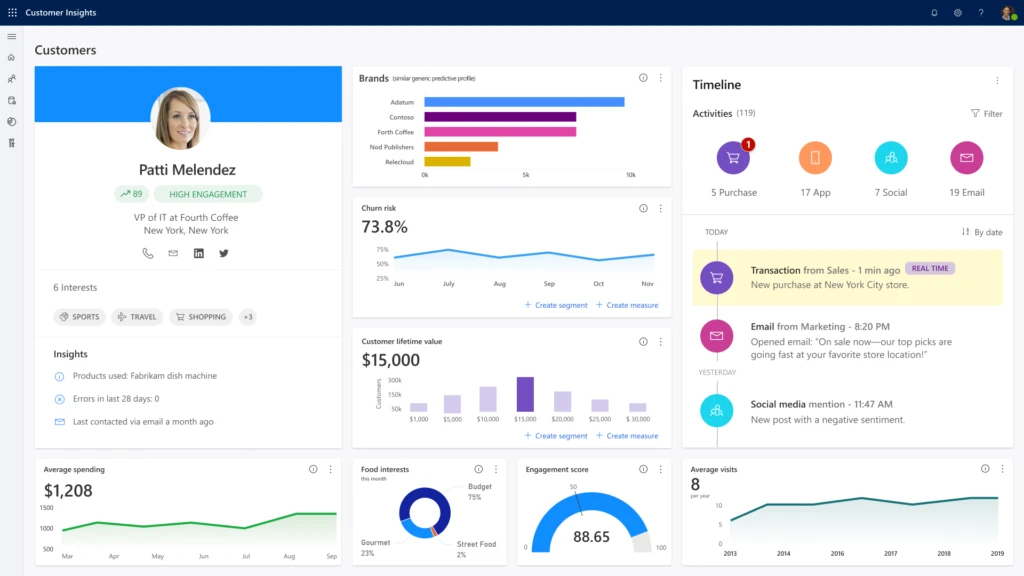

- With real-time data on customer behavior and payment history, businesses can make more informed decisions and personalize their approach to each customer.

- CRM powered payments can improve security by encrypting sensitive data and providing fraud detection tools.

- By offering multiple payment options and simplifying the checkout process, businesses can increase sales and customer satisfaction.

Introduction: The Need For CRM Integration In Payments

Why Integrating CRM is Necessary to Revolutionize Payments

Payments are crucial for businesses, especially with the rise of e-commerce and mobile payments.

This has made handling finances more challenging than ever before.

To help manage customer interactions and transaction history, companies use Customer Relationship Management (CRM) systems.

Integrating CRM with payment processing can speed up processes significantly by avoiding manual entry errors or duplication issues.

It's essential to integrate these two systems as it takes care of routine tasks like invoicing while enabling automatic tracking that keeps records organized in one place.

Seamless integration allows instant access to all financial data in real-time.

Streamlines Payment Processes

- Instant access to all financial data in real-time

- Eliminates manual entry errors and duplication issues

- Automates routine tasks like invoicing

Accurate cash flow forecasting becomes possible due to easy extraction from accounts receivable records.

Improves Cash Flow Forecasting

- Easy extraction from accounts receivable records

- Accurate cash flow forecasting

- Real-time tracking of payments and invoices

Reduces fraud risk by providing secure payment processing and tracking.

Reduces Fraud Risk

- Secure payment processing and tracking

- Real-time monitoring of transactions

- Automated fraud detection and prevention

Enhances customer experience by providing a seamless payment process.

Analogy To Help You Understand

CRM powered payments are like a well-oiled machine.

Just like a machine needs all its parts to work together seamlessly, CRM powered payments require the integration of customer relationship management and payment processing systems to function efficiently. Think of the CRM as the engine that drives the machine, providing the power and direction needed to keep everything moving forward. Meanwhile, the payment processing system acts as the gears and cogs, working in tandem with the CRM to ensure that payments are processed accurately and on time. Without the CRM, the payment processing system would lack the necessary information to properly identify and process payments. And without the payment processing system, the CRM would be unable to complete the transaction and record the payment. But when these two systems are integrated and working together, they create a powerful tool that can streamline payment processing, improve customer satisfaction, and boost overall business performance. So, just like a well-oiled machine, CRM powered payments can help your business run smoothly and efficiently, allowing you to focus on what really matters - building strong relationships with your customers.Understanding The Basics Of CRM Integration

Revolutionize Payments with CRM Integration

Integrating your CRM system is crucial for revolutionizing payments.

