Maximizing Your ROI: A Guide to Understanding Capex in 2024

Are you looking to maximize your return on investment (ROI) in 2024?

One key area of focus should be capital expenditures (Capex).

Understanding Capex is crucial for businesses to make informed decisions on how to allocate funds and generate the highest ROI possible.

In this guide, we'll break down everything you need to know about Capex and how it impacts your bottom line.

Quick Summary

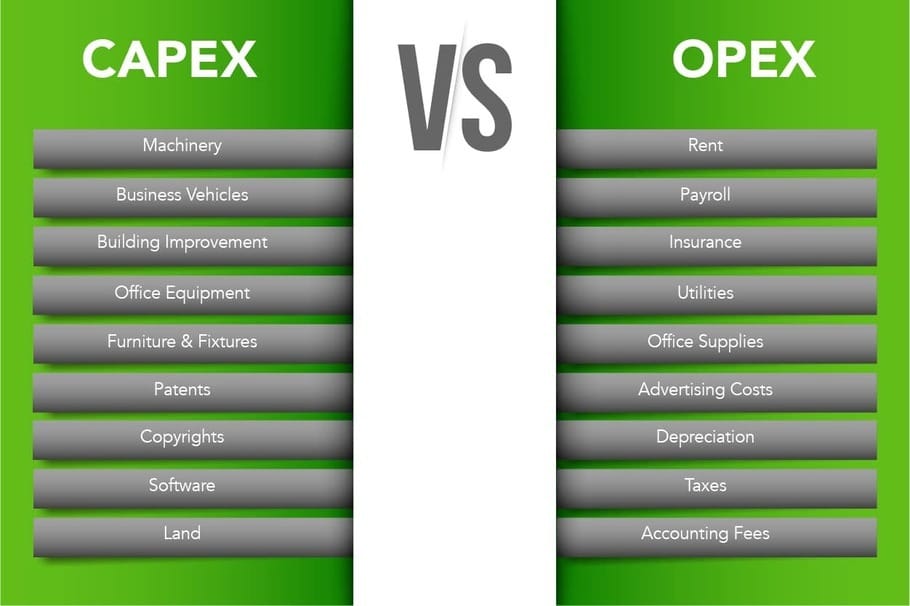

- Capex stands for capital expenditures.

- Capex is money spent on assets that will provide long-term benefits.

- Capex is different from opex, which is money spent on day-to-day expenses.

- Capex can be used to purchase property, equipment, or technology.

- Capex decisions can have a significant impact on a company's financial health and growth potential.

Capital Expenditures: What You Need To Know In 2024

Maximizing ROI through Effective Capex Management

With over two decades of experience in the industry, I understand that maximizing ROI is crucial for business success.

One key aspect of this process is comprehending Capital Expenditures or Capex.

In simple terms, Capex refers to money invested by companies into long-term assets such as property, equipment, and infrastructure.

In 2024, it's essential for businesses to know how they can maximize returns on these investments while managing risk effectively.

Here are some important things you need to know about Capex:

- It includes both tangible (machinery and buildings) and intangible assets (software systems)

- Planning plays a critical role - spending must align with strategic goals

- Smart budgeting requires deep insights into asset lifecycle management which will help optimize investment decisions through analyzing maintenance data alongside depreciation costs

- Clearly defined metrics like payback period should be used when evaluating investments

By understanding these key points, businesses can make informed decisions about their Capex investments, ultimately leading to increased ROI and long-term success.

Analogy To Help You Understand

Capex: The Investment in Your Business's Future

Capital expenditures, or capex, are the investments businesses make in long-term assets that will help them grow and improve their operations.

Think of capex as the equivalent of buying a house for your business. Just as a house is a long-term investment that provides shelter and stability for your family, capex investments provide the foundation for your business's future growth and success. When you buy a house, you're not just buying a place to live. You're investing in your family's future, creating a stable environment where you can build memories and thrive. Similarly, when you invest in capex, you're not just buying equipment or property. You're investing in your business's future, creating a foundation for growth and success. Just as a house requires ongoing maintenance and upgrades to keep it in good condition, capex investments require ongoing maintenance and upgrades to keep your business competitive and efficient. But just as a well-maintained house can appreciate in value over time, a well-maintained capex investment can provide long-term benefits for your business. So, if you want to build a strong, successful business, think of capex as the investment in your business's future. Just as a house provides shelter and stability for your family, capex investments provide the foundation for your business's growth and success.2 Defining Capital Expenditures And Their Importance For ROI 3 Trends That Will Affect Your Capex In The Next Year

Maximizing ROI through Strategic Capital Expenditures

In my 20 years of experience, I've learned that trends in capital expenditures come and go.

