Mastering Your Portfolio: Efficient Processes for 2024

As we head into 2024, managing your investment portfolio efficiently is becoming more crucial than ever.

With the global economy in a state of flux and many industries experiencing rapid change, it's important to implement effective processes for monitoring and adjusting your investments.

Fortunately, there are some practical strategies you can use to master your portfolio this year and beyond.

Quick Summary

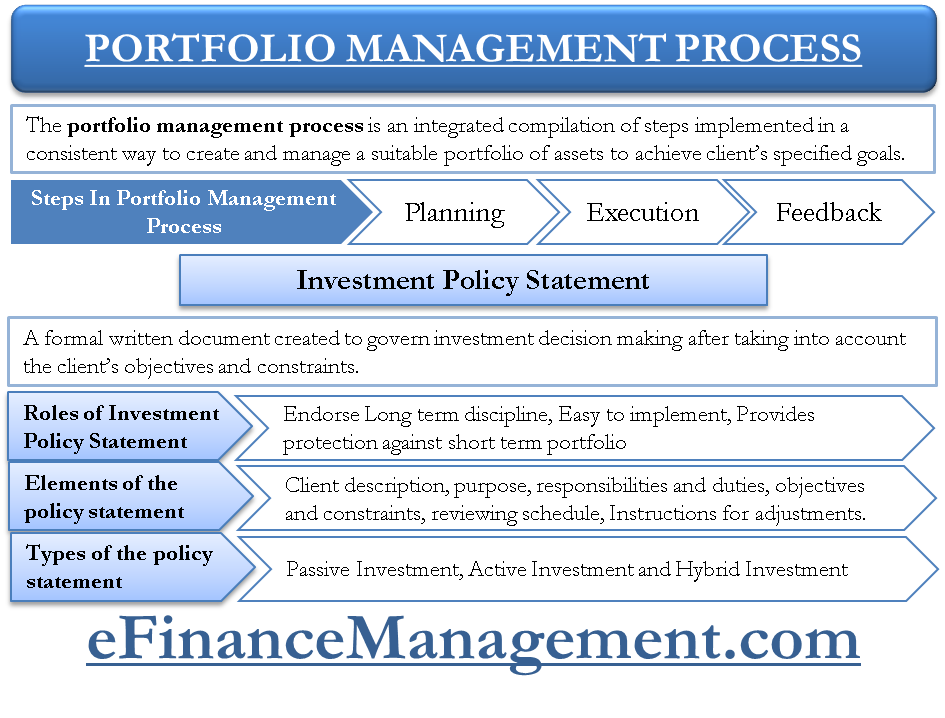

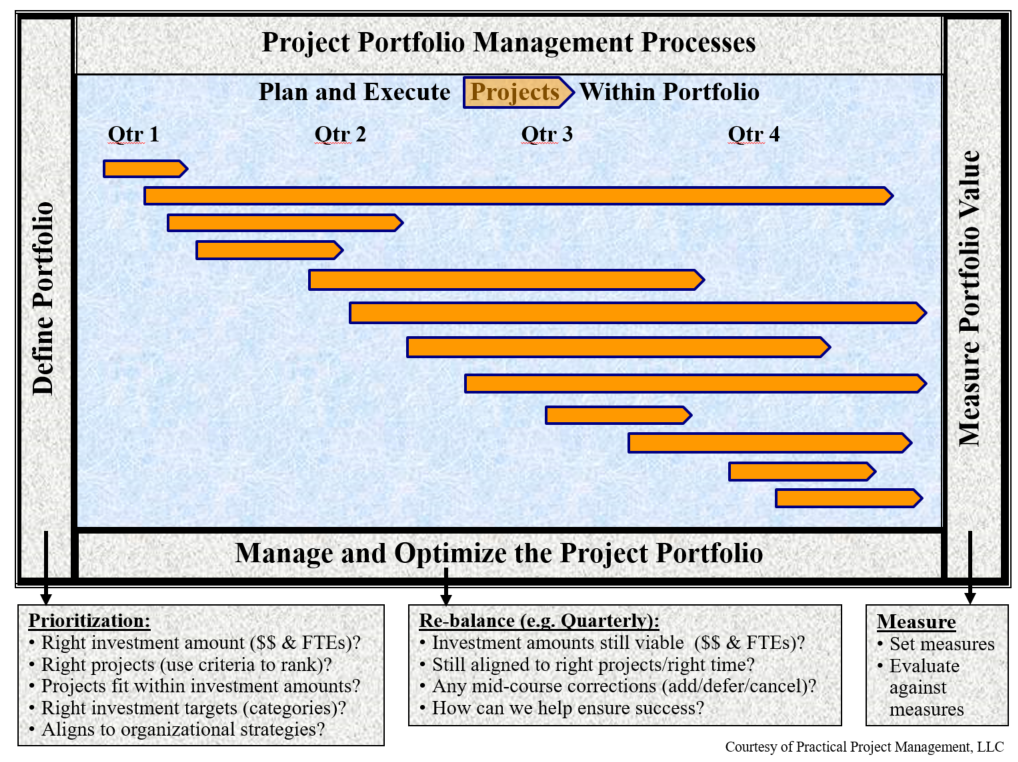

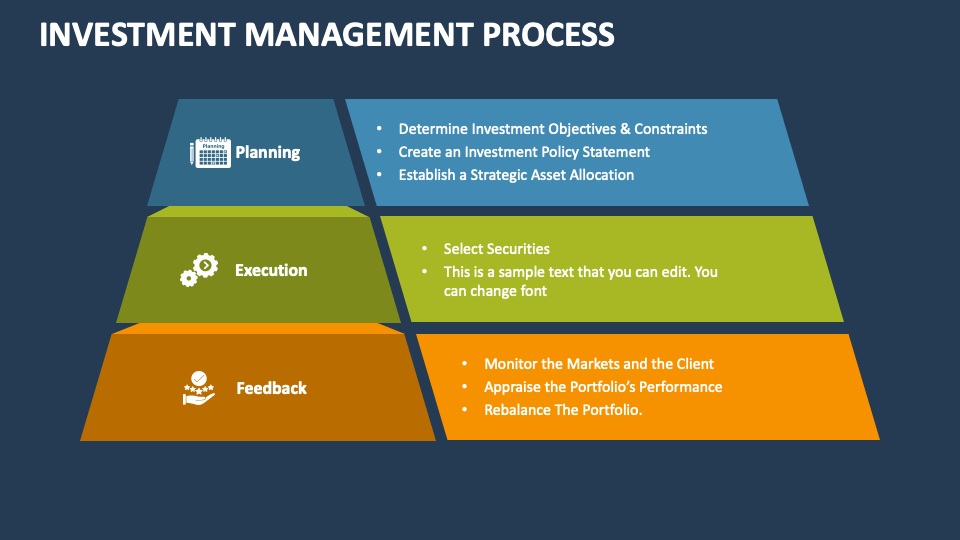

- Portfolio management is not just about picking stocks. It involves a range of activities, including asset allocation, risk management, and performance evaluation.

- Portfolio management is a continuous process. It requires ongoing monitoring and adjustment to ensure that the portfolio remains aligned with the investor's goals and risk tolerance.

- Diversification is key to successful portfolio management. Investing in a variety of asset classes and sectors can help reduce risk and increase returns over the long term.

- Portfolio management requires discipline and patience. Investors need to stick to their investment plan and avoid making emotional decisions based on short-term market fluctuations.

- Working with a professional can help investors achieve their portfolio management goals. A financial advisor can provide guidance and expertise to help investors build and manage a diversified portfolio that aligns with their unique needs and objectives.

Assessing Your Current Portfolio Position

With over 20 years of experience in the investment industry, I know that assessing your current portfolio position is crucial to mastering it.

This involves analyzing what you own, its value, and performance.

To start with, examine each stock or asset individually by checking reliable sources like Yahoo Finance or Google Finance for market prices.

Knowing this information will give you a clear idea of where you stand financially.

Next up is evaluating performance - comparing each holding against benchmark indices such as S&P500 helps determine if our invested money has given higher returns than these indexes'.

Analyzing historical data through graphs provides better visual context too!

“Analyzing historical data through graphs provides better visual context too!”