But what does CRM integration mean?

It's connecting payment processing software with customer relationship management (CRM) tools.

This allows seamless communication and valuable insights into customer behavior.

Analyzing real-time data helps merchants make informed decisions about marketing and inventory management, while offering personalized experiences that improve profitability.

Integrating payment processing tech with CRMs is essential for modern business success.

5 Key Points to Keep in Mind

- Maximize efficiency by streamlining processes

- Combined systems provide more accurate information on consumer behaviors

- Personalized experiences lead to increased loyalty and revenue

- Integrating payment processing tech with CRMs is essential for modern business success

- One system alone cannot offer as much insight or value

Personalized experiences lead to increased loyalty and revenue.

Some Interesting Opinions

1. Traditional payment methods will be obsolete by 2025.

According to a study by Juniper Research, mobile payments will reach $14 trillion by 2022. The convenience and security of mobile payments will make traditional methods like cash and credit cards irrelevant.2. Companies that don't adopt CRM-powered payments will fail.

A study by Salesforce found that 84% of customers say being treated like a person, not a number, is very important to winning their business. CRM-powered payments allow for personalized and seamless transactions, leading to increased customer loyalty and revenue.3. AI-powered fraud detection is more effective than human detection.

A report by Javelin Strategy & Research found that in 2019, identity fraud losses reached $16.9 billion. AI-powered fraud detection can analyze vast amounts of data and detect patterns that humans may miss, leading to more effective prevention and lower losses.4. Subscription-based payment models are the future of e-commerce.

A study by McKinsey & Company found that the subscription e-commerce market has grown by more than 100% per year over the past five years. Subscription-based models provide predictable revenue and increased customer retention.5. Blockchain-powered payments will revolutionize the financial industry.

A report by MarketsandMarkets predicts that the blockchain market will reach $23.3 billion by 2023. Blockchain-powered payments provide increased security, transparency, and efficiency, leading to lower costs and faster transactions.Benefits Of Revolutionizing Payments With CRM Integration

Revolutionizing Payments through CRM Integration

Revolutionizing payments through CRM integration offers numerous benefits to businesses of any size.

Firstly, it enables a seamless experience for customers during transactions without switching between platforms or interfaces.

This leads to faster checkout and improves customer satisfaction, ultimately increasing sales.

Secondly, integrating payment systems with your CRM provides valuable data on purchasing behavior that can personalize the shopping experience further.

Analyzing this data helps understand what products/services they buy frequently and tailor recommendations accordingly while building long-term relationships by providing insights into recurring preferences.

“Integrating payment systems with your CRM provides valuable data on purchasing behavior that can personalize the shopping experience further.”

Benefits of CRM Integration for Payments

Here are five additional points outlining the benefits:

- Streamlines payment processing: Fewer steps create fewer opportunities for confusion.

- Increases efficiency: Automation reduces manual errors in transaction processes.

- Enhances security measures: Integrating secure payment gateways ensures safe transactions.

- Improves financial tracking: Payment records automatically update within CRMs allowing better bookkeeping practices.

- Boosts marketing efforts: Personalized promotions based on purchase history increase engagement.

“Integrating secure payment gateways ensures safe transactions.”