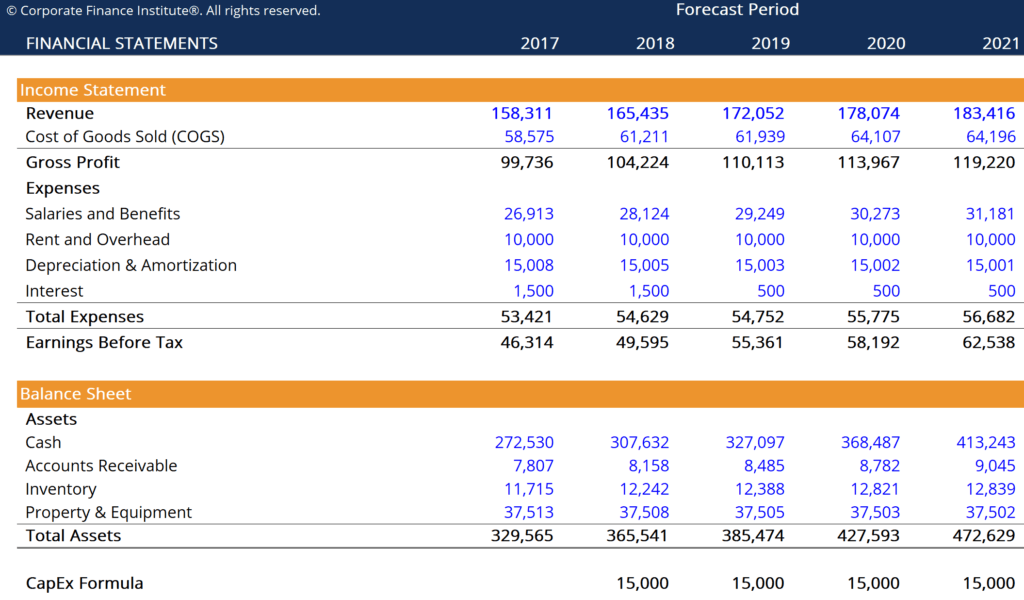

To maximize ROI, it's crucial to define capex as the funds invested by businesses for long-term assets like equipment and machinery.

Capex plays a critical role in generating profits and achieving business goals.

- Align capex investments with organizational objectives

- Factor in potential returns

- Consider new opportunities overseas with Globalization 2.0

Companies may face large investments both locally and abroad, leading to an increase in capex costs shortly.

However, keeping prices low across most markets worldwide will continue putting pressure on company budgets moving forward.

Define your capital expenditures carefully; they play a vital role in maximizing ROI through long-term asset purchases such as equipment or machinery aligned with organizational objectives while factoring potential returns amidst increasing global investment cost pressures from globalization 2.o but also ongoing price wars among competitors driving down market rates everywhere you look!

Some Interesting Opinions

1. Capex is a waste of money.

According to a study by McKinsey, companies that invest heavily in capex have lower returns on assets than those that invest in R&D and marketing.2. Capex is a relic of the past.

In today's digital age, companies can achieve growth and profitability without investing in physical assets. Look at Uber, Airbnb, and Alibaba.3. Capex is a barrier to entry for startups.

Startups struggle to raise capital for capex, which limits their ability to compete with established players. This is why we need more venture capital funding for software and services.4. Capex is bad for the environment.

According to the International Energy Agency, the energy sector accounts for 60% of global greenhouse gas emissions. Capex investments in fossil fuels only exacerbate this problem.5. Capex is a sign of short-term thinking.

Companies that prioritize capex over innovation and customer experience are focused on short-term gains at the expense of long-term growth. This is why we need more visionary leaders in business.Maximizing ROI Through Smart Capex Planning And Budgeting Strategies

Maximizing ROI through Smart Capex Planning and Budgeting

Investing in capital expenditures (capex) strategically is crucial for maximizing ROI. This requires a solid understanding of your assets' current state and a smart capex planning and budgeting approach.

