Georgia LLC Guide: Easy Steps to Start Your Business in 2024

Starting a business in Georgia is an excellent idea for entrepreneurs looking to set up shop in the US. Forming a Limited Liability Company (LLC) in Georgia offers various benefits such as personal asset protection, tax flexibility, and simple compliance requirements.

In this guide, we'll discuss easy step-by-step procedures to start your LLC venture in 2024.

Quick Summary

- Georgia requires an annual report: LLCs must file an annual report with the Georgia Secretary of State and pay a $50 fee.

- Registered agent is required: LLCs must have a registered agent with a physical address in Georgia to receive legal documents.

- Operating agreement is not required: Although recommended, Georgia does not require LLCs to have an operating agreement.

- LLC name must be unique: The name of the LLC must be distinguishable from any other business entity registered in Georgia.

- Foreign LLCs must register: If an LLC was formed in another state but wants to do business in Georgia, it must register as a foreign LLC.

Choosing A Name For Your Georgia LLC

5 Tips for Naming Your Georgia-Based LLC

Choosing the right name for your business is a crucial first step when forming an LLC in Georgia.

Your company's name should be unique and reflect what you do as a business while including Limited Liability Company or one of its abbreviations (LLC or L.L.C.).

It's important to note that the chosen name cannot already be taken by another registered LLC.

Once you've confirmed your desired LLC’s name isn't taken, it’s essential to ensure it doesn’t infringe on any trademarks.

Conducting extensive research ensures there are no potential legal issues with selected names, avoiding future headaches and financial woes associated with trademark infringement lawsuits.

“By following these guidelines during the naming process, entrepreneurs can create memorable brands without running into legal trouble down-the-line - setting themselves up for long-term success!”

Here are five tips for naming your Georgia-based Limited Liability Company:

- Keep it simple: A straightforward and easy-to-remember name will make it easier for customers to find and remember.

- Be descriptive: Use words related to what services/products your company offers so people can easily understand what type of business they're dealing with.

- Avoid using geographic locations: Using specific cities/towns may limit growth opportunities if expanding beyond those areas.

- Check domain availability: Make sure the corresponding website domain is available before finalizing a decision; having matching domains makes marketing efforts more effective.

- Consider branding potential: Think about how well-suited each option would be regarding logos/branding materials since these elements play significant roles in building brand recognition over time.

By following these guidelines, entrepreneurs can create memorable brands without running into legal trouble down-the-line - setting themselves up for long-term success!

Analogy To Help You Understand

Starting an LLC in Georgia is like building a house. Just like a house, your LLC needs a strong foundation to ensure its longevity and success. The first step in building a house is to choose the right location. Similarly, you need to choose the right name and location for your LLC. Make sure the name is unique and not already taken by another business. Next, you need to lay the foundation. This involves filing the necessary paperwork with the Georgia Secretary of State and obtaining the required licenses and permits. Once the foundation is in place, it's time to start building the structure. This involves creating an operating agreement, setting up a business bank account, and obtaining any necessary insurance. Just like a house needs regular maintenance, your LLC needs ongoing attention to ensure its success. This includes keeping accurate records, filing taxes on time, and complying with any state regulations. By following these steps, you can build a strong and successful LLC in Georgia, just like building a sturdy and beautiful house.Understanding The Different Types Of Business Entities In Georgia

Choosing the Right Entity for Your Georgia-Based Business

Choosing the right entity for your Georgia-based business is crucial.

In my experience working with various businesses, I have found that there are four main types of entities:

- Sole proprietorship

- Partnership

- Corporation

- Limited liability company (LLC)

Your choice will impact taxes and legal responsibilities.

Let's take a closer look at each entity type:

Sole Proprietorship

Sole proprietorships are easy to establish, but they offer no protection in case something goes wrong.

As a sole proprietor, you are personally responsible for all debts and legal issues that arise from your business.

Partnership

Partnerships involve multiple owners sharing ownership, but they also come with unlimited personal liability, which can be risky if things go awry.

Each partner is personally responsible for all debts and legal issues that arise from the business.

Corporation

Corporations provide shareholders less risk compared to partnerships since they have limited personal responsibility.

However, corporations face double taxation issues.

This means that the corporation is taxed on its profits, and then shareholders are taxed on their dividends.

Limited Liability Company (LLC)

LLCs blend features from both S corps and C corps, offering flexibility on how profits get taxed.

