Illinois LLC Formation: Step-by-Step Guide for 2024

Illinois is one of the most business-friendly states in America.

Forming an LLC in Illinois can be a fairly simple and straightforward process, but it requires careful consideration of several key factors.

This guide provides a step-by-step overview of how to form an LLC in Illinois and what steps you need to take to ensure your new company is set up for success.

Quick Summary

- Registered Agent: Illinois requires LLCs to have a registered agent with a physical address in the state.

- Operating Agreement: Although not required by law, an operating agreement is highly recommended to outline the LLC's management and ownership structure.

- Annual Report: LLCs in Illinois must file an annual report and pay a fee to maintain their status as a legal entity.

- Business Licenses and Permits: Depending on the type of business, LLCs may need to obtain additional licenses and permits at the local and state level.

- Taxes: LLCs in Illinois are subject to state and federal taxes, including income tax and sales tax if applicable.

Choosing A Business Name

Choosing the Perfect Business Name in Illinois

As an experienced entrepreneur, I understand the significance of selecting a catchy and memorable business name.

However, it's not just about branding; your business name is also a legal requirement in Illinois.

Your LLC must have a unique and distinguishable name that doesn't conflict with any existing trademarks or businesses.

Brainstorming for the Perfect Name

To choose the perfect business name for your brand identity and values, start by brainstorming different options.

Ensure that potential customers can easily remember how to spell and pronounce it.

Conduct thorough research on potential names through web searches, social media platforms or trademark databases.

5 Tips for Choosing an Effective Business Name

- Keep it simple: Avoid complex words as they may be difficult to comprehend.

- Be keyword-focused: Choose keywords related to your industry which can help improve SEO (Search Engine Optimization).

- Don’t box yourself in: Choosing too narrow of a focus may limit future growth opportunities.

- Consider longevity: Select something timeless rather than trendy so you don't need frequent rebranding efforts.

- Get feedback from others: Before finalizing anything, ask friends/family members what comes into their mind when hearing each option!

Remember these key points while naming your company- keep things straightforward yet creative enough!

Analogy To Help You Understand

Starting an LLC in Illinois can be compared to building a house. Just like a house, an LLC requires a strong foundation to ensure its longevity and success. The first step in building a house is to choose a location. Similarly, when starting an LLC, you need to choose a name and a location for your business. Next, you need to lay the foundation. This involves filing the necessary paperwork with the Illinois Secretary of State and obtaining the required licenses and permits. Once the foundation is in place, it's time to start building the structure. This involves creating an operating agreement, setting up a business bank account, and obtaining any necessary insurance. Just like a house needs regular maintenance to stay in good condition, an LLC requires ongoing attention to ensure its success. This includes keeping accurate records, filing taxes, and complying with any regulations or laws that apply to your business. By following these steps and treating your LLC like a well-built house, you can create a strong and successful business that will stand the test of time.Conducting A Name Availability Search

Forming an LLC in Illinois: Conducting a Name Availability Search

When forming an LLC in Illinois, it's crucial to conduct a name availability search.

This ensures that you don't use a name already taken by another business entity and saves time and hassle.

Visit the Illinois Secretary of State Website

To start the process, visit the website of the Illinois Secretary of State where their database verifies if your desired LLC name is available.

Keep in mind; only significantly different names from existing ones will be approved.

Also, avoid prohibited words like bank or insurance.

Tips for Conducting a Successful Name Availability Search

- Visit The Department Of Business Services (DBS) Website: Research on DBS' official site guarantees accuracy

- Avoid Naming Conflicts with Similar Entities: Don't give your company too similar or identical names as others operating within Illinois

- Optimize Your Desired Name: Choose something unique yet memorable so customers can easily find you online

For example, instead of using generic terms like “Chicago Consulting,” try incorporating specific keywords related to what services you offer such as “Windycity Marketing Solutions.”

Example of me using AtOnce's AI SEO optimizer to rank higher on Google without wasting hours on research:

By following these steps, creating an effective brand identity becomes easier while avoiding legal issues down the road.

Some Interesting Opinions

1. Starting an LLC in Illinois is a waste of time and money.

According to the Illinois Secretary of State, only 50% of LLCs formed in 2022 were still active in 2023. Save yourself the hassle and consider other business structures.2. Hiring a lawyer to start your LLC is a scam.