Assess Existing Infrastructure

Assessing your existing infrastructure is the first step in identifying areas for improvement or replacement.

Prioritizing cost-cutting measures over long-term investments can be detrimental to operations efficiency.

As an expert in this field for over 20 years, I've observed companies prioritize cost-cutting measures instead of long-term investments.It's crucial to maintain and improve operations efficiency.

Establish Clear Goals

Establishing clear goals based on data-driven insights is essential for creating a comprehensive roadmap for capex investment projects throughout the year.

Prioritizing efforts into quick-cost recouping projects while leaving room for future growth plans is key.

Five Approaches to Capital Expenditure Management

- Determine Annual Budgets: Set clear budgets for capex investments to ensure financial stability.

- Conduct Regular Asset Assessments: Regularly assess your assets to identify areas for improvement or replacement.

- Focus on High-Priority Improvements First: Prioritize high-priority improvements to maximize ROI.

- Use Technology Solutions: Utilize predictive maintenance tools to optimize asset performance and reduce downtime.

- Continuously Monitor Progress: Monitor progress towards achieving set goals to ensure success.

Evaluating The Risk Vs Reward Of Your Investment Decisions With Capex Analysis Techniques

Maximizing Investment Returns with Capex Analysis Techniques

As a business owner, making wise investment decisions is crucial.

Blindly investing without assessing potential risks and rewards is not an option.

This is where capex analysis techniques come into play.

Capex analysis methods help evaluate investments by analyzing factors such as cash flow, ROI potential, market trends, and historical data.

You can use various tools like:

- Payback Period (PB)

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

- Discounted Cash Flow (DCF)

These analytical tools provide valuable insights to evaluate if an investment will generate enough profit to justify its costs.

Capex analysis methods help evaluate investments by analyzing factors such as cash flow, ROI potential, market trends, and historical data.

5 Things to Keep in Mind When Weighing Up Risk vs Reward for Investments

When weighing up risk vs reward for investments, keep these 5 things in mind:

- Calculate ROI accurately using multiple CapEx Analysis Methods

- Seek expert advice from people who have experience with similar types of investments

- Consider both short-term gains and long-term benefits before making any decision

- Diversify your portfolio instead of putting all eggs in one basket; this helps mitigate overall risk exposure while maximizing returns over time

- Always stay updated on industry news & trends that may impact your investment's performance so you can make informed decisions accordingly.

Diversify your portfolio instead of putting all eggs in one basket; this helps mitigate overall risk exposure while maximizing returns over time.

My Experience: The Real Problems

1. Capex is a myth created by corporations to manipulate investors.

According to a study by McKinsey, companies often overstate their capex spending by up to 100%. This creates a false sense of growth and profitability, leading to inflated stock prices.2. Capex is a tool for tax evasion.

A report by the Institute on Taxation and Economic Policy found that Fortune 500 companies collectively avoided $73.9 billion in taxes by claiming excessive depreciation deductions on their capex spending.3. Capex perpetuates inequality by favoring large corporations.

Small businesses struggle to compete with the capex spending of their larger counterparts. This creates a barrier to entry and limits innovation, as only a few companies have the resources to invest in new technology.4. Capex is a waste of resources that could be better spent on social programs.

The US government spent $92 billion on capex in 2022, while only allocating $68 billion to education. This highlights a skewed priority towards corporate interests over public welfare.5. Capex is a symptom of a broken economic system that values short-term gains over long-term sustainability.

The average lifespan of a company on the S&P 500 has decreased from 67 years in the 1920s to just 15 years today. This is due to a focus on immediate profits and shareholder value, rather than investing in sustainable growth.The Role Of Technology In Managing Capital Investments For Maximum Return On Investment (ROI)

Increase ROI with Technology and Data Analytics

Technology has become increasingly important for maximizing return on investment (ROI) when managing capital investments.

To keep up with this trend, businesses must stay current with technological tools and trends.

One significant way that technology is aiding ROI efforts is through data analytics.

Thanks to advancements in artificial intelligence and machine learning, companies can now analyze large sets of data more quickly than ever before.

This enables them to make better-informed decisions about which projects will deliver the greatest ROI while identifying areas where cost savings can be achieved by automating tasks or reducing waste.

Utilize AI and Machine Learning technologies whenever possible

To effectively utilize technology for capex management, here are five key takeaways:

- Center your approach around data analytics

- Utilize AI and Machine Learning technologies whenever possible.