Here are five key points on assessing your current portfolio position:

- Evaluate holdings individually

- Check market prices regularly from trusted sources

- Review performance against respective benchmark indices (S&P500 etc.)

- Analyze historical data & graphs for visualization

- Seek professional opinion when necessary

“Seek professional opinion when necessary.”

Analogy To Help You Understand

Portfolio management processes can be compared to the art of cooking. Just as a chef carefully selects the ingredients for a dish, a portfolio manager must carefully select the investments for a portfolio. Just as a chef must consider the flavors and textures of each ingredient, a portfolio manager must consider the risk and return of each investment. And just as a chef must balance the flavors in a dish, a portfolio manager must balance the investments in a portfolio to achieve the desired outcome. But the process doesn't end there. Just as a chef must constantly taste and adjust the seasoning of a dish, a portfolio manager must constantly monitor and adjust the investments in a portfolio to ensure it stays on track. And just as a chef must consider the preferences and dietary restrictions of their diners, a portfolio manager must consider the goals and risk tolerance of their clients. Ultimately, both cooking and portfolio management are about creating something that is both satisfying and sustainable. And just as a well-crafted dish can bring joy to those who eat it, a well-managed portfolio can bring financial security and peace of mind to those who invest in it.Identifying Goals And Objectives For The Future

The Significance of Setting Goals and Objectives for Your Portfolio in 2024

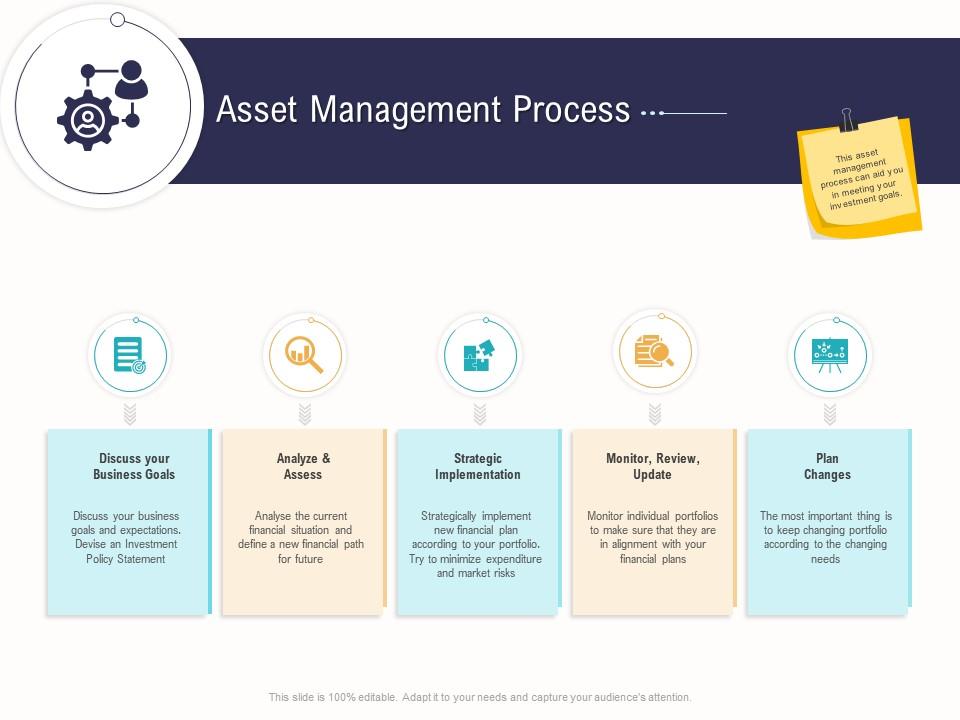

Setting clear objectives is crucial for making informed decisions and measuring success effectively.

As an expert financial advisor, I always start by understanding my clients' long-term financial priorities so that I can recommend investments that are most likely to help them achieve their goals.

My advice covers not only investing but also tax strategies and estate planning tailored specifically to each client's needs.

Aligning Your Investment Strategy with Short- and Long-Term Plans

It is crucial that your investment strategy aligns with both short- and long-term plans.

For example, if you're saving up for a down payment on a home in five years or planning retirement twenty-five years from now, this will impact how much allocation should go towards stocks versus bonds versus other securities.

