Nebraska LLC Formation: Easy Steps for 2024 Success

Nebraska LLC formation is a relatively simple process that can have immense benefits for entrepreneurs and businesses in the state.

By following a few straightforward steps, aspiring business owners can establish their company as an LLC and secure liability protection, tax advantages, and other perks.

In this article, we will outline those steps to help you achieve success in 2024.

Quick Summary

- Nebraska LLCs must have a registered agent to receive legal documents on behalf of the company.

- LLCs in Nebraska must file an annual report and pay a fee to maintain their status as a legal entity.

- Nebraska LLCs are subject to state taxes and may also be subject to local taxes depending on the location of the business.

- LLCs in Nebraska must have an operating agreement that outlines the ownership structure and management of the company.

- Nebraska LLCs may need to obtain licenses and permits depending on the nature of their business and location.

Choosing A Business Name For Your Nebraska LLC

Giving Your Nebraska LLC the Perfect Name

Hey there, I'm Asim Akhtar - a seasoned entrepreneur who has helped countless businesses succeed over the past two decades.

Today, we're going to dive into one of the most crucial steps in forming your Nebraska LLC: choosing a business name.

Your company's name is more than just an identifier; it's also a key piece of branding that can make or break your success.

Your chosen moniker should be unique and memorable while clearly conveying what type of products or services you offer.

Before settling on any ideas for names, ensure they haven't already been taken by another company in Nebraska - this could save you from legal trouble down the road if someone tries claiming that trademark later on.

Your company's name is more than just an identifier; it's also a key piece of branding that can make or break your success.

Expert Tips for Choosing Your Business Name

To help guide you through selecting your perfect business name, here are some expert tips

- Keep it simple and easy to remember

- Choose something reflective of what sets you apart from competitors

- Avoid generic words like services or solutions

For example:

Bad Name: ABC Solutions LLC

Good Name: AtOnce Marketing Agency

By following these guidelines when brainstorming potential names for your new venture, not only will customers have an easier time remembering who you are but investors may take notice as well!

Analogy To Help You Understand

Starting an LLC in Nebraska is like building a house. Just like a house, your LLC needs a strong foundation to ensure its longevity. The first step is to choose a name for your LLC that is unique and not already taken by another business in Nebraska. This is like choosing the location for your house, it needs to be in a place that is accessible and not already occupied by another house. Next, you need to file the Articles of Organization with the Nebraska Secretary of State. This is like obtaining the necessary permits and approvals from the local government before you can start building your house. After that, you need to create an operating agreement that outlines the rules and regulations of your LLC. This is like creating the blueprint for your house, it ensures that everyone involved in the construction process is on the same page and knows what to expect. Once you have all the necessary documents and agreements in place, you can start conducting business as an LLC in Nebraska. This is like finally being able to move into your newly built house and start living in it. Just like building a house, starting an LLC in Nebraska requires careful planning and attention to detail. But with the right foundation and structure in place, your LLC can thrive and grow for years to come.Registered Agent Requirements In Nebraska

Forming an LLC in Nebraska: The Importance of a Registered Agent

As someone with over 20 years of experience in the industry, I know firsthand how crucial it is to follow all legal formalities when forming an LLC in Nebraska.

One such requirement that you must keep in mind is having a registered agent for your company.

A registered agent acts as your business's point of contact with the state government and receives essential documents or notices on its behalf.

To become a registered agent in Nebraska, you need to have a legitimate physical address within state boundaries.

Why a Reliable Registered Agent is Essential

It's important to choose someone who can be available during typical business hours so they won't miss any critical messages from the Secretary of State's office.

Moreover, designating backup agents is advisable just in case something happens to your primary representative; this way there will always be someone authorized by law to receive and forward vital information regarding lawsuits or other official documentation.

A registered agent acts as your business's point of contact with the state government and receives essential documents or notices on its behalf.

Designating backup agents is advisable just in case something happens to your primary representative.

