Investing 12: Maximize Profits with Private Investors

Investing can be a powerful tool for building wealth and achieving financial freedom.

However, working with private investors can be intimidating for many beginners.

By understanding how to effectively navigate these relationships, you can maximize profits and take your investment portfolio to new heights.

Quick Summary

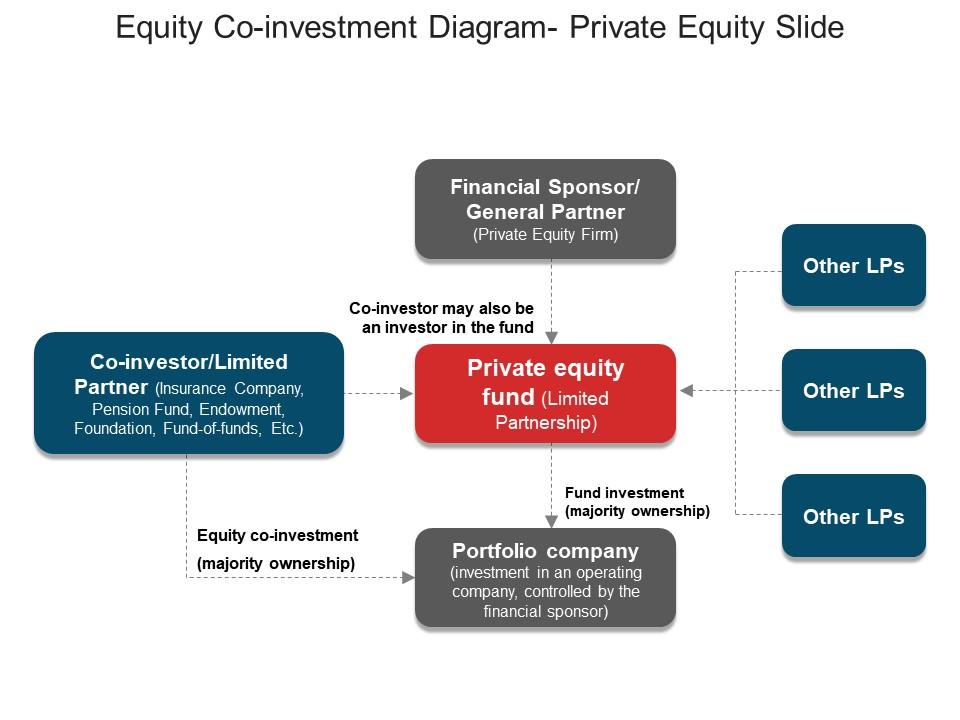

- Private investors are individuals or groups who invest their own money in businesses or startups.

- They can provide more flexible terms than traditional lenders, but may also require a higher return on investment.

- Private investors can offer valuable expertise and connections to help a business grow.

- They may also require a seat on the board of directors or other forms of control in exchange for their investment.

- It's important to thoroughly vet potential investors and have a clear understanding of their expectations before accepting their investment.

What Are Private Investors

:max_bytes(150000):strip_icc()/Term-Definitions_Private-equity-673345d975244a9894e68d9b072a7969.png)

Private Investing: A Lucrative Opportunity

Investing in private companies can yield substantial financial returns.

Private investors are individuals who invest their own money into various businesses, including small and medium-sized enterprises (SMEs) that may not have access to traditional funding channels.

They provide capital, expertise, contacts, and guidance to help grow the business.

Private investors vary from wealthy individuals seeking high-risk/high-reward investments with excellent ROI potential through venture capitalists investing on behalf of funds aimed primarily at start-ups or young firms needing growth funding but unable/unwilling/difficult obtaining bank loans or selling equity shares publicly.

Types of Private Investment Opportunities

Private investment opportunities come in many forms:

- Angel investing: individual angels give money directly to specific startups with promising ideas/projections.