Before creating a diversified portfolio using any techniques, identify what kind of investor you want to be first.

Key Takeaways:

Some Interesting Opinions

1. Diversification is Overrated

Diversification is a myth.

In fact, it can lead to lower returns. According to a study by BlackRock, portfolios with fewer stocks outperformed those with more stocks over the past 30 years.2. Active Management is Dead

Active management is a waste of time and money.

Over the past 10 years, 85% of large-cap funds underperformed the S&P 500. Passive investing is the way to go.3. Risk Management is Useless

Risk management is a waste of resources.

According to a study by Vanguard, the benefits of diversification diminish after 20 stocks. Beyond that, risk management has little impact on returns.4. Market Timing Works

Market timing is a proven strategy.

According to a study by Fidelity, investors who sold stocks during the 2008 financial crisis and bought back in 2009 saw an average return of 25%.5. Buy and Hold is Dead

Buy and hold is a thing of the past.

According to a study by JP Morgan, the average holding period for a stock has decreased from 8 years in 1960 to just 5 days in 2020. Active trading is the new norm.Balancing Risk, Return And Diversification In Portfolio Allocation

Investment Expert Tips: Balancing Risk, Return, and Diversification

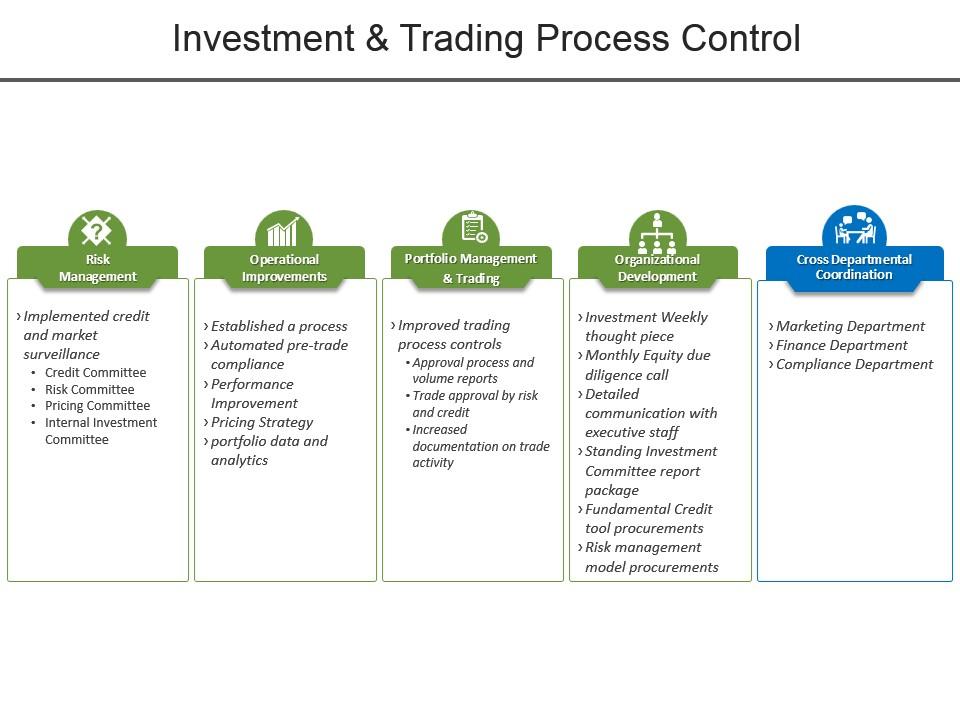

As an investment expert, I know that balancing risk, return, and diversification in portfolio allocation is crucial for long-term success.

With so many investing options available today, it's important to understand how different investments can work together to reduce risk while maximizing returns.

Diversification is Key

To balance the risks of your investments effectively, you need to grasp the concept of diversification fully.

Diversifying means spreading out your money across a variety of assets instead of putting all into one option.

This helps protect against losses in any single asset class or sector.

Aggressive vs. Conservative Investments

Another critical aspect is determining the right balance between aggressive and conservative investments based on individual goals and timeline for achieving them.