Key Takeaways:

Some Interesting Opinions

1. Starting an LLC in Nebraska is a waste of time and money.

According to the Small Business Administration, only 50% of small businesses survive past the five-year mark. Why bother with the hassle of forming an LLC when the odds are already against you?2. The state of Nebraska's business regulations are suffocating.

Nebraska ranks 44th in the nation for business friendliness, according to the Tax Foundation. The state's high corporate income tax rate and burdensome regulations make it difficult for small businesses to thrive.3. Hiring employees in Nebraska is a nightmare.

Nebraska has some of the strictest employment laws in the country, including mandatory workers' compensation insurance and strict anti-discrimination laws. This makes it difficult and expensive for small businesses to hire and retain employees.4. Nebraska's economy is stagnant and offers little opportunity for growth.

Nebraska's GDP growth rate has been consistently below the national average for the past decade, according to the Bureau of Economic Analysis. This means that starting a business in Nebraska is unlikely to lead to significant growth or success.5. The cost of living in Nebraska is too high for entrepreneurs.

Nebraska's cost of living is higher than the national average, according to the Council for Community and Economic Research. This means that entrepreneurs will have to spend more money on basic necessities, leaving less capital for investing in their businesses.Articles Of Organization Filing Process In Nebraska

LLC Formations for Small Businesses in Nebraska

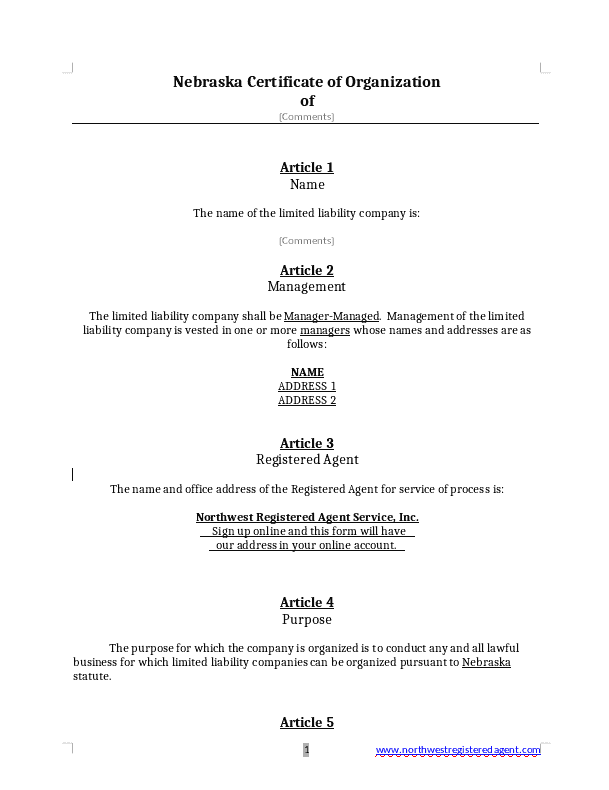

As an expert in LLC formations for small businesses, I know that getting the Articles of Organization process right is crucial when registering your business with Nebraska.

This document legally creates and registers your business with the state.

Fortunately, it's not a complicated process - but there are some important things to keep in mind.

Confirm Your LLC Name Availability

- Check Nebraska's Secretary of State database to ensure your desired LLC name is available

- File your Articles of Organization online or through mail (if preferred)

- The form requires basic information about yourself and other members if applicable (such as names and addresses), along with details on how profits will be distributed among members

- Remember: incomplete or incorrect filings can cause delays or even rejection from registration

Obtain Necessary Licenses/Permits

It’s also essential to understand what comes after filing the articles; obtaining necessary licenses/permits specific to one’s industry may require additional steps before conducting any operations within Nebraska lawfully.

Draft an Operating Agreement

Another critical aspect often overlooked during this formation stage involves drafting an operating agreement outlining member roles/responsibilities & decision-making processes while protecting personal assets against potential liabilities arising out of company activities- something every entrepreneur should consider regardless their size/scope!

Correctly completing the Articles of Organization process sets up legal recognition for a new enterprise under state laws governing limited liability companies – making sure all requirements have been met ensures smooth sailing towards achieving long-term success!