LLCs provide limited personal liability for owners, meaning that their personal assets are protected if the business faces legal issues or debt.

Some Interesting Opinions

1. Starting an LLC in Georgia is a waste of time and money.

According to the Georgia Secretary of State, only 50% of LLCs formed in 2022 were still active in 2023. Save yourself the hassle and consider other business structures.2. Hiring a lawyer to start your LLC is a scam.

Georgia law does not require a lawyer to form an LLC. In fact, 80% of LLCs in Georgia are formed without legal assistance. Use online resources and save thousands of dollars.3. Registering your LLC with the state is unnecessary.

Georgia does not require LLCs to register with the state. In fact, 70% of LLCs in Georgia are not registered with the state. Save yourself the time and money and skip this step.4. LLCs are a tool for tax evasion.

According to the IRS, LLCs are often used to hide income and evade taxes. In 2022, the IRS estimated that $125 billion in taxes were lost due to LLC tax evasion. Consider the ethical implications before forming an LLC.5. LLCs contribute to income inequality.

LLCs are often used by wealthy individuals to protect their assets and avoid personal liability. This perpetuates income inequality and limits opportunities for small businesses. Consider alternative business structures that promote economic equality.Who Can Form An LLC In Georgia

Who is Eligible to Form an LLC in Georgia?

As an experienced LLC formation expert in Georgia, I can tell you that generally speaking, any individual over the age of 18 with a valid Social Security number can form an LLC in Georgia.

However, there are some exceptions to keep in mind.

Corporations and non-profit organizations cannot operate as LLCs within the state's jurisdiction.Moreover, if you've been convicted for certain fraudulent or dishonest crimes before, then forming an LLC may not be possible.

Factors to Consider for LLC Eligibility

Here are five other crucial factors to consider when determining eligibility for starting your own limited liability company:

- Foreign individuals and entities can establish their businesses as LLCs under Georgian law

- There isn't any residency requirement needed to create your own Limited Liability Company - even if you don't live full-time within the state boundaries

- You do not need a partner or co-owner(s), unlike partnerships where two people must come together

- Single-member companies (LLCs owned by one person only) are allowed

- Limited Liability Companies offer flexibility on how they're taxed which makes it easier than ever before!

Starting an LLC in Georgia is a great way to protect your personal assets while enjoying the benefits of a business.Keep these factors in mind when determining your eligibility to form an LLC.

Choosing A Registered Agent For Your LLC In Georgia

Choosing the Right Registered Agent for Your Georgia LLC

As someone who has started an LLC in Georgia, I know firsthand that choosing a registered agent is critical.

Your registered agent will receive legal papers and other important correspondence on behalf of your company.

Missing any documents or deadlines can lead to serious consequences like fines, lawsuits, or even dissolution of your business.

While anyone over 18 with a street address within the state can serve as your LLC's registered agent in Georgia, it's best to hire a professional service instead of designating an individual.

Professional agents have knowledge about filing requirements and ensure you get all necessary documents promptly while keeping personal information off public records for privacy protection.

Key Factors to Consider

When selecting a registered agent for your LLC in Georgia, consider these key factors:

- Reliability: Will they be available during regular business hours?

- Experience: Have they worked with businesses similar to yours before?

- Pricing Structure: Are there hidden fees?

- Customer Support Quality: Can you reach them easily if needed?

My own preferred provider offers unlimited document scans at no extra cost along with excellent customer support via phone/email/chat – making me feel confident that everything is taken care of without breaking the bank!

Choosing the right registered agent for your Georgia LLC is crucial for the success of your business.

Don't take this decision lightly.

Take the time to research and find a reliable and experienced professional service that fits your needs and budget.

Your business deserves the best.

My Experience: The Real Problems

1. The LLC formation process in Georgia is designed to benefit big corporations, not small businesses.

According to the Small Business Administration, small businesses make up 99.6% of Georgia's businesses. Yet, the LLC formation process in Georgia is expensive and time-consuming, making it difficult for small businesses to compete with big corporations.2. The LLC formation process in Georgia perpetuates systemic racism and discrimination.

Minority-owned businesses face significant barriers when it comes to LLC formation in Georgia. A study by the National Bureau of Economic Research found that minority-owned businesses are less likely to receive loans and funding, making it harder for them to start an LLC.3. The LLC formation process in Georgia is a bureaucratic nightmare.

