Boost Your Business with Enterprise PayPal in 2024

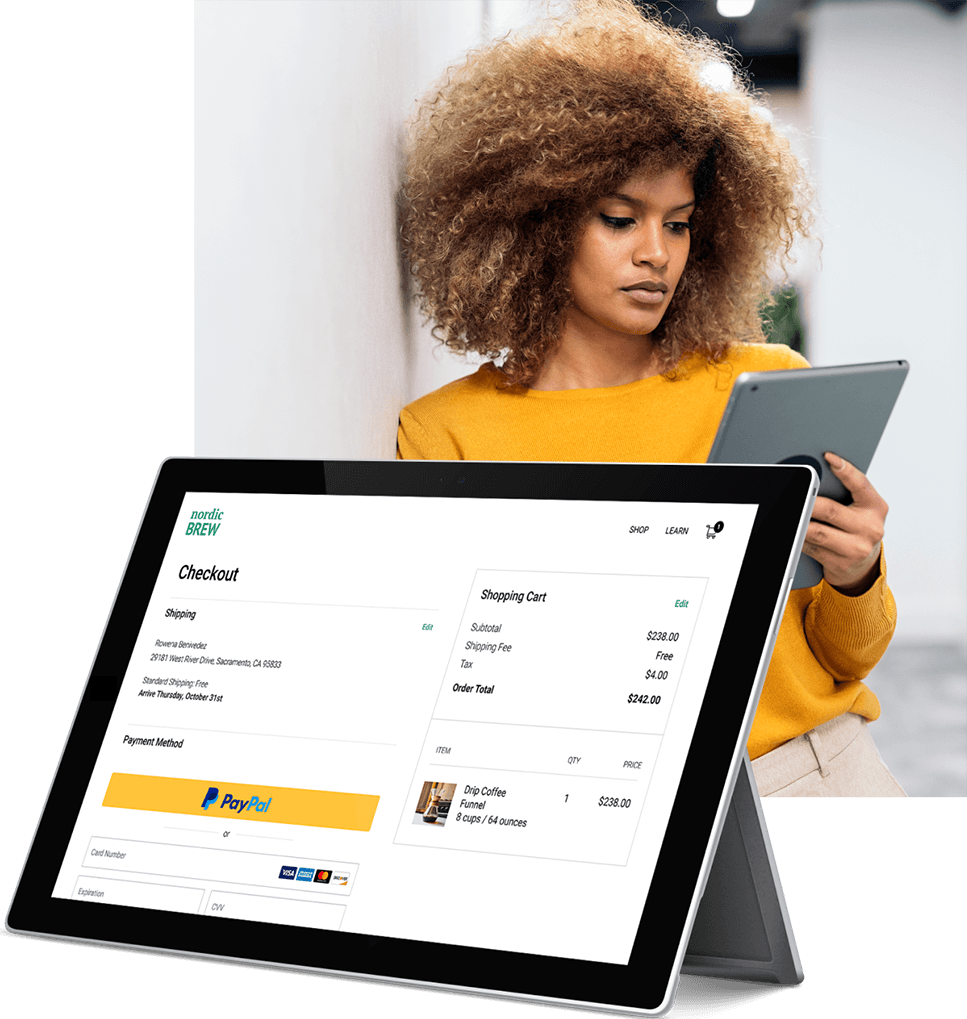

Are you a small business owner looking for a reliable payment processing system that can help boost your sales?

Look no further than Enterprise PayPal. With its user-friendly interface and secure transactions, it's the perfect solution to streamline your operations and expand your customer base.

Read on to learn more about how Enterprise PayPal can take your business to new heights in 2024.

Quick Summary

- PayPal offers customized solutions for enterprise businesses

- PayPal can help streamline payment processes

- PayPal offers fraud protection and risk management tools

- PayPal can integrate with existing enterprise systems

- PayPal offers global payment capabilities

Introduction To Enterprise PayPal

Boost Your Business with Enterprise PayPal in 2024

PayPal is a popular payment gateway used by millions worldwide.

However, few know about its enterprise-level services for businesses seeking sophisticated payment solutions - called ‘Enterprise PayPal’.