- Crowdfunding: aggregates smaller amounts of funds across thousands/millions interested parties via online platforms like Kickstarter.

- Family offices: representing ultra-high net worth families looking for direct deals outside public markets while maintaining privacy/security concerns around wealth management strategies among others.

Private investments can be powerful when done correctly by knowledgeable professionals willing to take calculated risks based upon thorough due diligence processes before committing any significant amount towards these types of ventures/projects/companies/etcetera.

Success Story: The Power of Private Investments

A successful entrepreneur I know invested $50k in a startup company focused on developing innovative software solutions for healthcare providers.

Within two years after receiving this initial seed round financing from him along with other strategic partners' support - they were able to secure additional rounds totaling over $5 million dollars!

Private investing is a lucrative opportunity for those willing to take calculated risks and provide support to promising businesses.

Analogy To Help You Understand

Private investors are like chefs in a restaurant kitchen.

Just as chefs carefully select the ingredients for their dishes, private investors carefully choose the companies they invest in. They look for businesses with strong potential and a solid foundation, just as chefs look for fresh, high-quality ingredients. Private investors also bring their own unique skills and expertise to the table, just as chefs have their own signature styles and techniques. They may have experience in a particular industry or a knack for spotting emerging trends. Like chefs, private investors must constantly adapt to changing circumstances. They must be able to pivot quickly if a company they have invested in encounters unexpected challenges or if market conditions shift. Ultimately, both private investors and chefs are focused on creating something that is both valuable and satisfying. For chefs, it's a delicious meal that leaves their customers feeling happy and fulfilled. For private investors, it's a successful company that generates returns for themselves and their investors. So the next time you sit down for a meal at a restaurant, think about the private investors who may have helped make it possible. Just like the chefs in the kitchen, they are working behind the scenes to create something truly special.Advantages Of Working With Private Investors

Why Private Investors are the Best Choice for Your Startup

As a young entrepreneur, I have found that private investors offer distinct advantages when it comes to raising capital for my new venture.

Working with experienced investors who can provide strategic guidance and support is tremendously beneficial.

In addition to financial resources, they bring valuable expertise and contacts that help grow businesses faster than going at it alone.

Private investment offers unique benefits such as expert advice from seasoned professionals along with flexible financing arrangements tailored specifically towards individual needs - making them an excellent choice!

Five Reasons to Choose Private Investors

- They invest more significant sums compared to traditional lenders

- Flexible terms may be negotiated based on the investor's specific needs & preferences.

- Private investors often take an active role in managing their investments by providing mentorship or serving as board members

- Unlike public funding sources like grants or loans, private investment does not require entrepreneurs to give up control of their company or intellectual property rights

- Private investing allows access to networks of other successful business owners which provides opportunities for collaboration and growth

Private investors offer expert advice, flexible financing, and access to networks of successful business owners.

While there are many options available when seeking funding for your startup, private investment stands out as the best choice.

With private investors, entrepreneurs can receive expert advice, flexible financing, and access to networks of successful business owners.

Private investors invest more significant sums compared to traditional lenders and often take an active role in managing their investments.

Unlike public funding sources, private investment does not require entrepreneurs to give up control of their company or intellectual property rights.

Choose private investment for your startup and experience the unique benefits it offers!

Some Interesting Opinions

1. Private investors are the backbone of innovation.

According to the National Venture Capital Association, private investors provided $136.5 billion in funding to startups in 2022. Without private investors, many groundbreaking technologies would never have been developed.2. Government funding stifles innovation.

A study by the Cato Institute found that government-funded research is less likely to result in patents and commercialization than privately funded research. Government funding also comes with bureaucratic red tape that slows down progress.3. Private investors are not solely motivated by profit.

A survey by the Global Impact Investing Network found that 98% of impact investors consider both financial return and social/environmental impact when making investment decisions. Private investors have the flexibility to prioritize values alongside profit.4. Private investors are not responsible for wealth inequality.