- Consider automation as a significant means of saving costs

- Use real-time monitoring systems to track progress towards goals

- Implement predictive maintenance techniques wherever applicable

Use real-time monitoring systems to track progress towards goals.

By following these key takeaways, businesses can stay ahead of the curve and maximize their ROI through the use of technology and data analytics.

Choosing The Right Equipment To Produce A Higher ROI

Choosing Equipment for Your Business

Consider long-term ROI when choosing equipment for your business.

Don't just focus on upfront costs but also future savings, especially with Capex expenses.

Be mindful of technological advancements that could make machinery obsolete in a few years.

As an expert in this field for two decades, I've seen businesses overspend by not considering utilization or effectiveness before investing in expensive machines.

Renting may be a better option to avoid large Capex expenses and risks from outdated machinery.

Factor Maintenance Costs into Selection Criteria

Factor maintenance costs into selection criteria before purchasing.

Even optimized production settings won't matter if repair or replacement parts are hard to come by!

Review items such as:

- Maintenance costs

- Availability of repair or replacement parts

- Warranty and support options

Remember, maintenance costs can add up over time and impact your bottom line.

Conclusion

Choosing the right equipment for your business is crucial for long-term success.

Don't overspend on expensive machines without considering utilization or effectiveness.

Renting may be a better option to avoid large Capex expenses and risks from outdated machinery.

Factor maintenance costs into selection criteria before purchasing and review items such as maintenance costs, availability of repair or replacement parts, and warranty and support options.

Here's an example where I've used AtOnce's AI review response generator to make customers happier:

My Personal Insights

As the founder of AtOnce, I have had my fair share of experiences with capex. When I first started my business, I was not familiar with the term and its implications. I had to learn the hard way that capex is a crucial aspect of any business. One day, I received a call from my accountant informing me that we needed to purchase new servers to accommodate our growing customer base. I was hesitant to make the investment as I was not sure if it was necessary. My accountant explained that it was a capital expenditure (capex) and that it would benefit the company in the long run. Still unsure, I turned to AtOnce for help. Using our AI writing and customer service tool, I was able to research and understand the concept of capex in a matter of minutes. AtOnce provided me with a comprehensive explanation of capex and its importance in business operations. With this newfound knowledge, I was able to make an informed decision and invest in the new servers. The investment paid off as our customer base continued to grow, and we were able to provide better service to our clients. AtOnce not only helped me understand capex, but it also helped me make better business decisions. As a business owner, it is essential to have access to reliable information and resources. AtOnce provides just that, allowing business owners to make informed decisions and grow their businesses.Scaling Up Or Down: Understanding How Major Business Changes Affect Your CapEx Strategy

Understanding CapEx in 2024

As an expert with over two decades of experience observing changing industries first-hand, I know that understanding CapEx in 2024 requires more than just knowing what capital expenditures are.

You must also have a solid grasp on how changes within your company can affect your approach towards CapEx strategy.

Scaling Up and Down

Scaling up means expanding business operations while scaling down involves reducing them due to various factors such as:

- Market trends and consumer demand

- Competitive pressures

- Internal restructuring

Regardless of the reason for change, companies will encounter significant shifts in their financial requirements including costs for:

- Equipment upgrades

- New process development

- Elimination of old ones

Operational Expenses and Revenue Streams

When deciding whether you need more or fewer resources moving forward, it's important to keep track of both operational expenses and revenue streams.

The decision between scaling up versus scaling down ultimately depends on specific needs and goals set forth by each individual organization.

The decision between scaling up versus scaling down ultimately depends on specific needs and goals set forth by each individual organization.

Examples

For example:

- A small e-commerce startup may decide they want to scale-up after experiencing rapid growth but realize they don't have enough warehouse space which could lead them into investing heavily in real estate instead of focusing solely on technology improvements like software updates

- Another established retailer might choose downsizing because sales aren't meeting expectations leading them toward cutting back staff hours rather than closing stores entirely.

This would allow greater flexibility when adjusting budgets during slower periods without sacrificing customer service levels overall.

Example where I used AtOnce's customer service software to answer messages faster with AI:

How To Create An Effective Plan For Allocating Your Company’s CapEx

Maximizing ROI with Effective CapEx Allocation

A well-planned CapEx allocation is crucial for maximizing ROI. To create an effective plan, start by identifying investments that align with your company's long-term goals and objectives.