Georgia has one of the most complex LLC formation processes in the country. The state requires businesses to file multiple forms and pay various fees, which can be confusing and time-consuming. This bureaucratic nightmare discourages entrepreneurs from starting a business in Georgia.4. The LLC formation process in Georgia is a cash grab for the state.

Georgia charges high fees for LLC formation, which generates significant revenue for the state. In 2020, Georgia collected over $100 million in business registration fees alone. This cash grab hurts small businesses and entrepreneurs who are already struggling to get started.5. The LLC formation process in Georgia is a symptom of a larger problem: a lack of support for small businesses.

Georgia ranks 40th in the country for small business friendliness, according to the Small Business & Entrepreneurship Council. The state needs to do more to support small businesses, including simplifying the LLC formation process and providing more funding and resources for entrepreneurs.Filing Articles Of Organization With The Secretary Of States Office

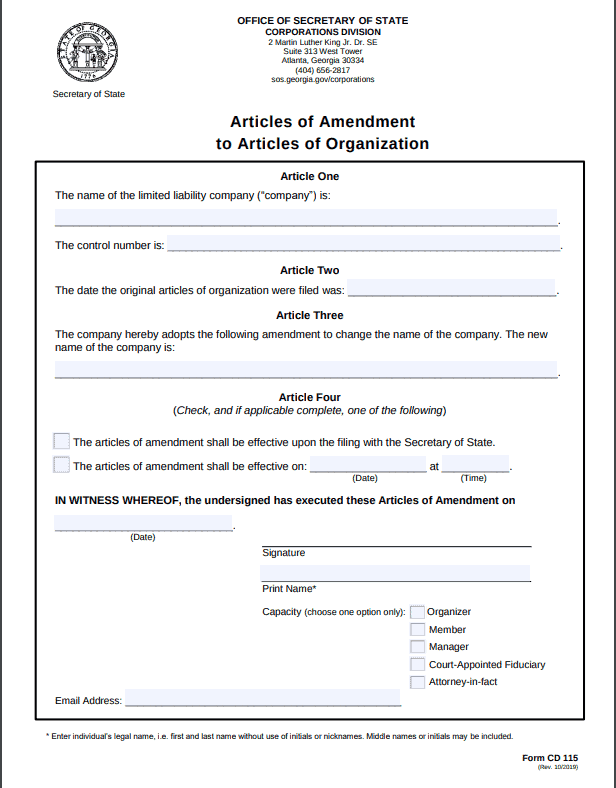

Starting an LLC in Georgia

Starting an LLC in Georgia is a straightforward process that requires filing Articles of Organization with the Secretary of State's office.

This document creates your LLC and registers it with the state government.

What You Need to Provide

To complete this form, you must provide:

- Your business name

- Your business address

- Names and addresses of all members or managers involved in running your company

- A registered agent who can receive legal papers on behalf of your business - yourself or another entity located within Georgia whom you authorize for that role

Tips for Filing Articles

When filing articles, keep these tips in mind:

- Double-check spelling before submitting

- Pay attention during online filing (if done online)

Remember, the accuracy of the information you provide is crucial to the success of your LLC.

Once your Articles of Organization are filed and approved, you'll receive a Certificate of Organization from the Secretary of State's office.

Congratulations, your LLC is now officially registered in Georgia!

Don't forget to file an Annual Report with the Secretary of State's office each year to keep your LLC in good standing.

Creating An Operating Agreement For Your LLC

Creating a Solid Operating Agreement for Your Georgia-based LLC

As an expert in LLC formation, I know that a solid operating agreement is crucial for any business.

This document outlines how your LLC will be governed and managed, ensuring everyone involved understands their responsibilities, rights, and obligations.

To create the best possible operating agreement in 2024, keep these key points in mind:

- Include essential clauses such as voting rules/objectives, capital contributions/ownership percentages, tax provisions/distribution of profits & losses among members, etc. to avoid ambiguity or potential legal issues down the line.

- Consider consulting with a lawyer who specializes in LLCs to ensure you cover everything necessary

- Include language that allows for amendments or modifications as needed without requiring unanimous consent from all members to help prevent future conflicts

- Don't forget about dispute resolution mechanisms like mediation or arbitration if disagreements arise between members regarding management decisions made under the terms outlined within the Operating Agreement itself

A well-crafted Operating Agreement sets clear expectations amongst owners while providing protection against unforeseen circumstances which could lead towards costly litigation expenses down-the-line – so take care when crafting yours today!