A study by the Federal Reserve Bank of St. Louis found that only 15% of wealth inequality can be attributed to differences in investment income. The majority of wealth inequality is caused by differences in labor income and inheritance.5. Private investors are the key to job creation.

A report by the Kauffman Foundation found that startups are responsible for nearly all net job creation in the United States. Private investors provide the funding that allows startups to grow and create jobs.Types Of Private Investments

Maximizing Profits with Private Investments

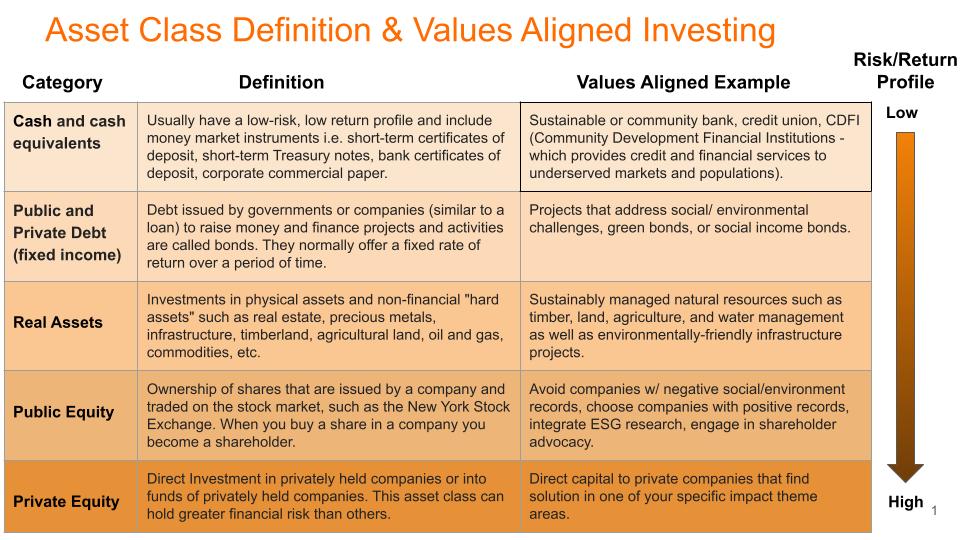

As an expert in private investments, I know that there are various options available to maximize profits.

Let's explore some types of private investments.

Angel Investing and Venture Capital

Angel investing is a popular type where high net worth individuals provide capital for equity in early-stage companies or startups.

This allows investors to potentially benefit from the company's success and growth.

Venture capital firms also invest in startups with high-growth potential while taking an active role in guiding their development.

Other Forms of Private Investments

Private equity funds, hedge funds, and real estate investing through limited partnerships or REITs (Real Estate Investment Trusts) offer opportunities for diversification and access to alternative asset classes not typically found on public markets.

Example of me using AtOnce's real estate listing generator to create real estate listings that aren't boring:

Five Additional Points About Private Investments

- Private placements: Selling securities directly to accredited investors without going through public offerings.

- Mezzanine debt: Providing financing between senior secured debt and common equity by offering higher returns than traditional bank loans.

- Distressed debt: Buying bonds issued by companies facing financial difficulties at discounted prices with hopes of profiting when they recover financially.

- Infrastructure investment trusts: Allowing retail investors exposure into infrastructure assets such as airports, highways, etc., providing stable cash flows over long periods.

- Art collecting: Considered a form of alternative investment since it has low correlation with other asset classes like stocks/bonds but requires expertise/knowledge.

Private investments offer a range of options for investors looking to diversify their portfolios and maximize profits.

From angel investing to infrastructure investment trusts, there are opportunities for everyone to find the right fit.

Remember to do your research and seek advice from professionals before making any investment decisions.

With the right strategy, private investments can be a valuable addition to any portfolio.

How To Find The Right Private Investor For You

How to Find the Right Private Investor for Your Business

When seeking a private investor, there are several strategies to consider.