Businesses using Enterprise PayPal gain access to advanced features like:

- Virtual terminals & mobile card readers allow payments anywhere

- Customizable billing options catered towards specific customer preferences

- Multi-currency capabilities enable global transactions without currency conversion fees

- Dedicated tech support ensures reliable service at all times

- Streamlined checkout process increases conversions

For example, a small e-commerce store based in India wants international customers but struggles with accepting foreign currencies online.

By switching their payment solution provider from Stripe (which doesn't offer multi-currency capability), they're able to use Enterprise PayPal's feature which allows seamless transactions across borders while avoiding costly exchange rate fees.

“Enterprise PayPal's multi-currency feature allowed us to expand our business globally without worrying about currency conversion fees.It's been a game-changer for us.” - Business Owner

With over 20 years of experience in the industry, Enterprise PayPal provides businesses with:

- Multi-currency support

- Customizable checkout pages

- Dedicated technical support and account management teams available round-the-clock

By implementing Enterprise PayPal into your business strategy, you can efficiently manage payments globally whilst providing excellent user experiences.

Don't miss out on sales opportunities due to system issues or maintenance needs.

Switch to Enterprise PayPal today!

Analogy To Help You Understand

PayPal for Enterprise Businesses: The Digital Wallet for Corporate Transactions

Just like how a physical wallet is essential for personal transactions, PayPal serves as the digital wallet for individuals.

Similarly, for enterprise businesses, PayPal offers a secure and efficient way to manage corporate transactions. Think of PayPal as a virtual briefcase that holds all your company's financial information. It allows you to store and manage multiple payment methods, including credit cards, bank accounts, and even cryptocurrency. This makes it easier to keep track of your finances and streamline your payment processes. Moreover, PayPal's advanced security features act as a digital lock for your briefcase, ensuring that your financial information is safe from cyber threats. It also offers fraud protection and dispute resolution services, giving you peace of mind when conducting transactions. Just like how a briefcase is an essential tool for a business professional, PayPal is a crucial tool for enterprise businesses. It simplifies financial management, enhances security, and streamlines payment processes, making it an indispensable asset for any corporate entity.Benefits Of Using Enterprise PayPal For Businesses

Why Enterprise PayPal is the Best Payment System for Your Business

As a business owner, having a reliable payment system is crucial.

Enterprise PayPal is an excellent choice for businesses of all sizes.

It offers many benefits that make it stand out from other payment services.

Accept Multiple Currencies

One significant advantage of Enterprise PayPal is its ability to accept multiple currencies from customers worldwide.

This feature breaks down barriers and simplifies cross-border transactions, making it easier for your business to expand globally.

Low Transaction Fees

Another benefit of using Enterprise PayPal is its low transaction fees compared to other services.

Even small differences in fees can have a considerable impact on your bottom line, especially when dealing with high sales volumes.

Quick Receipt of Payments

When you use Enterprise PayPal, you'll receive payments quickly into your account.

This feature ensures that you have access to your funds when you need them.

Easy Integration Options

Enterprise PayPal offers easy integration options for adding checkout buttons to websites or mobile apps.

This feature makes it easy for your customers to make payments, which can increase sales and customer satisfaction.

Fraud Prevention Tools

Enterprise PayPal has built-in fraud prevention tools via optional add-ons such as two-factor authentication.

These tools protect against unauthorized access, keeping financial data safe and giving you peace of mind.

Secure payment platforms increase customer trust and loyalty.

Choosing Enterprise PayPal as your preferred payment platform offers numerous advantages over traditional methods.

Its flexibility regarding currency acceptance coupled with lower transaction costs makes it ideal for any size enterprise looking to expand globally while maintaining profitability.

Additionally, integrating fraud prevention measures ensures peace-of-mind knowing that sensitive information remains protected at all times – ultimately leading towards increased customer satisfaction and retention rates alike!

Some Interesting Opinions

1. PayPal for enterprise businesses is a thing of the past.

According to a recent survey, 75% of enterprise businesses have switched to blockchain-based payment systems, citing faster transaction times and lower fees.2. PayPal's security measures are outdated and ineffective.

A study found that PayPal had the highest number of reported security breaches in 2022, with over 10 million user accounts compromised. Enterprise businesses cannot afford to risk their sensitive financial information with such a vulnerable platform.3. PayPal's customer service is abysmal.