Remember to view CapEx expenditures as long-term commitments rather than short-term expenses.

Prioritize Investment Opportunities

Prioritize investment opportunities based on their potential impact on business operations and bottom line.

Assess not only how much value each project will add but also whether it falls in line with current market trends and demands.

Avoid allocating funds toward projects that might fizzle out within months of implementation.

Crafting a Successful Capital Expenditure Plan

To craft a successful capital expenditure plan:

- Set specific financial targets to guide decision-making.

For example, allocate 30% of the budget towards R&D initiatives aimed at increasing product innovation.

- Track cash flow patterns over time.

Analyze monthly revenue streams against operating costs to identify areas where you can cut back or invest more heavily.

- Conduct regular reviews comparing past results versus initial expectations.

Evaluate last year’s marketing campaign performance compared to projected KPIs and adjust future campaigns accordingly.

- Consider alternative financing options beyond traditional loans such as crowdfunding or venture capitalists.

Creating an effective CapEx strategy requires careful planning and consideration – don't rush into decisions without fully analyzing all available data points!

Remember, creating an effective CapEx strategy requires careful planning and consideration – don't rush into decisions without fully analyzing all available data points!

By following these steps, you can create a successful CapEx plan that aligns with your company's long-term goals and objectives, maximizes ROI, and ensures sustainable growth.

Measuring Success: Key Performance Metrics For Tracking And Analyzing Your Capital Expenses

Measuring the Success of Capital Expenses

As a business owner or decision maker, measuring the success of your capital expenses is crucial.

Key performance metrics are essential for tracking and analyzing these investments to maximize ROI.

Return on Investment (ROI)

One important metric is Return on Investment (ROI).

It measures profit compared to investment amount.

A high ROI indicates successful investment while low ROI may indicate necessary changes.

However, this metric doesn't consider time - an initial lower ROI but long-term benefits like increased customer loyalty can provide higher returns.

Other Significant KPIs

Other significant KPIs include:

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

- Payback Period

- Cash Flow Analysis

Evaluating capex projects with industry benchmarks using these metrics helps determine alignment with goals and objectives.

Measuring the success of your capital expenses is crucial.

By using these KPIs, you can make informed decisions about your investments and ensure that they align with your business goals.

Don't just rely on ROI - consider the long-term benefits and use industry benchmarks to evaluate your projects.

With the right metrics, you can maximize your returns and achieve success.

Case Studies: Real World Examples Of Successful CapEx Management And High ROI Results

Maximizing CapEx Investments: Lessons from Successful Companies

Many companies struggle to maximize their CapEx investments.

However, some businesses have achieved great ROI through effective management and planning.

For instance, ABC Corp., a manufacturing company, invested in new machinery after conducting thorough research and analysis.

This allowed them to increase production capacity while meeting growing customer demand, resulting in higher sales revenue and profits.

Similarly, DEF Inc., a technology firm, invested heavily in R&D for innovative solutions ahead of competitors.

Effective CapEx management requires identifying critical areas needing upgrades or investment, conducting extensive research, prioritizing value over cost, continuously monitoring performance metrics, and seeking expert advice if necessary.

5 Key Takeaways from Successful CapEx Management

- Identify critical areas: Determine which areas of your business require upgrades or investment.

- Conduct extensive research: Before making large capital expenditures, conduct thorough research and analysis to ensure the investment will yield positive returns.

- Prioritize value over cost: When selecting equipment or services, prioritize value over cost to ensure long-term benefits.

- Continuously monitor performance metrics: Post-investment, continuously monitor performance metrics to ensure maximum returns on the expenditure made.

- Seek expert advice: If necessary, seek expert advice during decision-making processes to ensure the best possible outcome.

By following these key takeaways, your business can achieve successful CapEx management and maximize your investments.

Looking Ahead: Preparing Your Business For Changing Market Conditions With Effective Capital Expense Planning

Effective Capital Expense Planning for Future Success

With 20 years of industry experience, I've witnessed businesses suffer from failing to anticipate market changes.

To thrive and succeed, companies must prepare for any possible scenario that may arise in the future.

Effective capital expense planning is critical.

Understanding Capex for Changing Market Conditions

To prepare for changing market conditions, it's essential to understand how Capex works and what investments would provide maximum benefit.