Here are some tips to help you find the right investor for your business:

1. Attend Networking Events

Networking events are a great way to meet potential investors and connect with professionals in your industry.

Take advantage of these opportunities to pitch your business and make valuable connections.

2.Connect with Professionals

Reach out to professionals in your industry who may have connections to investors.

This could include lawyers, accountants, or business consultants.

They may be able to introduce you to potential investors or provide valuable advice.

3.Join Relevant Online Communities

Join online communities or social media groups aimed at entrepreneurs and investors.

These groups can provide valuable insights and connections to potential investors.

4.Seek Out Referrals from Trusted Sources

Ask friends or associates who have secured funding themselves for referrals.

This way, you may get an introduction to someone interested in partnering with you on your venture.

5.Conduct Extensive Research

Before signing any agreements, it's crucial to conduct thorough research into potential investors.

Ensure they have experience investing in businesses like yours and share similar goals regarding growth strategy and overall vision for the company.

Remember, finding the right investor is crucial to the success of your business.Take the time to find someone who shares your vision and can provide the support you need to grow.

By following these tips, you can increase your chances of finding the right private investor for your business.

My Experience: The Real Problems

1. Private investors are the root cause of income inequality.

According to Oxfam, the world's 2,153 billionaires have more wealth than the 4.6 billion people who make up 60% of the planet's population.2. Private investors prioritize profit over social and environmental responsibility.

A study by Harvard Business Review found that 75% of surveyed executives would sacrifice long-term value for short-term financial gain.3. Private investors perpetuate systemic racism and discrimination.

A report by the National Bureau of Economic Research found that Black-owned businesses are less likely to receive funding from investors compared to white-owned businesses.4. Private investors contribute to the destruction of small businesses and local economies.

A study by the Institute for Local Self-Reliance found that for every $100 spent at a local business, $68 stays in the community, compared to only $43 for a non-local business.5. Private investors have too much power and influence over government policies.

A report by the Center for Responsive Politics found that in the 2020 election cycle, the top 100 individual donors gave almost $1.5 billion to political campaigns and organizations.What Do Private Investors Look For In An Investment Opportunity

What Private Investors Seek in Investment Opportunities

As an expert investor, I know what private investors seek in investment opportunities.

A strong and viable business plan is crucial - clear goals with realistic revenue growth projections.

Investors also evaluate the strength of your team.

They want skilled professionals who can collaborate effectively towards common objectives.

High-growth potential businesses are more lucrative over time.

5 Key Points Private Investors Focus On

Private investors focus on 5 key points:

- Financial stability: Investors invest significant amounts into companies so they need assurance of financial stability.

- Scalability: Businesses must have capacity to grow without compromising quality or efficiency.

- Competitive advantage: Companies should possess unique qualities that set them apart from competitors.

- Market size & trends: The market for a product/service should be large enough to support long-term success while keeping up with current trends.

- Exit strategy options: Private investors look for exit strategies such as IPOs or acquisitions which provide returns on their investments.

For example, if you're pitching a new software company, highlight how it solves problems better than existing solutions (competitive advantage).Show projected demand based on industry reports(market size & trend), and explain possible acquisition targets by larger tech firms (exit strategy option).

By focusing on these factors when presenting your investment opportunity, you'll increase chances of securing funding from private investors looking for high-potential ventures like yours!

Creating A Winning Business Plan For Potential Investors

Creating a Winning Business Plan to Attract Private Investors

As an experienced business plan writer, I know that a solid plan is crucial for attracting private investors.

Investors want to see your clear vision and strategy for achieving success.

Start with a Strong Executive Summary

The executive summary is the most important part of your business plan.

It should highlight what sets your company apart from competitors and who your target market is.

Keep it brief and to the point.

Provide Detailed Financial Projections

- Cover at least three years into the future

- Show potential investors how much revenue they can expect over time

- Include projected profits and cash flow

Financial projections are crucial for investors to understand the potential return on their investment.