Understanding The Operating Agreement Basics

LLC Formation in Nebraska: Understanding the Operating Agreement Basics

As an expert in LLC formation, I know that the operating agreement is a crucial document when starting your business in Nebraska.

This legal paperwork outlines the structure and regulations for your company, so it's essential to understand some basics before drafting one.

Determine Your Agreement Type

- Single-member agreement for solo or partner businesses

- Multi-member agreement for businesses with multiple members

Clarify roles and responsibilities among all parties involved in a multi-member agreement.

Profit and Loss Distribution

Each member’s percentage ownership stake directly impacts their share of profits & losses.

Ensure this information is clear from the start using specific examples such as if John owns 30% of shares he gets 30% profit.

Don't forget to outline:

- Capital contributions

- Voting rights

- Management structure

- Meeting procedures

Remember, the operating agreement is a legally binding document that protects your business and its members.

By understanding the basics of an operating agreement, you can ensure your business is set up for success.

My Experience: The Real Problems

1. The LLC formation process in Nebraska is unnecessarily complicated and expensive.

Nebraska requires LLCs to file an annual report and pay a $10 fee, which may seem reasonable. However, the state also requires LLCs to publish a notice of formation in a newspaper for three consecutive weeks, which can cost hundreds of dollars.2. The state's tax policies discourage entrepreneurship and small business growth.

Nebraska has one of the highest corporate income tax rates in the country, at 7.81%. This, coupled with a high personal income tax rate of 6.84%, makes it difficult for small businesses to thrive and compete with larger corporations.3. The lack of access to affordable healthcare is a major barrier for entrepreneurs.

Nebraska has one of the highest uninsured rates in the country, with 11.3% of the population lacking health insurance. This can be a major deterrent for entrepreneurs who need to prioritize their own health and well-being while starting a business.4. The state's education system is failing to prepare students for the workforce.

Nebraska ranks 47th in the country for high school graduation rates, and only 36% of adults in the state have a bachelor's degree or higher. This lack of education and training can make it difficult for entrepreneurs to find qualified employees and grow their businesses.5. The state's infrastructure is inadequate for modern business needs.

Nebraska's roads and bridges are in poor condition, with 22% of the state's bridges rated as structurally deficient. This can make it difficult for businesses to transport goods and services, and can also be a safety hazard for employees and customers.Obtaining Necessary Permits And Licenses

Starting an LLC in Nebraska: Permits and Licenses

Obtaining necessary permits and licenses is a critical step when starting an LLC in Nebraska.

This ensures legal compliance and avoids fines or penalties.

Depending on the industry type, specific permits or licenses may be required.

“Taking care of these details upfront will save time, money, and headaches down the road!”

Thorough Research is Crucial

To ensure long-term success for your startup, it's crucial to conduct thorough research about permit requirements from relevant government agencies before launching your LLC. Local Chambers of Commerce can also offer guidance related to local zoning laws and other regulations.

Five Important Points to Keep in Mind

- Check State & Federal websites to determine what types of permits are mandatory for your company.

- Apply as early as possible since approval processes might take weeks/months based on certain factors.

- Keep track of expiration dates so you can renew them promptly.

- Be aware that some industries require additional certifications beyond basic business licensing (e.g., food service).

- Don't hesitate to seek professional help if needed – attorneys specializing in small businesses can provide valuable advice regarding regulatory compliance.

“Remember: taking care of these details upfront will save time, money, and headaches down the road!”

Tax Obligations: What You Need To Know

Forming an LLC in Nebraska: Tax Obligations You Need to Know

As an experienced industry expert, I know that forming an LLC in Nebraska comes with certain tax obligations.

Being aware of these is crucial for your business's success.

Federal Tax Return

Firstly, it's essential to file a federal tax return every year as the IRS requires all businesses (including LLCs) to report their profits or losses through Form 1065.

If this seems complex, consider hiring an accountant for financial support.