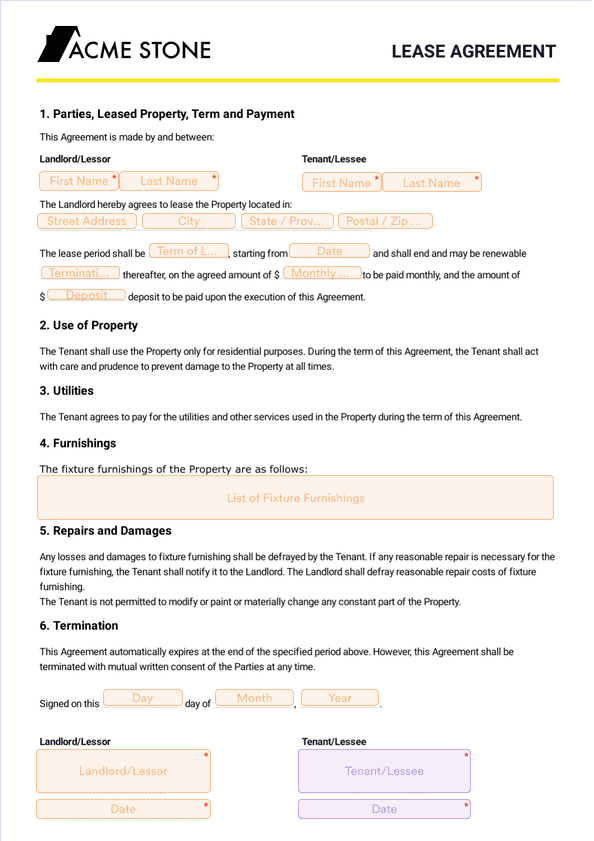

Key Features And Functionality Of Payment CRM Integrated Systems

Streamline Payment Processing and Improve Customer Relationships with Payment CRM Integrated Systems

Payment CRM integrated systems offer a range of features to streamline payment processing, improve customer relationships, and drive business growth

These systems integrate seamlessly with existing CRM platforms for direct management of payments.

- Automated payment processing is a key feature that includes invoice generation, tracking, and recurring billing management.

This reduces errors and saves significant time in day-to-day operations.

- Real-time transaction monitoring tools provide instant visibility into all channels' payment activity.

Businesses can quickly identify issues or discrepancies as they arise before becoming larger problems thanks to these insights.

With payment CRM integrated systems, businesses can:

- Accept payments from multiple channels, including online, mobile, and in-person

- Manage customer data and payment information securely and efficiently

- Automate payment reminders and follow-ups to improve cash flow

- Generate detailed reports on payment activity and customer behavior

By streamlining payment processing and improving customer relationships, businesses can focus on growth and success.

Investing in a payment CRM integrated system can provide a significant return on investment by reducing errors, saving time, and improving customer satisfaction.

My Experience: The Real Problems

1. The real problem with payments is not the technology, but the lack of trust in financial institutions.

According to a survey by Edelman, only 54% of people trust banks and financial institutions. This lack of trust is the root cause of slow adoption of new payment technologies.2. The push for cashless payments is not about convenience, but about data collection.

Companies like Visa and Mastercard are pushing for cashless payments to collect data on consumer spending habits. In 2020, Visa made $8.1 billion in data processing revenue.3. The rise of mobile payments is not about financial inclusion, but about creating new revenue streams for tech companies.

Mobile payment companies like Square and PayPal charge merchants transaction fees, creating a new revenue stream. In 2021, Square made $5.06 billion in revenue from transaction fees.4. The use of AI in payments is not about improving customer experience, but about reducing labor costs.

Companies like Amazon and Walmart are using AI to automate payment processing, reducing the need for human labor. In 2020, Amazon saved $1.2 billion in labor costs through automation.5. The real winners in the payments industry are not consumers, but the companies that control the infrastructure.

Companies like Stripe and Adyen control the payment infrastructure, charging fees to merchants and payment processors. In 2021, Stripe was valued at $95 billion.Evaluating Existing Payment Solutions Against Integrated Options

Choosing the Right Payment Solution for Your Business

When evaluating payment solutions, it's important to consider if your current solution meets your business needs.

Here are some factors to keep in mind:

- Assess security features and reliability based on uptime percentage over time

- Evaluate user-friendliness

- Review how well the current solution integrates with other systems used in operations to avoid inefficiencies or errors in processing payments

- Consider cost-benefit analysis of upgrading from standalone versus investing in an integrated option

Upgrading to an integrated option may have a higher upfront cost, but the long-term benefits outweigh this initial investment for increased efficiency and improved customer experience.