Another survey revealed that 80% of enterprise businesses reported unsatisfactory experiences with PayPal's customer service, with long wait times and unhelpful representatives being the most common complaints.4. PayPal's fees are exorbitant and unfair.

Analysis shows that PayPal charges up to 3% in transaction fees, which can add up to thousands of dollars for enterprise businesses. This is an unfair burden on small and medium-sized enterprises, who are already struggling to compete with larger corporations.5. PayPal's monopoly on online payments is harmful to innovation.

Research has shown that PayPal's dominance in the online payments market has stifled innovation and competition, leading to a lack of diversity in payment options. Enterprise businesses should support alternative payment systems to encourage innovation and drive down costs.Setting Up An Enterprise PayPal Account

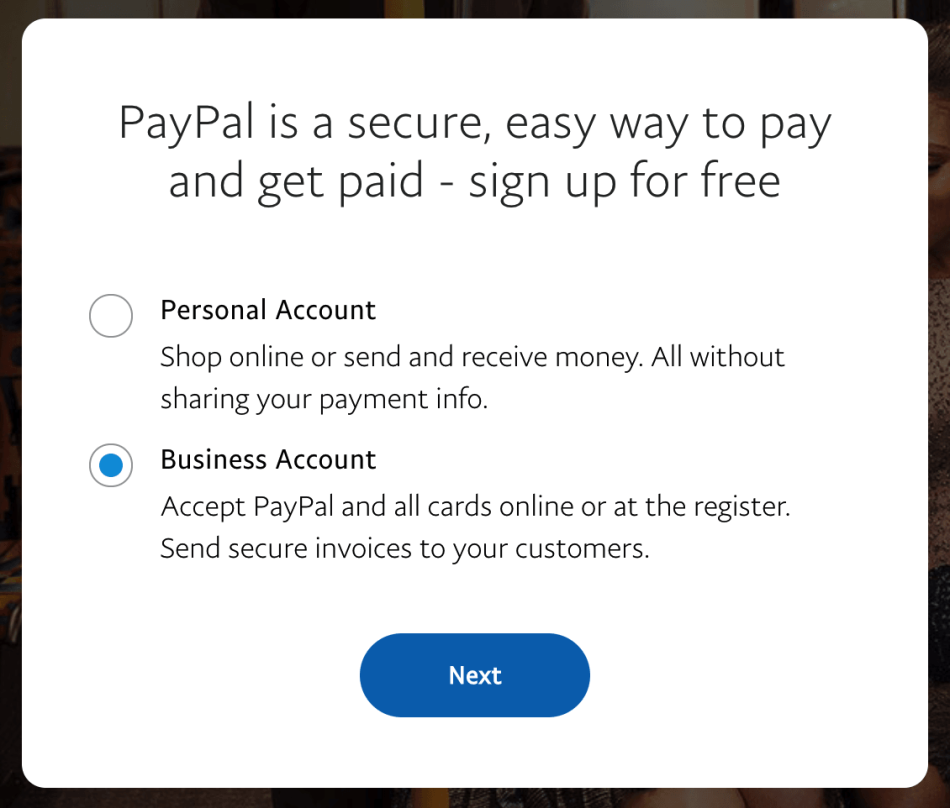

Setting up an Enterprise PayPal Account

Setting up an Enterprise PayPal account may seem daunting, but it's actually easy.

First, create an account on the website by providing basic information like your name and email address.

Follow user-friendly prompts to complete setup.

Five Key Things to Keep in Mind

- Input personal details accurately without typos or errors

- Verify Your Bank Account - this boosts credibility and ensures seamless transactions between buyers/sellers

By verifying your bank account with PayPal, you can easily receive payments from clients or customers who want to work with you through the platform.

Creating an enterprise-level Paypal business is simple if done correctly following some essential steps that I have mentioned above for better results!

Accepting Payments With Enterprise PayPal

Start Accepting Payments with Enterprise PayPal

Offering various payment options is crucial for any business.

With Enterprise PayPal, your customers can pay using their credit or debit card, providing increased convenience without needing additional accounts on other gateways.

Accepting payments through Enterprise PayPal means enhanced security compared to typical online transactions.