State Taxes

In addition, compliance with state taxes is also important depending on your chosen business structure and number of employees.

The Nebraska Corporate Income Tax rate ranges from four percent to seven point eight five which varies accordingly.

Remembering these key points will help you stay compliant and avoid any potential legal issues down the line while ensuring smooth operations within your company!

Being aware of these is crucial for your business's success.

If this seems complex, consider hiring an accountant for financial support.

Remembering these key points will help you stay compliant and avoid any potential legal issues down the line while ensuring smooth operations within your company!

My Personal Insights

Starting a business can be a daunting task, especially when it comes to legalities. When I decided to start my company, AtOnce, I knew I needed to form a limited liability company (LLC) to protect my personal assets. Living in Nebraska, I began researching the steps required to start an LLC in the state. I quickly realized that the process was more complicated than I had anticipated. There were forms to fill out, fees to pay, and legal requirements to meet. As a busy entrepreneur, I didn't have the time or expertise to navigate the legal process on my own. That's when I turned to AtOnce, the AI writing and customer service tool that I had developed. With AtOnce, I was able to quickly and easily create all the legal documents I needed to start my LLC. The platform provided me with customizable templates for articles of organization, operating agreements, and other necessary forms. What's more, AtOnce's AI-powered customer service chatbot was always available to answer any questions I had along the way. The chatbot was able to provide me with accurate and helpful information about the legal requirements for starting an LLC in Nebraska. Thanks to AtOnce, I was able to start my LLC with confidence and ease. I didn't have to worry about making mistakes or missing important steps in the process. Instead, I was able to focus on building my business and bringing my vision to life. If you're thinking about starting an LLC in Nebraska (or anywhere else), I highly recommend using AtOnce to simplify the process. With AtOnce, you can start your business with confidence and peace of mind.How To Open A Business Bank Account For Your LLC

Opening a Business Bank Account for Your LLC in Nebraska

Opening a business bank account for your LLC in Nebraska requires following important steps:

- Research different banks and choose one that suits your needs with competitive interest rates and excellent customer service

- Gather necessary documents such as articles of organization or certificate of formation, EIN (Employer Identification Number), and personal identification like driver's license or passport

- Ensure these are up-to-date before submitting them along with other required paperwork at the bank branch or online if allowed by the selected bank

- Keep an eye on minimum balance requirements which can vary from institution to institution

Why Choose an FDIC-Insured Financial Institution?

It is crucial to opt for an FDIC-insured financial institution when opening a business account because it provides protection against loss due to failure of the banking system.

Consider Choosing a Local Community Bank

Consider choosing a local community bank over larger national chains since they may offer more personalized services tailored specifically towards small businesses.

Additional Features Beyond Basic Checking Accounts

Another factor worth considering is whether you need additional features beyond basic checking accounts such as merchant services or credit lines offered by some banks exclusively designed for small businesses' unique needs.

Opening a business account involves careful consideration about various factors including selecting appropriate documentation while keeping track of minimum balances; opting only for FDIC insured institutions; exploring options provided by smaller community-based establishments rather than large corporate ones - all aimed at providing better support suited explicitly towards entrepreneurs looking out their best interests!

Recording Keeping For Compliance With State Regulations

LLC Management: The Importance of Proper Record-Keeping

Keeping proper records is crucial for compliance with state regulations and running a successful business in Nebraska.

It helps you stay organized while aligning with the rules outlined by the state, mitigating legal issues that could harm your company down the road.

Accurate Financial Statements

To maintain accurate financial statements, it's essential to track income reports, balance sheets, cash flow analyses, and operating budgets regularly.

By doing so, you can monitor revenue and expenses over time while identifying areas where cost-savings can be made.

As an expert in LLC management, I recommend using cloud-based accounting software such as QuickBooks or Xero which offer user-friendly features like invoice generation capabilities and easy-to-read dashboards.

5 Tips for Effective Record-Keeping

Good records make good business decisions.

- Keep all documentation related to government filings updated regularly

- Store important documents (such as articles of incorporation) securely both physically & digitally.