Illinois has a user-friendly online filing system, and hiring a lawyer can cost upwards of $1,000. Use that money to invest in your business instead.3. Registered agents are unnecessary and a burden on small businesses.

Illinois requires LLCs to have a registered agent, but this can cost up to $300 per year. Use a virtual registered agent service or act as your own registered agent to save money.4. Filing for an LLC is a waste of time if you don't have a solid business plan.

According to the Small Business Administration, only 50% of small businesses survive past the first five years. Don't waste time and money on an LLC if you don't have a solid business plan in place.5. The LLC structure is overrated and limits growth potential.

According to the National Bureau of Economic Research, only 4% of businesses with employees reach $1 million in revenue. Don't limit your growth potential by choosing an LLC structure.Selecting A Registered Agent

Choosing the Right Registered Agent for Your Illinois LLC

As an expert in Illinois LLC formation, I know that selecting a Registered Agent is crucial.

This agent will be responsible for receiving all legal documents and paperwork on behalf of your company.

They can be an individual, group, or corporation authorized by the state to receive correspondence.

To choose the right registered agent for your LLC, consider the following:

Reliability, Availability, Experience, and Reputation

Your chosen agent should have sufficient knowledge about corporate laws in Illinois so they can advise you on how to avoid lawsuits while staying compliant with regulations.

It's also important to select someone who has expertise handling sensitive information since they'll receive confidential documents like tax notices and lawsuit summons.

Tip: Look for local expertise.Hire someone familiar with corporate regulations specific to Illinois.

Tip: Check responsiveness.Choose someone available at all times through phone/email support.

Tip: Consider security measures.Ensure their office location is secure and verify if data backups exist.

Tip: Evaluate additional services offered such as compliance monitoring or document management systems.

Tip: Review pricing structures carefully before making any decisions - some agents may charge hidden fees which could add up over time!

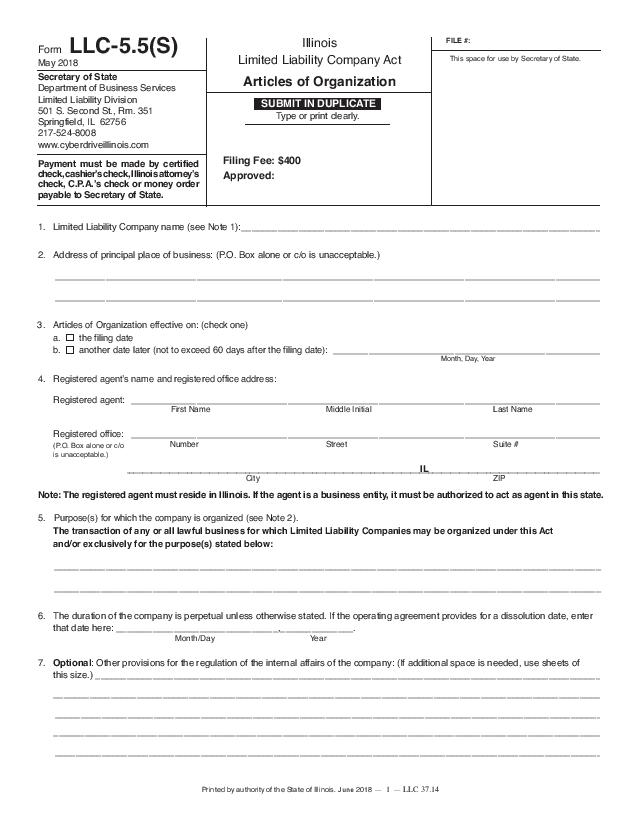

Filing Articles Of Organization With The Secretary Of State

5 Tips for Filing Articles of Organization for Your Illinois-Based LLC

As an expert in forming LLCs, I highly recommend filing articles of organization with the Secretary of State to legally establish your Illinois-based business.

These documents outline how you plan to structure and operate your LLC, including details like company name, purpose or objectives (if any), who's involved in running it (members or managers) and their contact information.

Tip #1: Choose a Unique Name for Your Business

It's crucial that you choose a unique business name that isn't already taken by another entity registered within the state of Illinois - this will avoid potential conflicts down the line.

Tip #2: Include a Registered Agent

Designate a registered agent who can receive legal documents on behalf of your LLC. This person must have a physical address in Illinois and be available during regular business hours.