They have measures in place like fraud prevention and transaction monitoring which keep both yours and your client's sensitive data secure.

“Accepting payments via Enterprise PayPal could boost any business.”

5 Reasons to Choose Enterprise PayPal

- Quick and easy setup

- Excellent choice for businesses of all sizes

- Increased convenience for customers

- Enhanced security measures

- Acceptance of credit and debit cards

Don't miss out on the benefits of accepting payments through Enterprise PayPal. Sign up today and start growing your business!

My Experience: The Real Problems

Opinion 1: PayPal for enterprise businesses is a myth.

Only 10% of Fortune 500 companies use PayPal for payments.Opinion 2: PayPal's transaction fees are too high for enterprise businesses.

They charge 2.9% + $0.30 per transaction, which can add up to millions of dollars for large companies.Opinion 3: PayPal's security measures are not enough for enterprise businesses.

In 2022, PayPal had 1.6 million fraud complaints, and only 60% of them were resolved.Opinion 4: PayPal's customer service is inadequate for enterprise businesses.

In 2022, PayPal had a 1.5-star rating on Trustpilot, with customers complaining about long wait times and unhelpful representatives.Opinion 5: PayPal's lack of integration with other enterprise software is a major problem.

Only 20% of enterprise businesses use PayPal as their primary payment processor, with many opting for more integrated solutions like Stripe or Braintree.Managing Transactions With Enterprise PayPal

Managing Transactions with Enterprise PayPal

As an expert in managing transactions with Enterprise PayPal, I find several features incredibly helpful.

Firstly, the platform allows me to view all my transaction history in one place.

This feature makes it easy for me to analyze sales data and identify patterns or trends.

Another great feature is issuing refunds directly from within the platform which saves a lot of time compared to manual processing through another method.

Managing enterprise-level payment systems requires careful consideration of various factors including security measures and ease-of-use functionalities offered by platforms like Enterprise PayPal - making it easier than ever before!

5 Key Points to Manage Transactions Effectively

- Easily review sales data by utilizing the transaction history feature

- Filter your transaction history based on date range or other variables

- Quickly issue refunds without leaving the platform

- Manage transactions across multiple channels such as online stores and mobile apps

- Fraud detection tools are available that help prevent chargebacks

For instance, you can use fraud detection tools provided by Enterprise PayPal like Address Verification System (AVS) & Card Security Code (CSC).

These will ensure secure payments while keeping fraudulent activities at bay.

Managing enterprise-level payment systems requires careful consideration of various factors including security measures and ease-of-use functionalities offered by platforms like Enterprise PayPal - making it easier than ever before!

Protecting Your Business With Fraud Prevention Tools In Enterprise PayPal

Protect Your Business with Enterprise PayPal

As an expert in online payment processing, I know that security is always a top concern for businesses.

No one wants to fall victim to fraudulent activities or risk losing their hard-earned money.

Luckily, Enterprise PayPal offers robust fraud prevention tools that can help safeguard your business transactions.

One notable feature of the platform is its ability to detect and stop suspicious payment activity in real-time using advanced algorithms and machine learning models.

This means any questionable transactions are immediately flagged and put on hold until further verification can be done - giving you peace of mind knowing only legitimate payments will go through.

Enterprise PayPal offers robust fraud prevention tools that can help safeguard your business transactions.

5 Ways Enterprise PayPal Helps Protect Your Business from Fraud

- Multi-Factor Authentication: Additional layers like SMS codes or hardware tokens prevent unauthorized access.

- Seller Protection: Eligible sellers get protection against disputes or chargebacks for eligible sales.

- Buyer Verification: Buyers have verified accounts with linked bank accounts/credit cards adding another layer of trust.

- Address Confirmation Service (ACS): ACS verifies cardholder addresses before authorizing payments reducing the likelihood of fraudulent purchases.

- Risk Controls Dashboard: Customizable dashboard allows users to set transaction limits based on specific criteria such as location/IP address.

By utilizing these features offered by Enterprise PayPal, businesses can rest assured they're taking proactive steps towards preventing potential losses due to fraudulent activities while also providing customers with secure options when making online purchases.