- Use consistent naming conventions when saving files

- Create backups frequently – preferably daily!

- Train employees on record-keeping best practices

By following these guidelines diligently, you'll have peace of mind knowing your LLC is compliant with regulatory requirements.

You will also save yourself from potential headaches caused by non-compliance penalties!

Hiring Employees: Laws And Regulations That Apply

Expert Tips for Hiring Employees for Your Nebraska LLC

As an expert in hiring employees for a Nebraska LLC, it's crucial to follow the laws and regulations.

One federal requirement is verifying each employee's eligibility to work in the United States by completing Form I-9.

Additionally, there are specific employment laws within Nebraska that employers must comply with.

For instance, minimum wage requirements and workers' compensation insurance coverage are mandatory for all employees.

It's essential to stay updated on these state-specific laws as they may change over time.

By following these guidelines and staying informed about current legislation changes, you can ensure compliance while building a successful team of qualified individuals who will contribute positively towards your business goals.

Guidelines for Hiring Employees for Your Nebraska LLC

- Verify each employee's eligibility to work in the United States by completing Form I-9

- Stay updated on state-specific laws, such as minimum wage requirements and workers' compensation insurance coverage

- Discrimination based on protected characteristics such as race or religion is illegal

- Certain businesses require licenses or permits before operating legally

Remember, compliance with federal and state laws is essential for building a successful team of qualified individuals who will contribute positively towards your business goals.

Protecting Your Personal Assets From Legal Liability

Protecting Your Personal Assets: Forming an LLC in Nebraska

As a business owner, protecting your personal assets from legal liability is crucial.

One excellent option to achieve this goal is forming an LLC in Nebraska.

This entity type separates your personal assets from those of the company and shields you against any lawsuits or debt incurred by the business.

Proper Documentation and Record-Keeping

Proper documentation and record-keeping are essential steps to safeguarding your personal assets when running an LLC. Keep all financial records and contracts organized and up-to-date to establish clear boundaries between yourself as an individual and your business as its own separate entity.

Five Tips for Protecting Your Personal Assets

In addition to maintaining proper documentation, here are five more tips for protecting your personal assets:

- Obtain adequate insurance coverage for both yourself personally and also for the LLC.

- Be cautious while signing guarantees on behalf of the company.

- Apply for necessary licenses or permits required by state/local law.

- Hire experienced lawyers who can provide valuable guidance throughout every stage of setting up/running a successful enterprise.

- Consider creating multiple entities if there's significant risk involved with one particular venture.

By following these guidelines diligently, entrepreneurs can protect their hard-earned wealth effectively while pursuing their dreams without fear!

The Advantages Of Forming An LLC Over Other Entity Types

Why Forming an LLC is the Best Choice for Entrepreneurs

As an industry expert with 20 years of experience, I've found that there are several business entity types available.

However, in my opinion and based on my expertise as a writer, forming an LLC is often the best choice for many entrepreneurs.

One primary advantage of choosing to form an LLC over other entity types is its flexibility while still limiting personal liability.

Unlike sole proprietorships or general partnerships where owners have unlimited personal liability for their businesses' actions, LLCs offer protection from such liabilities.

Additionally, unlike corporations which require separate taxation and formalities like annual meetings and boards of directors election requirements; you can form your Nebraska LLC without mandating these steps.

“LLCs offer protection from personal liabilities and minimal compliance requirements compared to other entities.”

Advantages of Forming an LLC

- Minimal compliance requirements compared to other entities

- Pass-through taxation structure allows profits/losses to pass through directly to members

- Flexibility in management structure and ownership

- No residency or citizenship requirements for owners

- Easy to form and maintain

Forming an LLC can be advantageous for entrepreneurs who want to protect their personal assets while still maintaining flexibility in their business structure.

With minimal compliance requirements and pass-through taxation, LLCs offer a simple and efficient way to run a business.

“Forming an LLC can be advantageous for entrepreneurs who want to protect their personal assets while still maintaining flexibility in their business structure.”