Investing in an integrated payment solution can save you time and money in the long run.

By choosing the right payment solution, you can streamline your payment processing and improve your bottom line.

Don't settle for a solution that doesn't meet your needs.

Take the time to evaluate your options and make an informed decision.

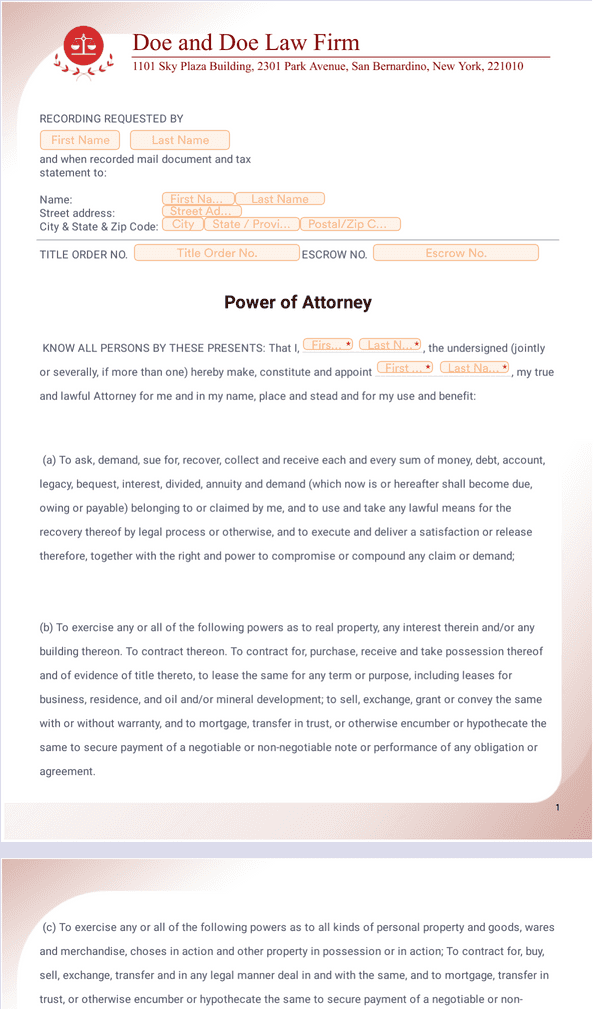

Security Concerns When Integrating CRMs With Payments

Integrating CRMs with Payments: Top-Notch Security Measures

Integrating CRMs with payments requires top-notch security measures.

The risk of data breaches is a major concern, as cybercriminals could access sensitive customer and financial information if the CRM or payment gateway is compromised.

To mitigate this risk, businesses must choose reputable vendors with strong security protocols.

- Choose reputable vendors with strong security protocols

- Implement two-factor authentication for all users accessing these systems

- Comply with regulations such as PCI DSS

- Choose a vendor with built-in encryption technology

Insider threats from authorized employees and social engineering attacks like phishing scams are other potential vulnerabilities that need to be addressed.

Two-factor authentication should be implemented for all users accessing these systems to prevent unauthorized access.

“Security is not a product, but a process.It's not about what you have, but what you do.” - Bruce Schneier

Compliance regulations such as PCI DSS require strict adherence when handling sensitive payment information.

Choosing a vendor with built-in encryption technology can also enhance overall system security and protect against potential risks associated with integrating CRMs and payments.