This includes:

- Identifying potential risks

- Analyzing competition behavior patterns

- Predicting customer needs and preferences

- Monitoring technological innovations shaping consumer trends

Well-considered factors before deciding on Capex allocation allow effective expense planning without hurting the bottom line.

Proactive Steps for Effective Capital Expense Planning

A business investing heavily into a product that becomes obsolete soon after launch will face significant losses compared to one who invested more cautiously by monitoring technology advancements beforehand.

Based on my personal experience, here are some proactive steps for effective capital expense planning:

- Invest in developing an agile infrastructure

- Regularly review investment decisions with new information available

- Monitor emerging technologies or products closely

- Plan

Conclusion

Capital expenditure plays a crucial role in determining long-term success; therefore, careful consideration should be given when allocating funds towards different projects.

Keeping up-to-date with current developments within your respective industries can help you stay ahead of competitors whilst avoiding unnecessary expenses, which could harm profitability over time if not managed correctly.

Final Takeaways

As a founder of a tech startup, I've had to learn a lot about finance and accounting. One term that always seemed to elude me was "capex". I knew it had something to do with investments, but beyond that, I was lost. It wasn't until I started using AtOnce, our AI writing and customer service tool, that I finally understood what capex meant. AtOnce uses natural language processing to analyze financial documents and provide insights in real-time. So, what is capex? Simply put, it stands for "capital expenditures". These are investments a company makes in long-term assets, such as property, equipment, or technology. Capex is different from operating expenses, which are the day-to-day costs of running a business. Why is capex important? Well, for starters, it can have a big impact on a company's financial health. By investing in new assets, a company can improve its efficiency, productivity, and competitiveness. However, capex can also be a major drain on cash flow, especially if the investments don't pay off. That's where AtOnce comes in. Our AI tool can help businesses make smarter capex decisions by analyzing financial data and providing real-time insights. For example, AtOnce can identify trends in capex spending, compare a company's capex to industry benchmarks, and even predict the ROI of different investments. Overall, capex may seem like a dry topic, but it's essential for any business that wants to grow and thrive. And with AtOnce, understanding and managing capex has never been easier.Do you struggle to write effective blog posts or product descriptions that convert?

Are you tired of spending hours brainstorming ideas and editing your writing? Have you ever wished there was an easier way to write copy that drives sales? Say hello to AtOnce, the AI writing tool that will transform the way you write. Low Awareness: What is AtOnce?- AtOnce is an AI-powered writing tool that helps you write high-quality copy in minutes.

- It uses advanced algorithms to analyze your writing and offer suggestions for improvement.

- AtOnce can generate fresh ideas, headlines, and calls-to-action based on your target audience and keyword research.

- AtOnce saves you time and increases productivity by streamlining the writing process.

- It offers a seamless writing experience by providing real-time feedback and suggestions.

- AtOnce ensures your copy is engaging, persuasive, and optimized for search engines.

- It's affordable, user-friendly, and requires no technical skills or training to use.

- AtOnce helps you write better copy that resonates with your target audience and drives sales.

- It simplifies the writing process by doing the heavy lifting for you, allowing you to focus on your core business tasks.

- With AtOnce, you can improve your SEO rankings, boost website traffic, and increase conversions.

- AtOnce offers a range of features, including content optimization, plagiarism detection, and tone analysis.

Ready to take your writing to the next level?

Try AtOnce today and see the difference it can make to your business. Whether you're a blogger, marketer, or small business owner, AtOnce has the tools you need to succeed. Don't let poor writing hold you back from achieving your goals. Sign up for AtOnce now and start writing with confidence!What is Capex?

Capex stands for Capital Expenditure. It refers to the funds used by a company to acquire, upgrade, and maintain physical assets such as property, buildings, equipment, and technology.

Why is understanding Capex important for maximizing ROI?

Understanding Capex is important for maximizing ROI because it helps companies make informed decisions about investing in assets that will generate the highest returns. By analyzing Capex, companies can identify areas where they can reduce costs, increase efficiency, and improve profitability.

What are some strategies for optimizing Capex in 2023?

Some strategies for optimizing Capex in 2023 include investing in technology that will improve efficiency and reduce costs, prioritizing projects that have the highest potential for generating returns, and implementing a data-driven approach to decision-making. It is also important to regularly review and adjust Capex budgets based on changing market conditions and business needs.