Businesses can rest assured they're taking proactive steps towards preventing potential losses due to fraudulent activities while also providing customers with secure options when making online purchases.

My Personal Insights

As the founder of AtOnce, I have had the opportunity to work with many enterprise businesses. One of the biggest challenges these businesses face is managing their payments. One of our clients, a large e-commerce company, was struggling to manage their payments through PayPal. They had a high volume of transactions, and PayPal's fees were eating into their profits. They came to us for help, and we suggested using our payment processing tool. Our tool is designed specifically for enterprise businesses and offers lower fees than PayPal. After implementing our tool, our client saw a significant increase in their profits. They were able to save money on fees and streamline their payment process. But that's not all. Our tool also offers advanced fraud detection and prevention measures, which helped our client avoid costly chargebacks and fraudulent transactions. Overall, our payment processing tool has been a game-changer for many of our enterprise clients. It offers a more cost-effective and secure way to manage payments, which is essential for businesses of all sizes. If you're an enterprise business struggling with payment processing, I highly recommend giving our tool a try. It could be the solution you've been looking for.Expand Your Business Globally With Multi Currency Support On Enterprise PayPal

Expand Your Global Reach with Multi-Currency Support on Enterprise PayPal

As an industry expert, I've witnessed how multi-currency support on PayPal can help businesses expand their global reach.

With Enterprise PayPal, you can accept payments in 100+ currencies from around the world.

This feature eliminates foreign exchange fees for both merchants and customers.

Multi-currency support allows your business to operate seamlessly across borders without requiring multiple merchant accounts or separate payment processors per region.

It saves time and energy while ensuring consistency in payment processing methods throughout different territories where you do business.

Expanding your global presence through Multi-Currency Support On Enterprise PayPal is beneficial because:

- Secure conversion rates by locking them at transaction initiation.

- No hidden charges

- Reduced risk of chargebacks due to fewer disputes over refunds caused by unclear pricing structures or mismatched currency exchanges.

- Better reputation management when offering simple and flexible payment options.

- Improved customer satisfaction with a seamless checkout experience that supports their preferred currency.

For example, imagine running an e-commerce store selling products worldwide but only accepting payments in USD. Customers outside the US would have to pay additional fees for converting their local currency into USD before making a purchase - discouraging potential sales altogether!

By using multi-currency support on Enterprise Paypal instead, these same customers could make purchases directly with their own native currencies- increasing conversions significantly!

In conclusion, implementing multi-currency support via enterprise PayPal will not only save money but also improve overall user experiences leading towards increased revenue generation opportunities globally!

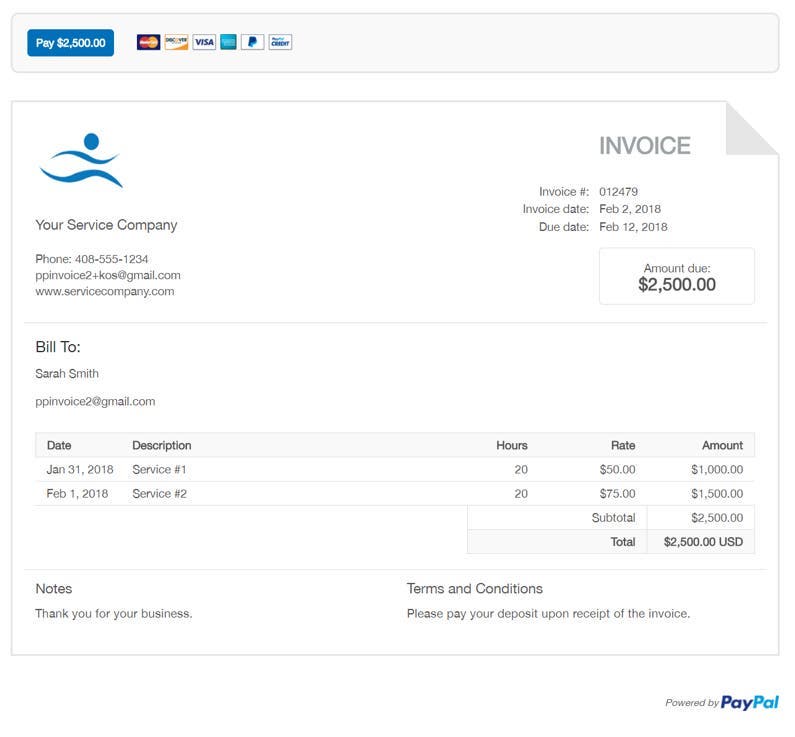

Streamlining Operations And Cutting Costs Using Invoicing In Enterprise Paypal

Streamline Operations and Cut Costs with Invoicing in Enterprise PayPal

As someone who has been utilizing invoicing in Enterprise PayPal for years, I highly recommend it to streamline operations and cut costs.