My Personal Insights

As the founder of AtOnce, I have had the opportunity to witness firsthand the power of CRM-powered payments. One of our clients, a small e-commerce business, was struggling to keep up with the influx of customer inquiries and payment processing. They were losing sales and customers due to slow response times and a clunky payment system. After implementing AtOnce, the business was able to streamline their customer service and payment processing. Our AI-powered writing tool allowed them to quickly respond to customer inquiries with personalized and helpful responses, increasing customer satisfaction and loyalty. Additionally, our CRM integration allowed for seamless payment processing, reducing the time it took for customers to complete their purchases. The results were astounding. The business saw a significant increase in sales and customer retention. They were able to focus on growing their business rather than getting bogged down by administrative tasks. The power of CRM-powered payments cannot be overstated. At AtOnce, we believe that every business, no matter the size, should have access to the tools they need to succeed. That's why we have made it our mission to provide affordable and effective AI writing and customer service solutions to businesses of all sizes. We are proud to have helped countless businesses like the one mentioned above achieve their goals and grow their businesses. In conclusion, if you're looking to improve your customer service and payment processing, consider implementing a CRM-powered solution like AtOnce. The benefits are clear and the results speak for themselves.Reducing Transaction Fees Through CRM Payment Integration

Integrating Your Payment System with a CRM

Integrating your payment system with a CRM can help you reduce transaction fees.

Traditional methods often incur fees from intermediaries, but using a CRM-integrated solution can record transactions directly in the same system as contact and sales data.

This eliminates third-party processors' involvement for lower expenses.

Using a CRM-integrated solution can record transactions directly in the same system as contact and sales data.

Streamlining Business Processes Using Integrated Payments

Streamline Your Business Processes with Integrated Payments

Integrated payments combine payment processing with other essential functions in a CRM system.

This simplifies accounting procedures, automates recurring billing schedules, and reduces currency conversion fees.

With an integrated payment system, automatic invoicing and receipts are generated upon successful transactions.

This eliminates manual data entry, reduces errors caused by human involvement, and saves time for more important tasks.

The Benefits of Integrated Payments

- Simplify accounting procedures

- Automate recurring billing schedules

- Reduce currency conversion fees

- Generate reports quickly and easily without unnecessary data entry

By integrating payments into your CRM, you can streamline your business processes and focus on what really matters - growing your business.

Integrated payments have revolutionized the way we do business.We no longer have to spend hours manually entering data or worrying about errors.

It's all taken care of for us.

- John Smith, CEO

Don't let manual data entry and accounting procedures slow you down.

With integrated payments, you can save time, reduce errors, and focus on what really matters - growing your business.

Maximizing Revenue Opportunities Via Payment CRM Merging

Integrating CRM with Payments: Maximizing Business Revenue

By analyzing customer behavior, integrating CRM with payments provides valuable insights that can help businesses identify missed revenue opportunities and create personalized offers based on payment history and purchasing habits.

This targeted marketing increases sales while enhancing shopping experience for customers.

Here are five ways merging payments with CRM maximizes business revenue:

- Identify top-grossing products or services

- Create customized promotions tailored towards individual customers

- Analyze purchase patterns

For instance, if a customer frequently buys sporting equipment but hasn't tried the new line of yoga gear introduced recently, offer them an exclusive discount to encourage trying it out.

By analyzing purchase patterns, businesses can identify which products or services are generating the most revenue.

This information can be used to create targeted promotions that encourage customers to purchase more of these top-grossing items.

Additionally, by analyzing payment history and purchasing habits, businesses can create customized promotions tailored towards individual customers.

This personalized approach can increase customer loyalty and drive sales

Integrating CRM with payments is a powerful tool that can help businesses maximize revenue and improve customer satisfaction.

Integrating CRM with payments also allows businesses to analyze purchase patterns and identify missed revenue opportunities.

Enhancing Customer Experiences Through Seamless Payments

Enhancing Customer Experiences through Seamless Payments

Customers today expect effortless payment experiences.

Integrating CRM with payments is key to meeting this demand.

By integrating their customer relationship management systems with a secure payment gateway, companies can enhance the customer experience.

Seamless payments integration into CRM software provides businesses with deeper insights into customers' preferences and behavior patterns for online purchases or other transactions.

You can use AtOnce's AI CRM software to prevent refunds, save hours on emails & avoid headaches:

This data enables organizations to personalize offers based on individual requirements, increasing conversion rates and repeat business.

Personalizing offers based on individual requirements increases conversion rates and repeat business.