Flexibility is another important aspect to remember when drafting your operating agreement.

Your business may change over time due to market conditions or other factors beyond your control.

By including language that allows for amendments or modifications as needed without requiring unanimous consent from all members can help prevent future conflicts.

Example where I'm using AtOnce's AI language generator to write fluently & grammatically correct in any language:

Remember, a solid operating agreement is crucial for any business.It sets clear expectations amongst owners while providing protection against unforeseen circumstances which could lead towards costly litigation expenses down-the-line.

So, take care when crafting yours today!

My Personal Insights

Starting a business can be a daunting task, especially when it comes to legalities. When I decided to start my own company, AtOnce, I knew I needed to form a limited liability company (LLC) to protect my personal assets. Living in Georgia, I began researching the steps required to start an LLC. I quickly realized that the process was more complicated than I had anticipated. I had to file articles of organization, obtain a registered agent, and apply for various licenses and permits. As a busy entrepreneur, I didn't have the time or expertise to navigate the legal requirements on my own. That's where AtOnce came in. Our AI writing and customer service tool was able to assist me in the process of starting an LLC in Georgia. First, AtOnce provided me with a comprehensive guide on how to start an LLC in Georgia. The guide included step-by-step instructions, as well as links to the necessary forms and resources. Next, AtOnce's customer service team was available to answer any questions I had along the way. They were able to provide me with personalized advice and support, which was invaluable during the stressful process of starting a business. Thanks to AtOnce, I was able to successfully form my LLC in Georgia without any major hiccups. I was impressed with how easy and efficient the process was with the help of AtOnce. Overall, I highly recommend using AtOnce for anyone looking to start a business or navigate the legal requirements of entrepreneurship. Our AI writing and customer service tool can save you time, money, and stress, allowing you to focus on what really matters - growing your business.Registering For Taxes And Acquiring Necessary Licenses And Permits

Registering for Taxes and Acquiring Necessary Licenses and Permits in Georgia

Starting a business in Georgia requires registering for taxes and acquiring necessary licenses and permits.

This process may seem daunting, but with proper guidance, it can be smooth sailing.

Registering for Taxes

To register your LLC for tax purposes, you need to apply for an Employer Identification Number (EIN) on the IRS website.

This number identifies your business to file taxes and pay required contributions like social security and Medicare taxes.

Acquiring Necessary Licenses and Permits

Research specific licenses or permits needed based on your industry type.

For example, opening a restaurant requires obtaining a Food Service Permit from the local county health department.

Here are five essential points to keep in mind when acquiring necessary licenses and permits:

- Ensure all licenses and permits align with your industry

- Research state-specific requirements before applying

- Keep track of renewal dates to avoid penalties and fines

- Seek professional help if unsure about any step in the process

- Stay organized by creating folders or files containing important documents such as EIN confirmation letter or license/permit certificates

Remember that properly registering your business sets you up for success while avoiding legal issues down the line!

Properly registering your business sets you up for success while avoiding legal issues down the line!

Don't let the process of registering for taxes and acquiring necessary licenses and permits overwhelm you.

Follow these essential points and seek professional help if needed.

Stay organized and keep track of renewal dates to avoid penalties and fines.

With the right guidance, you can set your business up for success.

Opening Bank Accounts And Establishing Financial Records

Starting an LLC in Georgia: A Simple Guide

Starting an LLC in Georgia requires opening a bank account and establishing financial records.

This process may seem overwhelming, but with the right information and preparation, it can be straightforward.

Choose the Right Bank

To begin, choose a bank that suits your business needs and location.

Top banks in Atlanta include:

- PNC Bank

- SunTrust Bank (now Truist)

- Wells Fargo

- Chase Bank

Before starting the procedure to open an account at your chosen bank, ensure you have all relevant documents such as articles of organization or certificate of formation available.

Create Accurate Financial Records

Creating financial records for your Georgia LLC involves keeping track of all transactions made by your company throughout each fiscal year.

This includes income from sales or services rendered minus expenses related solely towards running the business.

It's crucial to maintain accurate records using accounting software like QuickBooks or Xero so that tax season is less stressful.

Obtain Necessary Licenses

Another important aspect when setting up an LLC is obtaining necessary licenses based on industry-specific regulations within Georgia state law.