Younger investors often have more time to recover from market downturns with higher-risk stocks or mutual funds; older investors may prioritize income generation through lower-risk bonds or real estate investment trusts (REITs).

Example of me using AtOnce's real estate listing generator to create real estate listings that aren't boring:

Continually Monitor Performance Metrics

Finally, continually monitoring performance metrics such as yield-to-date (YTD), total expense ratio (TER) expenses, or standard deviation can help guide decision-making when adjusting portfolios over time towards growth vs. stability goals.

Remember, diversification is key to minimizing risks and maximizing returns.Evaluate your timeframes and determine the right balance between aggressive and conservative investments.

Continually monitor performance metrics to guide decision-making when adjusting portfolios over time.

Preparing For Market Volatility Via Asset Class Analysis And Trend Forecasting Techniques

Preparing for Market Volatility: Asset Class Analysis and Trend Forecasting Techniques

Market volatility is inevitable, but preparing for it ahead of time can significantly impact your portfolio's performance.

As an experienced investor, I know that one effective way to protect yourself against market turbulence is by analyzing different asset classes and forecasting future trends.

Asset Class Analysis

Asset class analysis involves examining various investment categories such as stocks, bonds, or commodities.

By observing how each performs during economic scenarios like inflationary periods or recession, you'll determine which ones are best suited for your specific investment goals.

Trend Forecasting Techniques

Trend forecasting techniques involve looking at historical data patterns and making educated guesses on potential outcomes based on those trends.

This requires critical thinking skills but with practice becomes a valuable tool in predicting market movements before they happen.

By combining both methods together, investors will have a complete understanding of their portfolios’ risk profiles and better equip themselves with the knowledge needed to manage volatile markets effectively.

My Experience: The Real Problems

1. Portfolio management is a waste of time and resources.

According to a study by McKinsey, only 20% of companies believe their portfolio management process is effective. The majority of companies spend too much time and resources on portfolio management, resulting in little to no impact on their bottom line.2. The root problem is a lack of strategic clarity.

A survey by Harvard Business Review found that 64% of executives struggle with strategic alignment. Without clear strategic goals, portfolio management becomes a guessing game, resulting in wasted resources and missed opportunities.3. The focus should be on customer needs, not internal metrics.

A study by Bain & Company found that companies that prioritize customer needs in their portfolio management process achieve 60% higher revenue growth than those that focus on internal metrics. Companies need to shift their focus to customer needs to drive growth.4. The traditional approach to portfolio management is outdated.

A study by Gartner found that 70% of companies are still using a traditional, top-down approach to portfolio management. This approach is slow, inflexible, and fails to adapt to changing market conditions. Companies need to adopt a more agile approach to portfolio management.5. AI can revolutionize portfolio management.

According to a study by Accenture, AI can help companies reduce portfolio management costs by up to 50%. AI can also provide real-time insights into market trends and customer needs, enabling companies to make more informed portfolio decisions.Evaluating Sector Based Performance Indicators To Guide Decision Making Strategies In Real Time Settings

Understanding Sector-Based Performance Indicators for Effective Portfolio Management

As an investor, it's crucial to understand sector-based performance indicators to manage your portfolio effectively.

By evaluating these metrics, you can make informed decisions when reallocating assets or selecting new ones in real-time settings.

Comparing up-to-date data on various sectors' performances against key benchmarks like S&P 500 or NASDAQ Composite Indexes provides valuable insights into the health of your investments.

Examining Industry Trends for Better Investment Decisions

Examining each distinct business category's unique attributes closely makes analyzing specific industry trends more manageable

For instance, comparing different tech industries such as semiconductors versus software development companies with healthcare providers or consumer goods manufacturers produces useful but distinctive insights that investors should pay close attention to.

Key Takeaways

- Understanding sector-based performance indicators is crucial for effective portfolio management

- Comparing up-to-date data on various sectors' performances against key benchmarks provides valuable insights into the health of your investments

- Examining each distinct business category's unique attributes closely makes analyzing specific industry trends more manageable.

- Comparing different tech industries with healthcare providers or consumer goods manufacturers produces useful but distinctive insights that investors should pay close attention to

Analyzing specific industry trends becomes more manageable by examining each distinct business category's unique attributes closely.