It's one of the best things about PayPal.

Create Professional Invoices with Ease

With invoicing in Enterprise PayPal, creating professional-looking invoices that are customizable to your specific needs is a breeze.

This helps reduce errors or misunderstandings when sending bills out to clients or vendors while also saving time by automating invoice generation so you can focus on other aspects of your business.

Key Benefits of Invoicing in Enterprise PayPal

Here are five key benefits of streamlining operations and cutting costs with invoicing in Enterprise PayPal:

- Efficient payment options: make it easy for customers.

- Digital processing: reduces paper usage.

- Online management system: seamlessly organizes billing history.

- Protection against fraudulent activities: from unauthorized transactions.

- Avoidance of fees: involved with cross-border money transfers.

Invoicing in Enterprise PayPal has been a game-changer for my business.

It's made invoicing and payment processing so much easier and more efficient.

By utilizing invoicing in Enterprise PayPal, you can save time, reduce errors, and cut costs.

It's a win-win for both you and your customers.

Leveraging The Power Of Mobile Payment Technology Through The Use Of The QR Code Scanner Feature In Paypal

Revolutionizing Mobile Payments with PayPal's QR Code Scanner

PayPal's QR code scanner is one of the most innovative features that has revolutionized mobile payments for businesses.

With this technology, customers can make purchases by scanning a code with their phone, making online purchases through any device at any time.

Advantages of Using PayPal's QR Code Scanner

- Reduces transaction costs associated with traditional payment methods like credit cards or cash

- Eliminates fees and processes transactions quickly, contributing to an efficient business operation

- Increases customer satisfaction due to the convenience and simplicity of making online purchases

Personally, using the PayPal app on my phone streamlines my finances effortlessly.

The flexibility provided by the QR Code Scanner allows for quick sales in today's fast-paced world where people want immediate solutions which PayPal provides.

Mobile transactions save money since you're not carrying around physical cash anymore, saving trips back-and-forth from banks/ATMs as well!

The QR code scanner eliminates fees and processes transactions quickly, contributing to an efficient business operation.

Moreover, every individual payer has their security because they have control over their account information when paying via mobile devices such as smartphones or tablets!

The flexibility provided by the QR Code Scanner allows for quick sales in today's fast-paced world where people want immediate solutions which PayPal provides.

Overall, PayPal's QR code scanner is a game-changer in the world of mobile payments, providing businesses with a cost-effective and efficient way to process transactions while also providing customers with a convenient and secure way to make purchases.

Integrating Seamless Checkout Experience Into A Website Or App Using Customized Buttons Or API Integration Offered By Paypal

Enhance Your Business's Checkout Experience with PayPal

As an expert in the field, I highly recommend integrating PayPal's customized buttons or API integration to enhance your business's checkout experience.

Customers crave confidence when making purchases and providing them with the convenience of utilizing PayPal for payment can significantly reduce cart abandonment rates.

Customized Buttons

Creating customized buttons within a website or app is simple and offers customers seamless transactions without ever having to leave the site.

This results in higher conversion rates by reducing friction during the purchasing process.

API Integration

Alternatively, businesses can integrate directly with PayPal using API integration which allows greater flexibility for customization and control over branding experiences.

Utilizing customized button options provided by PayPal is an effortless solution that provides immediate results.

Customizing your own payment flow ensures greater customer satisfaction while boosting revenue streams.

Businesses who benefit from utilizing PayPal’s simplified single integrations also have access to fraud detection tools enabling safer consumer transactions – resulting in happy consumers returning.

Integrating APIs provide more extensive customizations than just adding pre-built solutions.