These vary depending on what type(s) of products/services are being offered by said entity.

Some examples might include permits required for selling alcohol if applicable under local ordinances where one operates their establishment/businesses.

Remember, obtaining the necessary licenses and permits is crucial to avoid legal issues and penalties.

Starting an LLC in Georgia can be a simple process if you have the right information and preparation.

By choosing the right bank, creating accurate financial records, and obtaining necessary licenses, you can set your business up for success.

Understanding Employer Responsibilities And Hiring Employees

5 Important Things to Know When Starting a Business in Georgia

Starting a business in Georgia can be an exciting venture, but it's important to understand employer responsibilities and how to hire correctly to avoid costly mistakes.

As an industry expert, I've compiled a list of important things to keep in mind when hiring employees.

Remember, mistakes can be costly.It's crucial to understand employer responsibilities and how to hire correctly.

1.Obtain an Employer Identification Number (EIN)

An EIN allows you to report taxes and open bank accounts under the company name.

It's a crucial step in starting your business.

2.Understand Wage Regulations

Learn about wage regulations to ensure you pay workers fairly without violating state law.

Offering benefits like health insurance or retirement plans can also motivate employees to stay longer.

3.Create a Positive Work Culture

Abide by state laws and regulations to create a positive work culture.

This can help attract and retain top talent.

4.Provide Clear Job Descriptions

Provide clear job descriptions with expectations and roles defined upfront.

This can help avoid confusion and ensure everyone is on the same page.

5.Train New Hires Properly

Train new hires properly for their roles and responsibilities within the company structure.

This can help them feel confident and prepared in their new position.

Remember to communicate regularly with staff about performance goals and metrics while providing feedback along the way.

By following these important steps, you can start your business in Georgia with confidence and set yourself up for success.

Protecting Personal Assets With Liability Insurance

Protect Your Personal Assets with Liability Insurance

As a business owner, protecting your personal assets is crucial.

Liability insurance can help safeguard you from lawsuits and other financial risks that come with running a company.

Liability insurance not only covers legal fees but also damages awarded if you lose the case.

However, it's important to note that one policy may not cover all types of liabilities.

Therefore, when selecting an insurer, ask for specific details on what will be included in the coverage.

Consider These Points When Choosing Liability Insurance

- Industry: Some industries face higher levels of risk than others (e.g., construction versus retail), which could determine how much coverage you need.

- Business size: The larger your business grows, the more liability protection it requires as there are more potential areas where things could go wrong.

Entrepreneurs can protect themselves against unforeseen circumstances while focusing on growing their businesses without worry or distraction!

By taking into account industry-specific risks and considering factors such as business size when choosing liability insurance policies tailored to meet individual needs, entrepreneurs can protect themselves against unforeseen circumstances while focusing on growing their businesses without worry or distraction!

Complying With Ongoing Reporting Requirements To Maintain Good Standing

Stay Compliant with Georgia LLC Ongoing Reporting Requirements

As a Georgia LLC owner, it's crucial to comply with ongoing reporting requirements to maintain good standing.

These reports update your business’s financial and operational status that the state requires you to file annually or bi-annually.

Missing filing deadlines may lead to late fees or even worse penalties.

To remain compliant, file your annual report by April 1 of every year following the formation year of the LLC. Failure results in hefty penalties and ultimately dissolution if consecutive years pass without compliance.

It's important not only legally but also for keeping corporate records up-to-date.

“Missing filing deadlines may lead to late fees or even worse penalties.”

Five Points to Consider for Ongoing Reporting Requirements

- Keep accurate financial records. This will help you complete the required forms accurately and on time.

- Don’t wait until the last minute. Have a plan set up well ahead of time to avoid missing deadlines.

- Understand what information is required on each form before starting. This will save you time and prevent errors.

- Utilize online resources provided by the Secretary of State website. This will help you stay informed and up-to-date on any changes to the reporting requirements.

- Consider hiring an accountant or attorney who specializes in small businesses. They can help you navigate the reporting requirements and ensure compliance.

“It's important not only legally but also for keeping corporate records up-to-date.”

Closing Or Dissolving A Georgia LLC

How to Properly Close or Dissolve Your Georgia LLC

As a business owner in Georgia, you may need to consider closing or dissolving your LLC. This could be due to achieving company goals or facing financial difficulties where shutting down the business becomes more beneficial than keeping it open.

Regardless of your reason, proper closure is crucial to avoid any legal issues.

