Get CMOs To Scale Your SEO Content: The Different Way In 2025

We help brands scale with high quality SEO content. Without wasting years on hiring.

We plan, research, write, and publish content for you. Get your first articles within 2 to 3 weeks:

How We're Different: Our CMOs Do Your SEO Content, Without Wasting Your Time

- You don't have to manage a big content team.

- You don't have to find keywords or plan content.

- You don't have to write or edit hundreds of articles.

First we understand your brand. Then we plan and write content. Focused on your goals.

Want more traffic? Leads? Sales? Brand awareness? We can help:

1. Book A Call

Pick a date and time. And tell us your website and email.

2. Talk Strategy

We can discuss your business goals and SEO needs.

3. Get Content

We plan an SEO strategy. And start writing content for you.

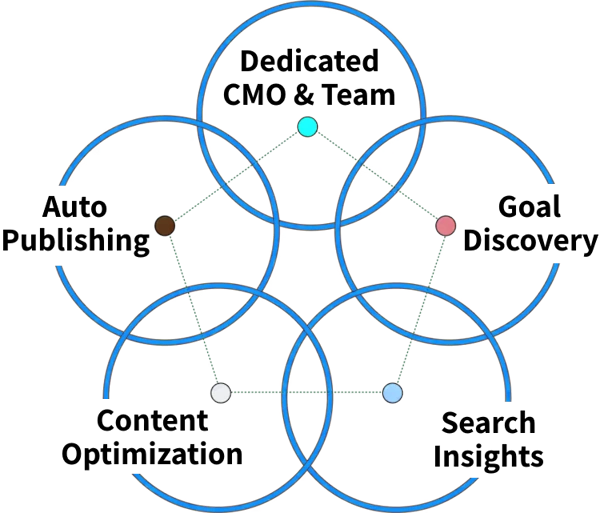

You Get A CMO And Full Team, Just For SEO

Our SEO agency can do your content for a simple monthly rate:

- SEO Strategy: Get a plan to grow your rankings and traffic.

- Writing Content: Get top ranking blog posts that target your ideal customers.

- Making Images: Get images that help build your brand authority in your niche.

- Automated Publishing: Get new content published for you. So you can rank faster.

Benefits Of A Full Team, Without Constant Meetings

We won't waste your time in weekly meetings. You don't need to deal with a big SEO team.

You only need to talk with our Chief Client Officer on the initial call. For everything else, just message us.

Every brand we work with gets a CMO and SEO team. They can plan, write, and publish content for you.

We can do everything from scratch. Or you can give us a list of topics / keywords to start with.

Why Brands Choose Us To Write Their Content

We're easy to work with. And we get results. Here's why we're in short supply:

- High Quality: Our editors make the content more engaging. So your traffic converts better.

- Easy to Scale: Our CMOs find keywords and can even publish content for you. Just sit back and relax.

- Full Team for Cost Of One Hire: Stop wasting time with slow agencies that charge hourly.

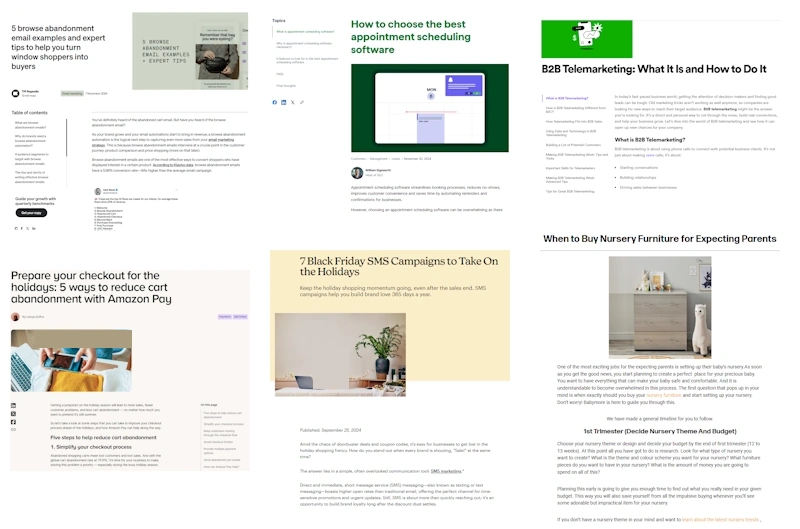

We Make Content For Your Industry And Audience

We're the SEO company that gets results. We make content that gets traffic, leads, and sales:

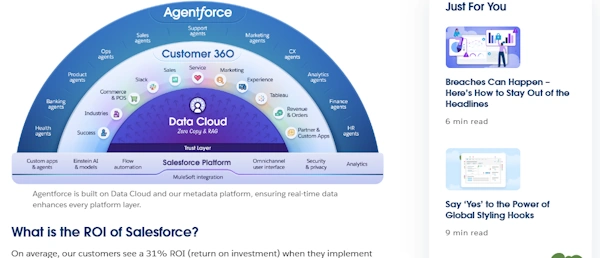

- Understand Your Brand: We know what works in most industries like B2B, SaaS, and e-commerce.

- High Ranking Content: We write blog articles that people read. We rank high and improve KPIs.

- Written By Experts: Our articles match your brand voice. Find your ideal customers. And convert them.

Get On Brand SEO Content That Sounds Like You Wrote It

Our CMOs plan and write high quality articles for you. Focused on your business goals:

1. Product Led Content

Our articles are easy to read. And they can be based around your product.

We target keywords your customers are searching for. And link it to your brand.

2. Matches Brand Voice

We write content that meets your brand guidelines.

We can add your colors, logos, and make it look nice. While increasing traffic and leads.

3. With Product Photos

We show people how your product solves their problems.

This helps them remember you. And increase conversions. And improve brand awareness.

How It Works

Want us to write about certain topics? Just give us a list and we can start making content.

Want us to do it all instead? We can research, write, and publish content for you.

Here's our 4-step process:

Week 1: Audit, Research, Planning

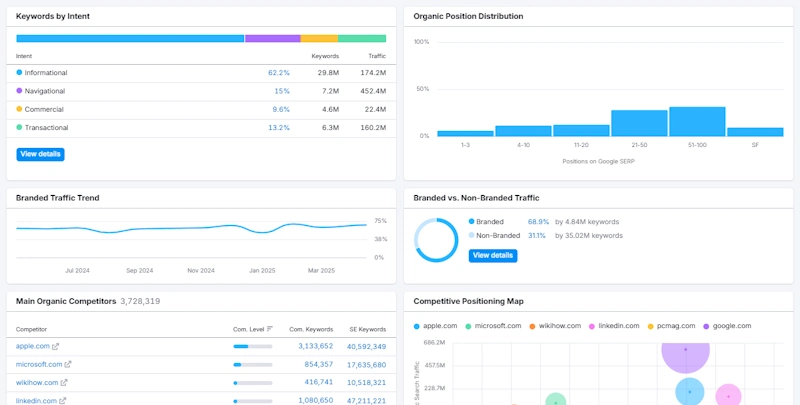

Our CMOs review your website to find gaps and new opportunities. We do a full content audit.

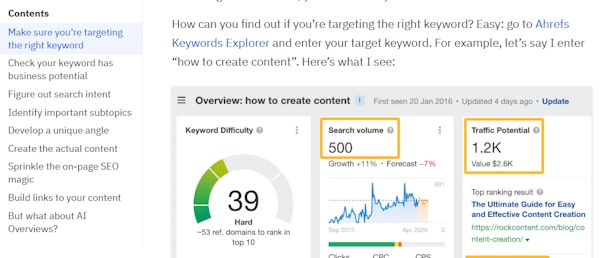

We research your industry and analyze competitor websites. For keywords, content, and structure.