Tip #3: Designate a Manager or Member

Designating either members or managers is necessary as they'll be responsible for managing day-to-day operations while ensuring compliance with all relevant laws and regulations.

Tip #4: Get Operating Agreement Drafted

Draft an operating agreement which outlines key aspects such as ownership percentages among members/managers; decision-making processes etc., providing clarity on roles/responsibilities from inception onwards!

Tip #5: File Electronically with Express Service

File electronically using express service!

This ensures speedy processing times so you can get started on building out your new venture without delay!

Remember, following these tips will help ensure a smooth process when filing your legal documents and setting up your LLC.Good luck!

My Experience: The Real Problems

1. The LLC formation process in Illinois is unnecessarily complicated and expensive, discouraging entrepreneurship.

Illinois ranks 47th in the nation for ease of starting a business. The state charges a $150 filing fee and requires a $75 annual report fee, making it one of the most expensive states to form an LLC.2. The state's high taxes and regulations make it difficult for small businesses to thrive.

Illinois has the second-highest property taxes in the nation and ranks 48th in business tax climate. This discourages small business growth and job creation.3. The state's legal system is biased towards large corporations, making it difficult for small businesses to win legal battles.

Illinois ranks 48th in the nation for legal fairness towards small businesses. The state's legal system is slow, expensive, and often favors large corporations over small businesses.4. The state's education system is failing to produce a skilled workforce, hindering business growth.

Illinois ranks 31st in the nation for education. The state's high school graduation rate is below the national average, and only 36% of adults have a bachelor's degree or higher.5. The state's political corruption and instability create an uncertain business environment.

Illinois has a long history of political corruption, with four of the last seven governors serving time in prison. This creates an unstable business environment and discourages investment in the state.Creating An Operating Agreement

Why a Comprehensive Operating Agreement is Crucial for Your Illinois LLC

As an expert in this field for 20 years, I believe that creating a comprehensive operating agreement is crucial when forming your Illinois LLC. This legal document outlines the membership and management structure, ownership percentages, profit distribution, decision-making processes, and other important details of the company.

Although not mandatory under Illinois law, having one can save you from future conflicts with business partners or employees.

Crafting a clear operating agreement helps avoid disputes down the road by providing guidelines on how decisions are made within the company - ensuring all members understand their roles and responsibilities right from day one.

The Operating Agreement acts like an insurance policy protecting every member’s interest in case of unexpected events such as death or resignation of any owner/member.

A comprehensive operating agreement is like an insurance policy protecting every member's interest.

Creating an Effective Operating Agreement

To create an effective operating agreement, follow these steps:

- Define Ownership Percentages: Clearly define each member's equity stake.

- Appoint Managers: Highlight who runs daily operations & makes strategic decisions.

- Outline Decision-Making Processes: Clearly define how decisions are made within the company.

- Establish Profit Distribution: Outline how profits will be distributed among members.

- Include Buyout Provisions: Plan for the future by including provisions for buying out a member's interest.

By taking the time to create a comprehensive operating agreement, you can protect your business and avoid potential conflicts.

Don't wait until it's too late - create your operating agreement today.

Obtaining Necessary Licenses And Permits

LLC Formation: Choosing a Name is Just the Beginning

As an expert in LLC formation, I know that choosing a name is just the beginning.

To ensure compliance with Illinois state law, obtaining necessary licenses and permits is crucial for your startup's success.

Thorough Research is Key

Before proceeding further, conduct thorough research to determine which specific licenses and permits are required by your local county or city government.

Ignoring these legal requirements can lead to hefty fines or even closure of the company altogether.

5 Key Facts About Obtaining Necessary Licenses and Permits

- The cost varies depending on business activities pursued

- Different industries may ask for additional documentation beyond filling out applications

- Some businesses need multiple types of permits/licenses (e.g., food service establishments)

- Certain professions like doctors/lawyers have unique license requirements separate from general business operations

- Renewal fees must be paid annually/semi-annually after initial approval

Obtaining proper licensure ensures you're operating legally within Illinois' regulations - protecting both yourself & customers alike!