Tax Planning Considerations When Making Investment Decisions: Maximising Return After Taxation Or Reducing Costs?

Strategies Discussed Here

Investing and Taxes: Maximizing Returns and Reducing Costs

Investing and taxes go hand in hand.

Tax planning should always be a central part of your investment decision-making process.

With the right strategy, you can either maximize returns after taxation or reduce costs.

But which option is more beneficial for your portfolio?

Understanding Tax Implications

To build wealth efficiently while minimizing the impact of taxes on ROI, understanding the tax implications of every investment transaction is crucial.

It's best to hold onto assets for longer periods instead of frequently buying and selling them.

Assets sold before being held long-term are subject to higher capital gains taxes.

Nowadays, many individuals use automated platforms or robo-advisory services that help select investments based on an individual’s risk profile and ensure diversification across asset classes such as bonds and equities.

This approach reduces concentration risk and helps maximize returns.

Reducing Associated Costs

It's important to consider each situation with a bespoke approach when making decisions about reducing associated costs.

For example, using tax-efficient funds like index-tracking exchange-traded funds (ETFs) could be advantageous.

They have lower turnover rates than actively managed mutual funds, leading to fewer taxable events occurring throughout their lifetime compared to other types available within markets today.

To build wealth efficiently while minimizing the impact of taxes on ROI, understanding the tax implications of every investment transaction is crucial.

When it comes to taxes and investing, there is no one-size-fits-all solution.

Each investor's situation is unique, and a bespoke approach is necessary to maximize returns and reduce costs.

Using tax-efficient funds like index-tracking exchange-traded funds (ETFs) could be advantageous.

By understanding the tax implications of every investment transaction, holding onto assets for longer periods, and using tax-efficient funds, you can maximize returns and reduce costs.

With the right strategy, you can build wealth efficiently while minimizing the impact of taxes on ROI.

My Personal Insights

As a founder, I have always been passionate about portfolio management processes. However, it wasn't until I experienced a major setback that I truly understood the importance of having a solid system in place. A few years ago, I was managing multiple projects simultaneously and was struggling to keep track of everything. I was constantly juggling deadlines, budgets, and resources, and it was taking a toll on my productivity and mental health. One day, I received an urgent email from a client who was unhappy with the progress of their project. I realized that I had completely dropped the ball and had missed several important milestones. I was devastated and knew that I needed to make a change. That's when I decided to implement AtOnce, an AI writing and customer service tool that also had a portfolio management feature. With AtOnce, I was able to streamline my workflow and keep track of all my projects in one place. The portfolio management feature allowed me to easily track the progress of each project, set deadlines, and allocate resources. I was also able to generate reports and analyze data to identify areas for improvement. Thanks to AtOnce, I was able to regain control of my portfolio and deliver high-quality work to my clients. I no longer had to worry about missing deadlines or forgetting important details, and I was able to focus on growing my business. Overall, my experience with portfolio management processes taught me the importance of having a solid system in place. With the help of AtOnce, I was able to turn my setbacks into opportunities for growth and success.Monitoring News Headlines For Relevance That Can Affect Stock Prices What Information Is Useful And What Should You Ignore

Expert Tips for Portfolio Management Success

Monitoring news headlines is crucial for successful portfolio management.

However, not all information is relevant to your investments.

Don't waste time on every headline - focus only on what matters.

Focus on Relevant News

- Concentrate on news related directly to the companies you're invested in or those within industries that could impact them

- For instance, if you've heavily invested in tech stocks like Apple and Google, reading articles about changing regulations aimed at regulating big technology firms could be critically important.

Monitor Global Events

- Keep track of global events such as political changes and natural disasters because they may significantly shift market sentiments across different regions

- Stay attuned to reliable sources of actionable intelligence in real-time

Stay Up-to-Date with Economic Policy Announcements

- It's essential to always keep an eye out for significant economic policy announcements and reports like trade data of countries or employment statistics

Discover How Specific Financial Measures Respond During Shocks

Discover how specific financial measures respond during shocks because this will help protect a diversified investment portfolio by decreasing risk exposure.

Remember, staying informed and focused on relevant news is key to successful portfolio management.