Week 2: SEO Strategy

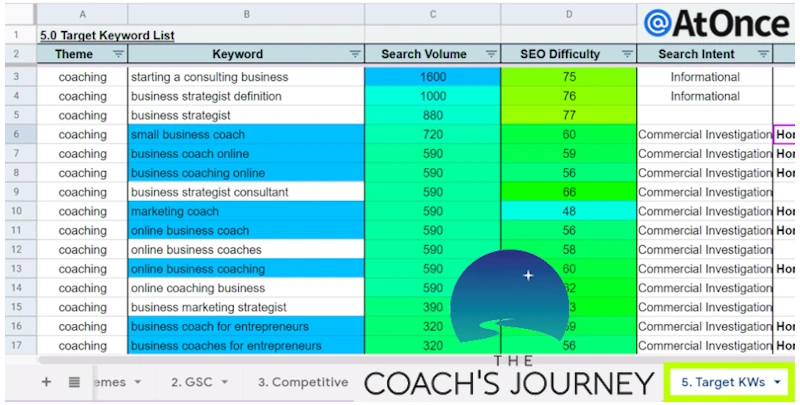

Next, we make your SEO content strategy. And create a list of high converting keywords.

We focus on the highest impact areas first. So you rank faster and see results quicker.

Week 2 to 3: Writing Content

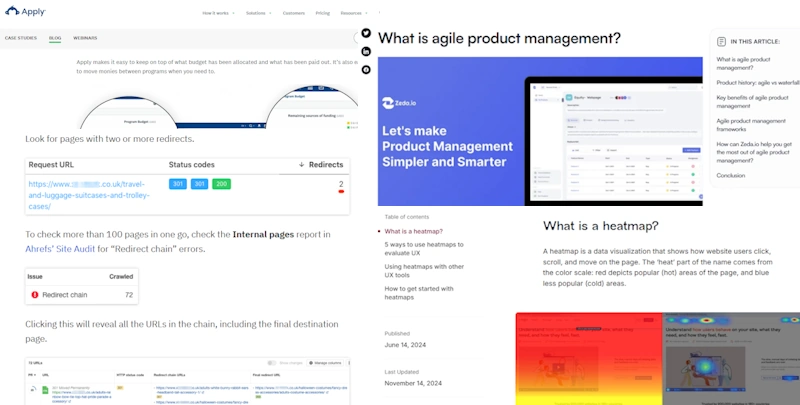

After Week 2, we start writing content. High quality blog posts that target your ideal customers.

Our team can write 10,000 to 35,000 words of SEO articles per month.

Depending on your industry, that's 10 to 35 articles per month. Done for you.

Week 3 Onwards: Edits And Publishing

Our editors add custom images, meta descriptions, internal links, and more.

So our posts fit your brand's voice and style. And we can even publish these articles for you.

You can get high quality content going live regularly. Without lifting a finger.

Get A CMO And Team For SEO

We replace unreliable freelancers and slow SEO agencies for one monthly fee.

You get the benefits of a full SEO team. Without needing to manage them.

Pick the best option for your needs:

Booster

$2,700 / month

Get highly polished SEO blog articles that are ready to rank.

This includes:

- 10 blog articles / posts every month

- Keyword research

- Original images

Want to upgrade?

Article uploading, monthly reporting, Slack support, and more can be added for an extra monthly charge.

Done For You

$4,700 / month

For brands who want to scale SEO production. Rank for keyword categories fast.

This includes:

- ~22,000 words of blog articles / posts every month

- Content audit

- SEO strategy

- Content strategy

- Original images

- Auto publishing

Fully Staffed

$7,700 / month

Perfect for brands who want max efficiency and ROI. Outsource the entire SEO content process.

This includes:

- ~35,000 words of blog articles / posts every month

- Content audit

- SEO strategy

- Content strategy

- Original images

- Auto publishing

- Optimization of current content

- Internal linking

- Slack support

- Monthly reporting

Limited Availability: Book A Call

**Please note we only partner with a few clients per month. So slots are limited:

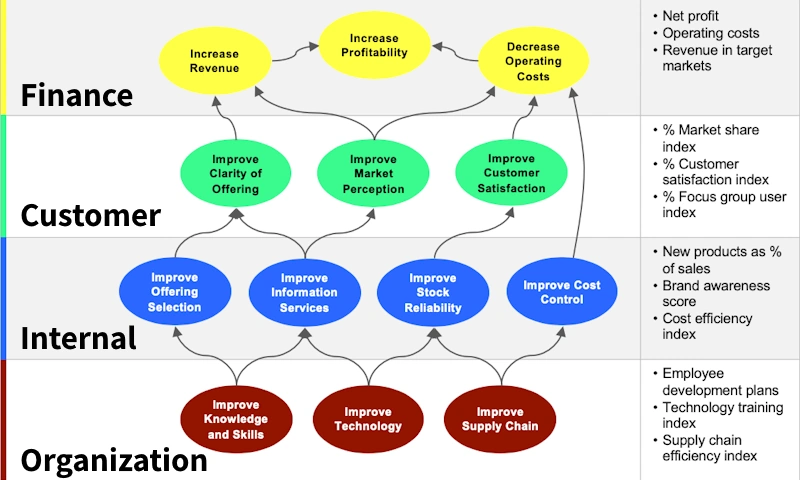

Lower Your KPIs: Get More Conversions At Less Costs

Our CMOs make a plan based on what your company needs. Want more leads? More traffic? Want people to see you as a top brand?

Then we get to work. Our team researches and writes blog posts that turn visitors into customers.

We handle everything for your SEO content creation. Keywords, writing, reports — you name it. Increasing traffic, brand awareness, and sales.

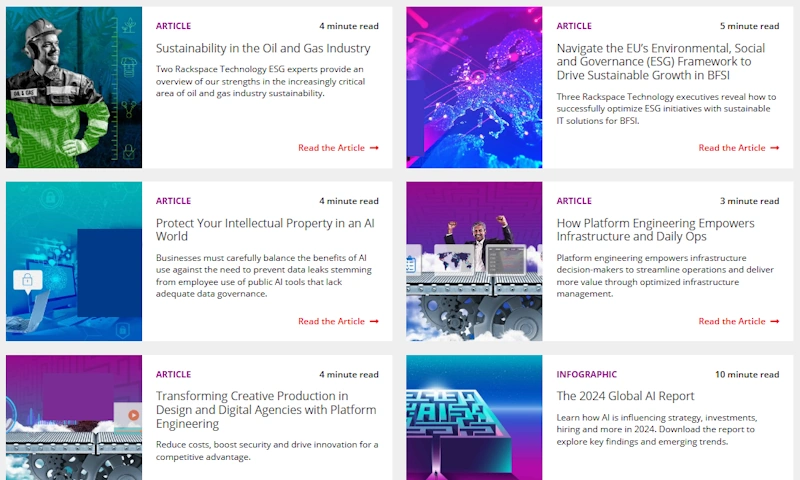

Make Your Brand Stand Out With Thought Leadership

Google puts the best content at the top. So your brand should show authority. Here's how we do that:

Our industry experts research and plan everything. Then real writers turn that into great content.

But we don’t just write blog posts. We link that content to your product. So readers become leads and sales.

- Easy-to-read charts and tables

- Clear answers to what people search for

- Brand logos, brand colors, meets brand guidelines

Yes, SEO Content Still Works

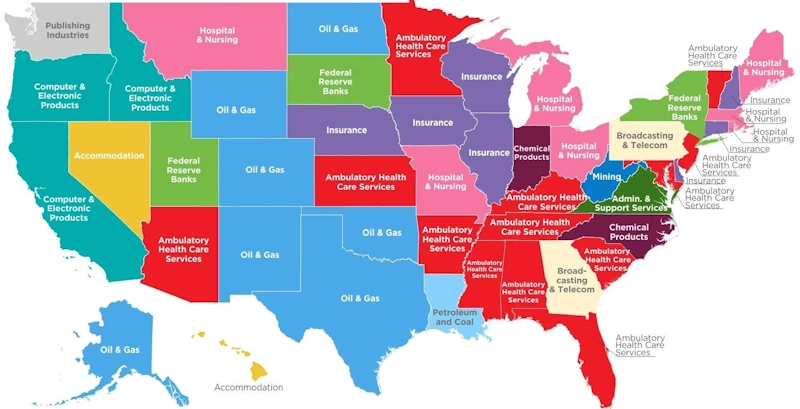

SEO works in most industries. From B2B to SaaS and e-commerce. Our SEO company mainly works with medium and large brands.