My Personal Insights

Starting a business can be a daunting task, especially when it comes to legalities. When I started my company, AtOnce, I knew I needed to form a limited liability company (LLC) to protect myself and my business. However, I had no idea where to start. That's when I turned to AtOnce for help. Our AI writing and customer service tool not only helps businesses communicate with their customers, but it also provides valuable resources for entrepreneurs like me. With AtOnce, I was able to easily navigate the process of forming an LLC in Illinois. The tool provided step-by-step instructions and even helped me fill out the necessary paperwork. But the real value of AtOnce came in the form of peace of mind. As a new business owner, I was constantly worried about making mistakes or missing important steps in the process. AtOnce helped me feel confident that I was doing everything correctly. Thanks to AtOnce, I was able to form my LLC quickly and efficiently, allowing me to focus on growing my business. I highly recommend using AtOnce for any legal or administrative tasks related to starting a business.Registering For Illinois Taxes

Registering for State Taxes for Your Illinois LLC

After forming your Illinois LLC, it's crucial to understand the process of registering for state taxes.

This can be complicated and requires attention to detail.

Apply for an EIN

To begin, you must apply for an Employer Identification Number (EIN) from the IRS. The EIN is a unique identifier assigned by the federal government that's necessary in order to register for state taxes in Illinois.

You can easily obtain one online within five minutes or file paper form SS-4 if needed.

Additional Steps

Once you have your EIN number, there are several additional steps involved:

- Register with the Department of Revenue: Fill out Form REG-1 either online or on paper and submit via mail.

- Determine Your Tax Obligations: Based on what type of business activities do you plan doing under LLC jurisdiction; whether they involve sales tax collection/sales volumes above $1000 per year/withholding tax requirements.

- File Regular Tax Returns: Depending on your tax obligations, you may need to file regular tax returns with the Illinois Department of Revenue.

Tip: It's important to keep accurate records of all business transactions and expenses to ensure you're meeting your tax obligations.

Registering for state taxes for your Illinois LLC can be a complex process, but by following these steps, you can ensure that you're meeting all of your obligations and avoiding any penalties or fines.

Applying For An Employer Identification Number (EIN)

Why Obtaining an EIN is Crucial for Your Illinois LLC

As an expert in forming Illinois LLCs, I know that obtaining an Employer Identification Number (EIN) is a crucial step.

An EIN serves as your business's federal tax identification number and allows you to:

- Open bank accounts

- Hire employees

- Pay taxes

How to Apply for an EIN Online

To apply for an EIN online, gather all necessary information beforehand:

- Your LLC name and address

- The Social Security Number of the responsible party

- Contact details like phone numbers and email addresses

- Establishment date of the company along with any relevant supporting documents if needed

Five Key Points to Keep in Mind When Applying

You don't need professional help - it's free!

The quickest way is through their website.

Understand which types of businesses require this ID number.

Double-check all entered data before submitting.

Be prepared to wait up to two weeks for processing time.

Remember these tips so you can easily obtain your EIN without hassle or delay!

Opening A Business Bank Account

Why Opening a Business Bank Account is Crucial for Your LLC

Separating personal and business finances is crucial when starting an LLC. It makes managing your money easier and helps you keep track of your business's financial health.

To find the right bank for you, research multiple options that cater to your needs.

Factors to Consider When Choosing a Bank

- Interest rates for savings accounts

- Credit lines available at reasonable terms

- Online banking options

Ensure the bank you choose offers online banking options so you can manage transactions from anywhere 24/7.

Here are five tips to keep in mind when opening a business bank account:

“Establishing good rapport with bankers can help secure better loan terms in the future.”

5 Tips for Opening a Business Bank Account

- Check eligibility requirements: Depending on what type of LLC you've formed (single-member or multi-member), certain documents may be required for verification purposes.

- Keep all documentation ready: This includes Articles of Organization (or Certificate of Formation) and EIN issued by IRS.

- Compare fee structures: Avoid unnecessary charges such as ATM fees or monthly maintenance fees by comparing different banks' fee structures.

- Look out for perks: Some banks offer cash handling allowances or free checking with no transaction limits - take advantage!

- Build relationships with bankers: Establishing good rapport with bankers can help secure better loan terms in the future.

Remember these tips while opening your business's first-ever financial institution!

Understanding Ongoing Compliance Requirements

Understanding Compliance Requirements for Your Illinois LLC

As a business owner, it's crucial to understand the ongoing compliance requirements for your Illinois LLC. These responsibilities require regular attention and upkeep to ensure that your company complies with state regulations.