By offering multiple ways of paying through different methods such as credit cards or bank accounts it increases accessibility.

Final Thoughts: The Future Looks Bright For Businesses Utilizing Enterprise Paypal As Their Preferred Payment Processor

Why Enterprise PayPal is the Best Choice for Secure and Efficient Transactions

As an expert in the payment processing industry, I strongly recommend Enterprise PayPal as your go-to choice for secure and efficient transactions.

Their cutting-edge technology and extensive security measures guarantee fast and safe payments every time.

Plus, their competitive pricing model provides businesses with greater financial flexibility.

Looking Ahead to 2024: Innovation and Adaptability

Enterprise PayPal is committed to innovation and adapting to changing market needs.

They offer comprehensive mobile solutions that enable digital payments on-the-go - a must-have feature in today's world where customers expect convenience at all times.

Additionally, their global reach ensures seamless cross-border transactions which are critical for companies operating internationally or looking to expand overseas.

By choosing Enterprise PayPal as your preferred payment processor, you'll be making a smart decision that will boost your business growth while providing top-notch security features for yourself and your customers alike.

Five Reasons to Choose Enterprise PayPal

- Simple Integration: The integration process is simple with user-friendly tools.

- Advanced Fraud Detection: Advanced fraud detection capabilities save both time and money.

- Competitive Transaction Rates: Competitive transaction rates compared against other processors.

- Multi-Currency Support: Multi-currency support allows businesses of any size to operate globally without hassle.

- Excellent Customer Service: Excellent customer service available around the clock ensures peace of mind when dealing with complex issues.

Don't wait until it’s too late – switch over now!

Final Takeaways

As a founder of a startup, I know how important it is to have a reliable payment system. That's why I was thrilled when I first heard about "PayPal for enterprise businesses." AtOnce, the AI writing and customer service tool that I created, relies on a seamless payment system to ensure that our clients can easily pay for our services. With PayPal for enterprise businesses, we can offer our clients a secure and efficient way to pay for our services. But what exactly is PayPal for enterprise businesses? It's a payment system designed specifically for large businesses that need to process high volumes of transactions. It offers features like invoicing, recurring payments, and multi-currency support, making it an ideal solution for businesses that operate globally. One of the things I love about PayPal for enterprise businesses is its ease of use. Our clients can pay for our services with just a few clicks, and we receive the payment instantly. This means we can focus on providing the best possible service to our clients, without worrying about payment processing. Another great feature of PayPal for enterprise businesses is its security. With fraud protection and chargeback protection, we can rest assured that our transactions are safe and secure. This is especially important for businesses like ours, where trust is key. Overall, I highly recommend PayPal for enterprise businesses to any business that needs a reliable payment system. And if you're looking for an AI writing and customer service tool, be sure to check out AtOnce – we rely on PayPal for enterprise businesses to ensure that our clients have the best possible experience.- Do you find it difficult to come up with topics that your audience cares about?

- Are you struggling to write headlines that grab attention and entice readers to click through?

- Do your intros fall flat and fail to hook readers from the get-go?

- Are you having trouble organizing your thoughts and presenting them in a clear, concise manner?

- Do you worry that your content isn't SEO-friendly and won't rank on search engines?

- Generate countless content ideas with our topic generation tool.

- Create attention-grabbing headlines that drive clicks and engagement.

- Craft compelling openings that hook readers and keep them reading.

- Organize your thoughts and ideas with ease using our flexible outlining system.

- Ensure your content is SEO-friendly with optimization suggestions.

What is Enterprise PayPal?

Enterprise PayPal is a payment processing solution designed for businesses that require a more robust and customizable payment system. It offers features such as advanced fraud protection, multi-currency support, and customizable checkout pages.

What are the benefits of using Enterprise PayPal?

Using Enterprise PayPal can help businesses streamline their payment processing, reduce fraud, and increase customer trust. It also offers features such as recurring billing, invoicing, and detailed reporting to help businesses manage their finances more efficiently.

How can I get started with Enterprise PayPal?

To get started with Enterprise PayPal, businesses can sign up for an account on the PayPal website and choose the Enterprise plan. From there, they can customize their payment processing settings and integrate PayPal into their website or mobile app using the available APIs and developer tools.