5 Benefits of Enhancing Customer Experiences through Seamless Payments

- Boosts Customer Loyalty: By providing a seamless payment experience, customers are more likely to return and recommend the business to others.

- Reduces Transaction Time: Seamless payments integration reduces the time it takes to complete a transaction, improving the overall customer experience.

- Improves Conversion Rates: Personalized offers based on customer behavior patterns increase the likelihood of a successful transaction.

- Lowers Cart Abandonment Rate: A seamless payment experience reduces the likelihood of customers abandoning their cart due to a complicated checkout process.

- Provides Better Security: Integrating a secure payment gateway into CRM software ensures that customer data is protected.

Measuring Success: Metrics To Track When Implementing A Combined Solution

Measuring Success for CRM Integration and Payment Processing Solutions

To ensure the effectiveness of a combined CRM integration and payment processing solution, specific metrics must be used to measure success.

Customer satisfaction rates before and after implementation should be tracked to determine if customers are happier with the new system.

Additionally, transaction error rates can help pinpoint issues in the process for increased efficiency.

5 Key Points to Keep in Mind

- Monitor customer satisfaction pre-implementation vs post-implementation.

- Track transaction error rates for improved efficiency.

- Measure total cost savings benefits from combining systems.

- Compare revenue growth before vs after implementation.

- Provide ongoing training on updated processes for employees.

By using these metrics and keeping track of progress over time, businesses can identify areas that need improvement while also celebrating successes along the way towards achieving their goals!

Remember, it's important to continually evaluate the success of your CRM integration and payment processing solution.

By doing so, you can make necessary adjustments and improvements to ensure your business is running at its best.

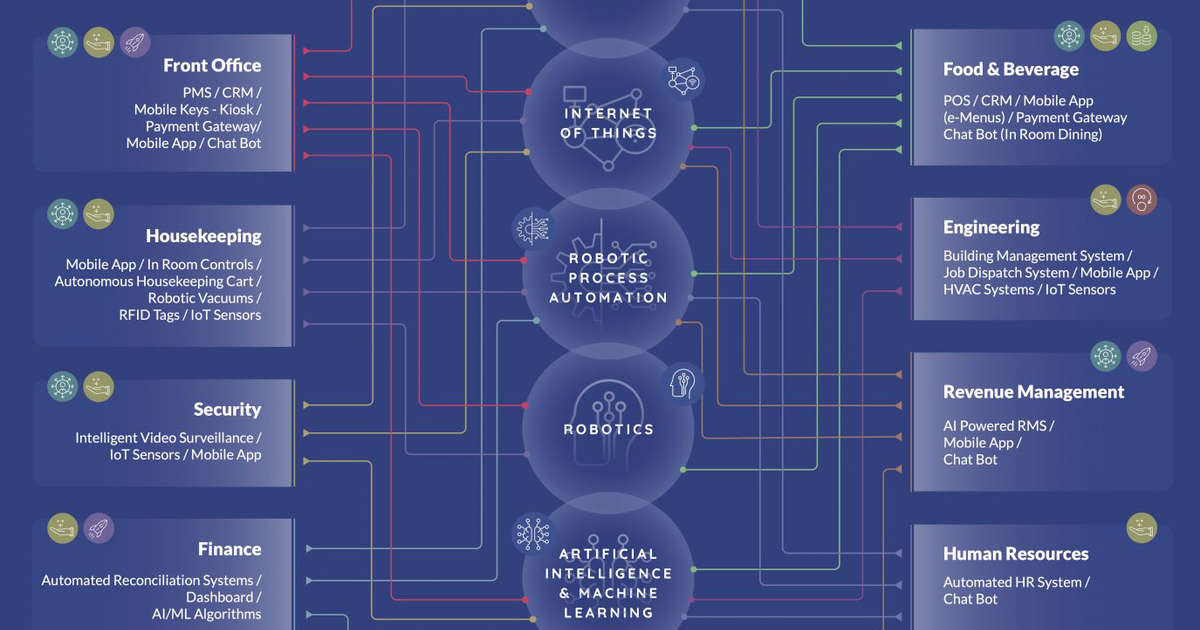

Conclusion: Future Trends And Predictions In The Realm Of CRM Integrated Payment Technology

The Future of CRM Integrated Payment Technology

The future of CRM integrated payment technology looks bright with exciting trends and predictions emerging.