- 53.3% of website traffic comes from organic search*

- 60% say SEO/content marketing is their highest quality source of leads*

- Leads from SEO are 8x more likely to become paying customers*

*According to collected data

Simple Guarantee: You Can Go Back Anytime

We guarantee to plan and write your SEO content on time. But we don't promise results.

We won't lock you into a 12-month contract like other agencies. You only pay monthly.

If you aren't 100% satisfied, you can cancel anytime. And go back to your previous SEO methods.

- Professional SEO Services: No backlinks. No PR campaigns. Just high quality content.

- First Results Can Take 2-3 Months: You get the articles quickly. But SEO rankings take time.

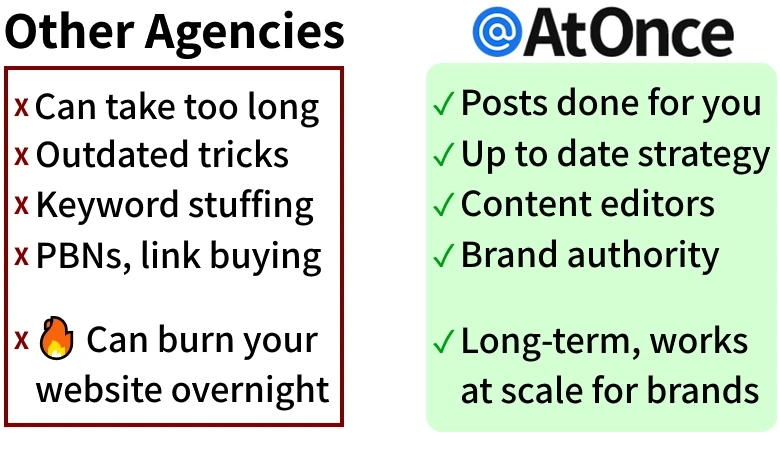

Why AtOnce Is Better Than Other SEO Agencies

Many agencies focus on technical SEO. They use outdated tricks like keyword stuffing, PBNs, and link buying. This can burn your site overnight.

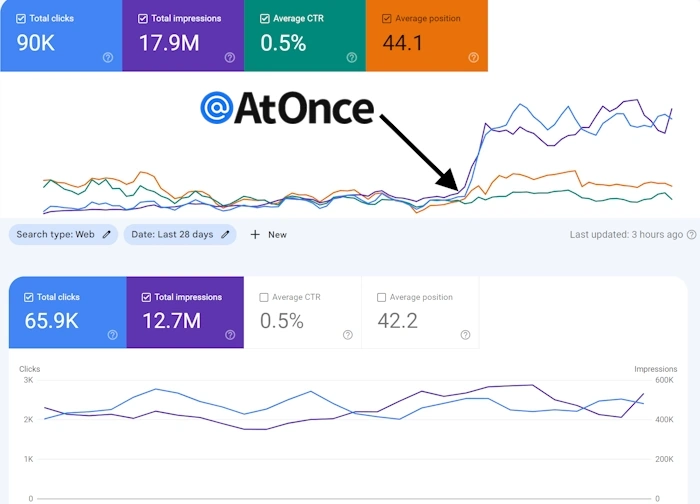

AtOnce has CMOs with a full content strategy. We find high value keywords that get conversions. Then we make dozens of articles on each topic. This builds your brand authority and works at scale.

- Done For You, No Meetings: Just email us. Or message us in Slack.

- Easy To Scale, No Delays: We can meet deadlines and write more content within 24 hours.