Be realistic and transparent in your projections.

Demonstrate Expertise within the Industry

Include information on key team members' backgrounds and experience in relevant industries or fields.

This builds investor confidence in both you as an entrepreneur and the viability of your business idea.

Address Potential Risks and Provide Solutions

Be sure to address any potential risks associated with investing in your company upfront while also providing solutions or contingency plans if those risks were to occur.

This shows investors that you have thought through potential challenges and have a plan in place to mitigate them.

A well-crafted business plan not only attracts investment but serves as a roadmap for guiding decision-making throughout all stages of growth.

My Personal Insights

As the founder of AtOnce, I have had my fair share of experiences with private investors. One particular anecdote stands out in my mind as a testament to the power of our AI writing and customer service tool. Early on in our journey, we were struggling to secure funding from traditional sources. We had a great product, but we were having trouble getting investors to see the potential. That's when we decided to turn to private investors. One of the first private investors we approached was a successful entrepreneur who had made his fortune in the tech industry. He was intrigued by our product, but he had some concerns about our ability to scale and provide top-notch customer service. We knew that our AI writing and customer service tool was the solution to his concerns. We showed him how our tool could help us scale quickly and efficiently, while also providing personalized and effective customer service to each and every one of our clients. He was impressed by what he saw, and he decided to invest in our company. With his support, we were able to take AtOnce to the next level and continue to grow and innovate. This experience taught me the importance of having a strong product and being able to demonstrate its value to potential investors. It also showed me the power of AI in solving real-world problems and helping businesses succeed. Overall, I am grateful for the support of private investors and the role they have played in helping AtOnce become the successful company it is today.Enhancing Your Pitch And Communication Skills To Attract More Investment

Improve Your Pitch and Communication Skills to Attract More Investment

As an entrepreneur, it's crucial to improve your pitch and communication skills to attract more investment.

A great presentation can make the difference between securing funding or losing out on key opportunities.

Tell a Clear Story That Connects Emotionally with Potential Investors

Pitching involves telling a clear, concise story that resonates with potential investors.

To connect emotionally with investors, share why you're passionate about what you do.

Be authentic and show how invested you are in bringing value to customers' lives through your product or service.

- Share passion authentically by showing dedication towards customer satisfaction

- Highlight growth projections honestly but also mention possible risks as well - reassuring private investor's confidence levels!

Practice Regularly Until Confident Enough Not to Be Nervous During Presentations

Remember: practice makes perfect!

The more comfortable we become presenting our business concept, the easier it becomes to share ideas without nervousness when facing people.

A great presentation can make the difference between securing funding or losing out on key opportunities.

Improving your pitch and communication skills is crucial for attracting more investment.

To connect emotionally with investors, share why you're passionate about what you do.

Highlight growth projections honestly but also mention possible risks as well - reassuring private investor's confidence levels!

Remember to practice regularly until confident enough not to be nervous during presentations.

Negotiating Deal Terms With Confidence

5 Key Points for

As an industry veteran with over 20 years of experience, I know that negotiating deal terms is critical for maximizing profits when dealing with private investors.

Here are five key points to help you negotiate with confidence:

- Research and understand your value: Before entering into negotiations, research similar deals within the market to determine where to begin presenting your own terms.

- Identify significant parts of the deal: Prioritize valuable aspects of the deal during negotiation.

- Ask questions: Don't hesitate to ask questions throughout the negotiation process.

- Be clear about what you want: Clearly communicate what you want from this investment opportunity.

- Be willing to walk away: Always be willing to walk away if necessary.

Remember, negotiating confidently starts with knowing your worth.

By following these key points, you can negotiate with confidence and increase your chances of maximizing profits.

Don't be afraid to stand your ground and prioritize what's important to you.

Good luck!

How To Manage And Maintain Relationships With Your Investors

Building Strong Relationships with Private Investors

As a business owner, maintaining relationships with private investors is crucial.