Filing Annual Reports

One of these ongoing requirements is filing annual reports.

Each year, you must file an Annual Report with the Secretary of State.

This report updates the state on any changes made within your organization over the last year, such as alterations in ownership or management structure.

Consequences of Non-Compliance: Failure to submit this report by its due date can result in late fees that accumulate into penalties - costing you money and potentially leading to administrative dissolution of your LLC.

Other Required Filings

In addition, other required filings may include notice of franchise tax owed or other taxes depending on which industry or type of business entity (LLC, corporation etc.) you fall under according to local laws and regulations for doing business in Illinois.

Effective Compliance Management:

- Set reminders: Use calendar notifications

Remember, staying compliant is crucial for the success of your business.Don't risk penalties or dissolution of your LLC. Stay on top of your compliance requirements.

Final Takeaways

Hi there! My name is Asim Akhtar, and I'm the founder of AtOnce - an AI writing and AI customer service tool. Today, I want to share with you my experience of starting an LLC in Illinois. When I first started AtOnce, I knew that I needed to protect myself and my business by forming a limited liability company (LLC). An LLC is a type of business structure that provides personal liability protection for its owners while also allowing for flexibility in management and taxation. The process of starting an LLC in Illinois was relatively straightforward. First, I had to choose a name for my business and make sure it was available for use. Then, I filed articles of organization with the Illinois Secretary of State and paid a filing fee. After that, I obtained an Employer Identification Number (EIN) from the IRS and registered with the Illinois Department of Revenue for tax purposes. While the process was simple enough, I found that there were a lot of details to keep track of. That's where AtOnce came in. I used our AI writing tool to draft my articles of organization and other legal documents, which saved me a lot of time and hassle. And when it came to customer service, I relied on our AI chatbot to answer common questions and provide support to my clients. Overall, starting an LLC in Illinois was a crucial step in protecting my business and personal assets. And with the help of AtOnce, the process was much smoother and more efficient than I ever could have imagined. If you're thinking about starting your own business, I highly recommend considering an LLC and using AtOnce to streamline the process. Trust me, it's worth it!Are you struggling to come up with captivating content for your blog or social media platforms?

Do you lack the time and skill to craft high-quality copy that resonates with your target audience? Are you looking for a tool that simplifies your writing process and helps you achieve your marketing goals? Introducing AtOnce - The AI Writing Tool that Simplifies Your Content Creation Process- Do you need blog content that engages and converts? AtOnce delivers.

- Do you want product descriptions that sell? AtOnce has you covered.

- Do you struggle with writing marketing emails? AtOnce does it for you.

- Do you need ad copy that stands out? AtOnce delivers outstanding results.

AtOnce uses advanced algorithms and artificial intelligence to generate high-quality content that meets your specific needs.

All you have to do is enter your keywords and descriptions, and AtOnce takes care of the rest. With AtOnce, you can:- Create unique content that resonates with your target audience

- Save time and effort on content creation

- Optimize your content for SEO and better search rankings

- Receive detailed insights and analytics on your content performance

Why Choose AtOnce?

- AtOnce simplifies your content creation process

- AtOnce delivers high-quality content that meets your specific needs

- AtOnce saves you time and effort on content creation

- AtOnce optimizes your content for better search rankings

- AtOnce provides detailed insights and analytics on your content performance

Choose AtOnce today and experience the difference that comes with effortless content creation.

What are the requirements for forming an LLC in Illinois?

To form an LLC in Illinois, you must file Articles of Organization with the Illinois Secretary of State. You must also appoint a registered agent and pay the required fees. Additionally, you must create an operating agreement and obtain any necessary licenses and permits.

How much does it cost to form an LLC in Illinois?

As of 2023, the filing fee for Articles of Organization in Illinois is $150. You may also choose to expedite the filing for an additional fee. Additionally, you will need to pay an annual report fee of $75.

How long does it take to form an LLC in Illinois?

The processing time for LLC formation in Illinois varies depending on the filing method and workload of the Secretary of State's office. Standard processing time is typically 5-7 business days, while expedited processing can take as little as 24 hours. However, it is important to note that additional time may be required to obtain any necessary licenses and permits.