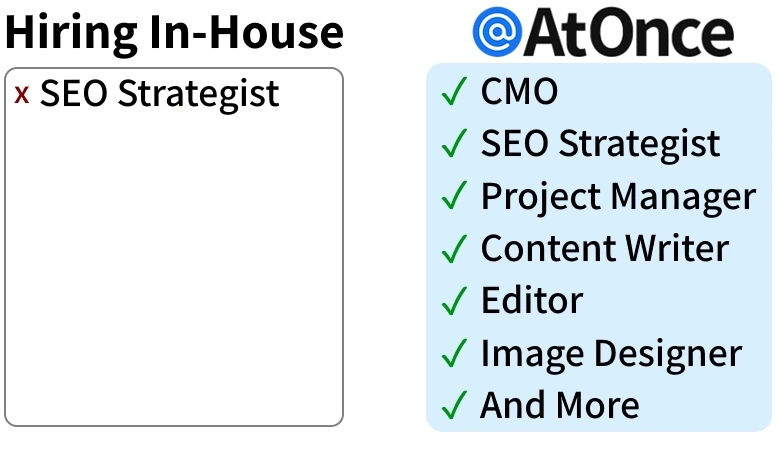

Why AtOnce Is Better Than Hiring In-House

Many businesses can't find, train, or afford a full team for SEO services. Strategists. Content Managers. Writers. Editors.

AtOnce can save you years of hiring. We let you buy blog posts off the shelf. We give you the benefits of a top team. Fully trained. With a CMO.

Plus, we save you the headaches of a big SEO team. You only talk to our Chief Client Officer. If you need something new, just send us a message.

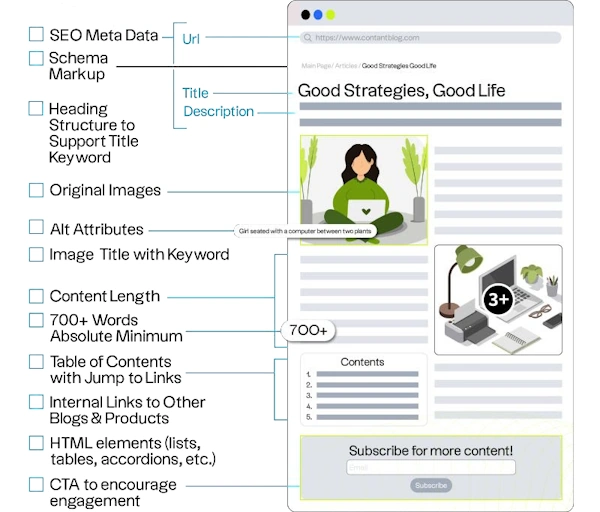

Here's What We Include In Every SEO Article

We're a done for you SEO company. That gives you high quality content - one of the best SEO services:

- Keyword research for H1's, H2's, and H3's

- Article outline with SEO optimizations

- 700 to 2,000 words (depending on the keyword)

- 1 main article image (at the top of the article)

- 3 to 10 article images (depending on the length)

- Optimized internal links

- 1 meta description

You Get On Brand Content

Our CMOs manage your SEO content. Our expert team edits it. So the content is unique and SEO optimized:

- Grammatically correct

- Plagiarism checked

- Fact checked

- Highly engaging

- SEO optimized, without keyword stuffing

How We Build Long-Term Brand Value

We plan, research, and write great content for you.

At first, you can show up more in search results.

Then, your team can use that content in emails, social media, and sales.

Over time, people can start seeing you as a leader in your space:

Step 1: Discover & Plan

We audit your site and look for gaps. Then we research your market and top competitors.

We figure out what your audience is searching for. And how to reach them.

Step 2: Brand Content Strategy

We build a content plan that fits your brand voice and goals.

We focus on keywords that help you grow traffic and bring new leads.

Step 3: Writing Content

We write blog posts that show your expertise and builds trust.

Every piece is designed to rank high on Google. And support your sales team.

Step 4: Growth Mode

We add visuals, links, and polish everything for your brand.

We can write new articles. Improve existing content. And update it for you.

Get On Brand SEO Content: Without Finding, Hiring And Training An SEO Team

Book a call. Tell us your business goals. Pick an SEO package. Then we start writing content.

You won't deal with a big SEO team directly. Just talk to our Chief Client Officer:

1. Book A Call

Pick an available date and time. Tell us your website. We email you a Zoom link.

2. Talk Strategy

Meet with our CCO. Discuss your business needs and website goals.

3. Get Content

We plan an SEO content strategy. Then we start writing articles for you.

Grow Your Brand's Traffic And Conversions

We can handle the SEO strategy, write 10+ articles per month, and can make sure it goes live on your site.

We give you new, high quality content. Written by experts. Focused on your goals. Consistently on schedule.