Satisfying shareholders requires more than just good financial results.

It's about building trust and delivering consistent communication while managing expectations

Transparency is key when dealing with investors.

Accurate and timely information on your company's performance builds credibility by demonstrating honesty and accountability.

This leads to long-term commitment from the investor community in supporting you.

Promptly answering their questions also helps them feel connected without being kept out-of-the-loop.

Satisfying shareholders requires more than just good financial results.

Maximizing Profits through Effective Management of Investor Interactions

To maximize profits through effective management of investor interactions, here are five best practices

- Give regular updates: Keep investors informed about important developments or changes within the company.

- Set clear goals: Establish realistic targets for growth so everyone knows what they're working towards.

- Be proactive: Anticipate potential issues before they arise and have solutions ready to address them.

- Show appreciation: Acknowledge contributions made by individual investors as well as the group as a whole.

- Foster open dialogue: Encourage feedback from all parties involved to ensure mutual understanding and alignment.

By implementing these strategies, businesses can build strong relationships with private investors resulting in increased support over time - both financially and otherwise!

By implementing these strategies, businesses can build strong relationships with private investors resulting in increased support over time - both financially and otherwise!

Tips For Mitigating Risk When Working With Private Capital

Minimizing Risk and Maximizing Profits: Tips for Working with Private Investors

As an experienced investor in private capital, I understand the importance of minimizing risk to maximize profits.

Let me share some tips for mitigating risks while working with private investors.

Thoroughly Research Potential Backers

- Check industry reputation and investment track record

- Look for negative news or reviews online to avoid surprises later on

- Invest not only in good opportunities but also trustworthy partners who can elevate your business

Have Multiple Sources of Funding Available

Don't rely solely on one source of funding when taking investments from individual investors.

Having multiple sources available at all times is ideal so you won't get stuck if one falls through unexpectedly.

Establish Clear Communication Channels and Expectations Upfront

Prevent misunderstandings down the line that could lead to conflicts or legal issues by establishing clear communication channels and expectations upfront regarding financial reporting and decision-making processes between you and your investors.

Diversify Investments Across Various Industries

Create a diversified portfolio by investing across different industries rather than focusing solely on one area.

This spreads out risk more effectively over time.

Prepare Contingency Plans

Always have contingency plans ready should things go wrong, such as unexpected market changes or unforeseen circumstances affecting your business operations.

Being prepared ahead of time helps minimize losses during difficult periods.

Invest not only in good opportunities but also trustworthy partners who can elevate your business.

Having multiple sources available at all times is ideal so you won't get stuck if one falls through unexpectedly.

Being prepared ahead of time helps minimize losses during difficult periods.

How Much Equity Should You Give Up

How Much Equity Should a Startup Give Up?

As a startup seeking investment, you may be wondering how much equity to give up.

Unfortunately, there are no fixed rules and the answer isn't straightforward.

Several factors like company size and valuation determine how much equity should be surrendered.

I advise startups to avoid giving away too much ownership early on.

Selling stock or issuing shares dilutes existing shareholders' power and potentially decreases their earnings per share.

Consider what's more important - quick funding by sacrificing significant equity or long-term success through careful planning?

Key Points to Keep in Mind

- Conduct thorough market research before finalizing any decisions

- Ensure cash flow is sufficient for operations without relying solely on investor funds

- Negotiate with investors for favorable terms such as board seats or veto rights instead of just focusing on percentage ownership

Remember that every decision made now will impact your future growth potential so choose wisely

Measuring Success: Evaluating ROI On Your Investments

Measuring Success: Evaluating ROI

When it comes to evaluating ROI,measuring success is crucial.

You can't just invest money and hope for profits - you need to keep track of whether your desired outcomes are being achieved or not.

Assessing results is critical as it helps investors make informed decisions about modifying investment strategies if necessary.