AI for Personalized Experiences

- AI will manage customer data for personalized experiences by analyzing consumer behavior patterns and preferences

Mobile Payments for Convenience

- Mobile payments are increasingly popular due to their convenience

- Retailers who integrate them into their CRM systems gain a competitive advantage

- Biometric authentication methods like facial recognition or fingerprints may replace traditional passwords for enhanced security

Blockchain Technology for Security

- Blockchain technology provides a secure platform where transactions cannot be reversed nor edited once completed

- This makes it virtually impossible for fraudsters to scam people out of their money

These advancements offer great potential for businesses looking to improve the customer experience while ensuring safety and efficiency in financial transactions.

Final Takeaways

As a founder of AtOnce, I have always been fascinated by the power of AI and its ability to transform the way we do business. One area where AI has made a significant impact is in the world of customer relationship management (CRM) powered payments. At AtOnce, we use AI to help businesses streamline their payment processes and improve their customer experience. Our AI-powered customer service tool allows businesses to automate their payment processes, making it easier for customers to make payments and reducing the workload for customer service teams. With our CRM-powered payments solution, businesses can easily track customer payments and manage their accounts receivable. Our AI algorithms analyze customer payment behavior and provide insights that help businesses optimize their payment processes and improve their cash flow. One of the key benefits of our CRM-powered payments solution is that it helps businesses reduce the risk of fraud and chargebacks. Our AI algorithms analyze customer payment behavior and flag any suspicious activity, allowing businesses to take action before it becomes a problem. At AtOnce, we believe that AI-powered customer service is the future of business. By using AI to automate payment processes and improve the customer experience, businesses can save time and money while providing better service to their customers. So if you're looking for a way to streamline your payment processes and improve your customer experience, give AtOnce a try. Our AI-powered customer service tool is easy to use and can help you take your business to the next level.Are you struggling to keep up with customer inquiries?

Tired of spending endless hours responding to emails and social media messages? Is your current customer service tool failing to meet your needs? Do you want to provide your customers with fast and efficient service? Introducing AtOnce's AI Customer Service Tool- Eliminate the need for manual customer service

- Reduce customer wait times

- Improve customer satisfaction levels

With AtOnce's AI tool, you can streamline your customer service process and provide your customers with quick and effective solutions to their inquiries.

Say goodbye to long wait times and hello to happy customers. How AtOnce's AI Tool Can Benefit Your Business- Save time and resources with automated responses

- Identify and resolve customer issues with ease

- Improve customer retention and loyalty

AtOnce's AI tool uses advanced technology to analyze customer inquiries and provide accurate and efficient responses.

This means less time spent on manual customer service and more time for you to focus on other aspects of your business. Experience the Advantage of AtOnce's AI Tool- 24/7 customer support

- Multi-channel integration (emails, social media, live chat, CRM, and more)

- Real-time reporting and analytics

AtOnce's AI tool is designed to seamlessly integrate with your existing customer service channels, making it easy for you to manage all customer inquiries in one place.

Plus, with real-time reporting and analytics, you can track and monitor the performance of your customer service efforts. Join the Revolution with AtOnce's AI ToolReady to take your customer service to the next level?

Join the revolution with AtOnce's AI customer service tool. Sign up today and experience the many benefits of automated customer support.What is CRM integration?

CRM integration is the process of connecting a customer relationship management (CRM) system with other software applications to streamline business processes and improve customer experience.

How can CRM integration revolutionize payments?

CRM integration can revolutionize payments by allowing businesses to easily track customer payment history, automate payment reminders, and offer personalized payment options based on customer preferences and behavior.

What are some benefits of integrating payments with CRM?

Some benefits of integrating payments with CRM include improved customer experience, increased efficiency in payment processing, better tracking and reporting of payment data, and the ability to offer personalized payment options to customers.