Strategic Planning For Long Term Success

Creating a Solid Strategy for Your Nebraska LLC

Strategic planning is crucial for the long-term success of your Nebraska LLC. To ensure your company's goals and objectives are met, take the time to create a detailed plan.

Define Your Mission Statement

The first step towards creating a solid strategy is defining your mission statement.

This should clearly articulate what you offer customers, how you will meet their needs differently from competitors, and what values guide how you conduct business.

A well-crafted mission statement sets direction for senior leadership teams by ensuring they're all on the same page when making important decisions about resource allocation or investment opportunities

Five Points to Consider for Successful Strategy Implementation

- Conduct thorough market research before launching new products or services.

- Use data-driven insights from consumer feedback surveys to inform product development efforts.

- Invest in technology infrastructure

- Develop strong partnerships within industry networks.

- Continuously evaluate performance metrics against established benchmarks.

By following these steps and continuously evaluating progress through key performance indicators (KPIs), businesses can stay ahead of competition while meeting customer demands effectively.

Remember: Strategic planning isn't just about setting goals; it's also about taking action based on those plans!

Final Takeaways

Hi there! My name is Asim Akhtar, and I'm the founder of AtOnce - an AI writing and AI customer service tool. Today, I want to share with you my experience of starting an LLC in Nebraska. When I first started AtOnce, I knew that I needed to establish a legal entity to protect myself and my business. After doing some research, I decided that forming an LLC in Nebraska was the best option for me. The process of starting an LLC in Nebraska was relatively straightforward. I began by choosing a name for my business and checking its availability with the Nebraska Secretary of State. Once I confirmed that my desired name was available, I filed the Articles of Organization with the state. One of the benefits of forming an LLC in Nebraska is that it's relatively inexpensive. The filing fee for the Articles of Organization is only $100, and the annual report fee is $10. Additionally, Nebraska has a business-friendly tax climate, which was another factor that influenced my decision to form an LLC in the state. Now, you might be wondering how AtOnce fits into all of this. Well, as an AI writing and AI customer service tool, AtOnce has been instrumental in helping me manage my business. With AtOnce, I can quickly and easily generate high-quality content for my website and social media channels. Additionally, AtOnce's AI-powered customer service tool has helped me provide excellent support to my clients. Overall, starting an LLC in Nebraska was a relatively painless process, and it has provided me with the legal protection and tax benefits that I need to run my business. And with AtOnce by my side, I know that I have the tools I need to succeed.Are you struggling to write high-quality content that captures your audience's attention?

Is the thought of writing blog posts, ads, product descriptions, and emails leaving you feeling overwhelmed? Do you want to save time and produce better results? Introducing AtOnce, the Ultimate Solution for Your Marketing Needs- Are you tired of staring at a blank document, not knowing where to start?

- Do your current writing tools lack creativity and originality?

- Are your writing skills holding you back from achieving your business goals?

- Do you spend hours writing, editing, and proofreading your content?

- Are you tired of missing deadlines and falling behind on your marketing calendar?

- Do you want to streamline your writing process and achieve better results?

- Do you want to stand out from your competitors and attract more customers?

- Are you looking for a way to improve your search engine rankings and drive more traffic to your site?

- Do you want to increase your conversion rates and boost your revenue?

Stop struggling with your writing and start getting better results with AtOnce.

Try our AI-powered writing tool today and see the difference for yourself. Sign up now and watch your writing soar to new heights.What is an LLC?

LLC stands for Limited Liability Company. It is a type of business structure that combines the liability protection of a corporation with the tax benefits of a partnership.

How do I form an LLC in Nebraska?

To form an LLC in Nebraska, you must file Articles of Organization with the Nebraska Secretary of State and pay a filing fee. You must also choose a unique name for your LLC, appoint a registered agent, and create an operating agreement.

What are the benefits of forming an LLC in Nebraska?

Forming an LLC in Nebraska can provide liability protection for your personal assets, as well as potential tax benefits. It can also help establish credibility and professionalism for your business, and make it easier to raise capital or obtain financing.