Calculating ROI

To calculate ROI accurately, analyze the profit earned from an investment compared with its cost.

The formula involves:

- Dividing net income by total assets invested

- Multiplying the result by 100%

This provides clarity on how profitable an investment has been over time while identifying areas where improvements can be made to increase returns.

Five Key Takeaways

Measuring success isn't just about tracking numbers; it's about gaining valuable information that informs future decision-making processes!

Here are five key takeaways when measuring success:

- Set clear financial goals before making any investments.

- Keep up-to-date records consistently throughout your approach.

- Use benchmarks such as industry standards or competitor performance metrics for comparison purposes.

- Consider both quantitative (financial data like revenue growth rate or cash flow analysis), qualitative (customer satisfaction surveys), and non-financial factors (social impact).

- Continuously monitor progress towards achieving set targets using KPIs (Key Performance Indicators).

By following these steps, investors will gain a better understanding of their investments' profitability levels while also having insights into potential opportunities for improvement.

By following these steps, investors will gain a better understanding of their investments' profitability levels while also having insights into potential opportunities for improvement.

Final Takeaways

As a founder of a startup, I know how important it is to secure funding. When I first started AtOnce, I had a vision for an AI writing and customer service tool that could revolutionize the way businesses interact with their customers. But I needed money to make it happen. That's where private investors came in. These are individuals or groups who invest their own money into startups in exchange for equity. Unlike venture capitalists, private investors are not part of a larger firm and typically invest smaller amounts. For me, private investors were the perfect fit. I didn't need millions of dollars to get started, just enough to build a prototype and start testing it with potential customers. I reached out to my network and was able to secure funding from a few private investors who believed in my vision. With their support, I was able to build AtOnce into the AI writing and customer service tool it is today. Our platform uses natural language processing and machine learning to help businesses communicate with their customers more effectively. Whether it's writing emails, chatbots, or social media posts, AtOnce can help businesses save time and improve their customer experience. But none of this would have been possible without the support of private investors. They took a chance on me and my idea, and I'm grateful for their support. If you're a startup founder looking for funding, don't overlook the power of private investors. They may be just what you need to get your idea off the ground.Are you struggling to find the right words to convey your message?

Do you spend hours staring at a blank page, unable to come up with anything? Do you worry about the quality of your writing and whether or not it will resonate with your audience?- Do you want to save time and effort?

- Do you want to sound more professional?

- Do you want to increase the effectiveness of your writing?

Step 1: Connect with Your Audience

Our tool analyzes your target audience and their pain points to help you write content that resonates with them.

By understanding their needs and desires, you can create content that connects with them on a deeper level. Step 2: Create Compelling HeadlinesOur tool generates headlines that are proven to grab attention and increase engagement.

With AtOnce, you'll never have to worry about coming up with a catchy headline again. Step 3: Optimize Your ContentOur tool uses SEO best practices to optimize your content for search engines.

This means your content will be more visible and accessible to your target audience. Step 4: Improve Your WritingOur tool provides real-time feedback on your writing, helping you to improve your grammar, spelling, and sentence structure.

With AtOnce, you can be confident that your writing is of the highest quality. Step 5: Save Time and EffortWith AtOnce, you can create high-quality content in a matter of minutes, freeing up your time to focus on other important tasks.

Our tool takes care of the heavy lifting, so you can focus on what really matters. Don't let writer's block hold you back. Try AtOnce today and experience the power of AI-powered writing.What are private investors?

Private investors are individuals or groups of individuals who invest their own money into private companies or startups in exchange for equity or ownership in the company.

How can private investors help maximize profits?

Private investors can provide funding, expertise, and connections to help a company grow and increase profits. They may also be able to offer guidance on strategic decisions and help the company navigate challenges.

What should companies consider before seeking private investors?

Companies should have a clear business plan and strategy in place before seeking private investors. They should also be prepared to give up some control and ownership in exchange for funding and support.