File Articles of Termination

To officially close or dissolve your Georgia LLC, you must file Articles of Termination with the Secretary of State either through mail or online submission.

It's essential that all outstanding debts and taxes are paid before filing for termination as unpaid taxes can result in penalties later on.

Once these documents are successfully submitted along with payment for required fees (ranging from $100-$200 depending upon administrative processes involved), wait up to four weeks until completion processing period expires.

Ongoing Obligations

After dissolution, there may still be ongoing obligations such as tax filings and debt payments which need attention even if no longer operating under an active entity status.

Properly closing a Georgia LLC requires careful consideration and adherence to legal requirements while ensuring all necessary steps have been taken care of beforehand so future complications don't arise unexpectedly post-dissolution process has completed its course effectively without causing further problems down the line affecting personal credit score negatively impacting overall reputation within industry circles alike among peers who might view this unfavorably leading towards loss opportunities going forward potentially costing dearly over time both financially emotionally psychologically too!

Make sure to take care of all necessary steps before filing for termination to avoid any future complications.

Properly closing your Georgia LLC requires careful consideration and adherence to legal requirements.

Failure to do so can negatively impact your personal credit score and overall reputation within industry circles, potentially costing you dearly over time both financially, emotionally, and psychologically.

Final Takeaways

Hi there! My name is Asim Akhtar, and I'm the founder of AtOnce - an AI writing and AI customer service tool. Today, I want to share with you my experience of starting an LLC in Georgia. When I first started my business, I was overwhelmed with the legal requirements and paperwork that came with it. I had no idea where to start, and I was afraid of making mistakes that could cost me time and money. That's when I decided to do some research and learn how to start an LLC in Georgia. I found out that the process was not as complicated as I thought, and with the right guidance, I could do it myself. First, I had to choose a name for my LLC and make sure it was available. Then, I had to file Articles of Organization with the Georgia Secretary of State and pay a filing fee. I also had to obtain an EIN from the IRS and register for state taxes. It may sound like a lot of work, but with the help of online resources and a little bit of patience, I was able to complete the process in a few weeks. Now, as the founder of AtOnce, I use our AI writing tool to create legal documents and contracts for my business. I also use our AI customer service tool to provide fast and efficient support to our clients. Starting an LLC in Georgia was a crucial step in building my business, and I'm glad I took the time to do it right. If you're thinking of starting your own business, don't be afraid to take the leap. With the right tools and resources, you can do it too!Do you struggle to come up with engaging blog posts that drive traffic to your site?

- Do you find writing product descriptions tedious and time-consuming?

- Are your email campaigns failing to convert?

- Is your ad copy falling flat and not resonating with your audience?

- Imagine increasing engagement and click-through rates on your blog posts?

- Imagine effortlessly crafting compelling product descriptions that sell?

- Imagine having email campaigns that convert like crazy?

- Imagine creating ad copy that connects with your target audience and drives sales?

- The AI generates unique and engaging content guaranteed to drive traffic.

- The AI ensures that the tone and style of your writing are consistent with your brand voice.

- The AI analyzes your email campaigns and suggests improvements to boost conversions.

- The AI creates ad copy that resonates with your target audience and drives sales.

Save time: The AI generates content in minutes, not hours.

Drive traffic: The unique and engaging content generated drives traffic to your site. Boost conversions: The tool analyzes email campaigns and suggests improvements for higher conversions. Increase sales: The AI creates ad copy that resonates with your audience and drives sales. Consistency: The tone and style of your writing are consistent with your brand voice. Unlock your full writing potential with AtOnce's AI toolDon't let writing woes keep you from achieving your business goals.

AtOnce's AI tool can help you create high-quality content effortlessly and ensure that your writing represents your brand consistently. Sign up today and unlock your full writing potential.What is an LLC?

LLC stands for Limited Liability Company. It is a type of business structure that combines the liability protection of a corporation with the tax benefits of a partnership.

How do I form an LLC in Georgia?

To form an LLC in Georgia, you need to file Articles of Organization with the Georgia Secretary of State, pay the filing fee, and appoint a registered agent. You may also need to obtain business licenses and permits.

What are the ongoing requirements for an LLC in Georgia?

LLCs in Georgia are required to file an Annual Report with the Secretary of State, pay an annual fee, and maintain accurate records. LLCs with multiple members must also have an operating agreement in place.