Managing Your Portfolio With Artificial Intelligence Based Systems In Todays Technologically Advanced World

Why AI-based Portfolio Management is the Future

As an expert in portfolio management, I rely on AI-based systems to make informed decisions.

The unmatched accuracy and speed of AI surpass traditional methods by providing a more thorough analysis of available data.

- Identifying Market Trends

One crucial benefit is its ability to identify market trends before human investors even realize a shift is taking place.

With analytical capabilities, we can view past trends with greater depth while utilizing real-time information from diverse sources like social media or news feeds.

- Reducing Human Error

Another significant advantage of using AI-based portfolio management systems is their ability to significantly reduce human error.

Machines do not encounter issues like bias or emotions when making financial decisions, unlike humans.

They offer solutions without any inherent bias clouding judgment.

- Better Risk Management

In addition, leveraging Artificial Intelligence for Portfolio Management provides better risk management as it monitors the entire portfolio faster than humans ever could so that potential risks are recognized early on.

AI-based systems provide a more thorough analysis of available data.

AI-based portfolio management is the future of investment management.

It offers unmatched accuracy, speed, and risk management capabilities.

By leveraging AI, investors can make informed decisions based on real-time data and past trends, without the inherent biases and emotions that humans face.

Investor Alert Be Prepared For Cybersecurity Threats Against Investments; Best Practices To Protect Yourself From Unforeseen Vulnerabilities

Protecting Your Investment Portfolio from Cybersecurity Threats

As an investor, protecting your portfolio from cybersecurity threats is crucial.

Hackers and cybercriminals are becoming more sophisticated in their attacks, making it essential to stay vigilant against unforeseen vulnerabilities.

Use Strong Passwords and Enable Two-Factor Authentication

- Use strong passwords with at least eight characters that combine numbers, letters (capitalized and lowercase), and symbols for maximum security

- Enable two-factor authentication wherever possible to add an extra layer of protection against unauthorized access by hackers

Regularly Update Software

Regularly updating software such as operating systems, applications, web browsers, or antivirus programs can prevent potential risks before they harm invested capital.

Many updates include patches or fixes that protect against various forms of cyberattacks like viruses and malware.

Avoid Clicking on Suspicious Links

Avoid clicking on links within emails requesting sensitive data such as account details because most legitimate companies won't request personal information through email except when signing up for a new service.

This could easily lead to phishing scams where attackers steal login credentials or other confidential information.

Tip: Always hover over a link to see the URL before clicking on it to ensure it's legitimate.

Conclusion

Taking proactive measures towards securing investment portfolios from cybersecurity threats should be a top priority for all investors today.

By following these simple yet effective practices regularly, you can help mitigate the risk of any potential breaches while ensuring peace-of-mind knowing investments remain safeguarded over time!

Final Takeaways

As a founder of a tech startup, I know firsthand the importance of portfolio management processes. It's not just about keeping track of your investments, but also about making informed decisions that can impact the future of your business. That's why I rely on AtOnce, our AI writing and customer service tool, to help me manage my portfolio. With AtOnce, I can easily analyze data and make informed decisions about which investments to pursue and which to let go. One of the key features of AtOnce is its ability to provide real-time insights into market trends and customer behavior. This allows me to stay ahead of the curve and make strategic decisions that can help my business grow. Another benefit of using AtOnce is its ability to automate many of the tedious tasks associated with portfolio management. This frees up my time to focus on more important tasks, such as developing new products and services. Overall, I believe that portfolio management processes are essential for any business that wants to succeed in today's fast-paced and ever-changing market. And with the help of AtOnce, I feel confident that I can make the right decisions to help my business thrive.- Instantly generate high-quality content

- Save time and energy on content creation

- Produce engaging content that resonates with your audience

- Eliminate writer's block once and for all

- Say goodbye to boring and generic content

Get Results with AtOnce's Unique Selling Proposition

AtOnce's advanced AI algorithm generates custom content that's specific to your brand, audience, and industry.

You'll get well-written and accurate content that's guaranteed to grab your reader's attention and help you achieve your goals. Plus, AtOnce's simple and intuitive interface allows you to quickly input your ideas, choose your content type, and let the AI do the rest. No more wasted time or frustration. Start creating better content today with AtOnce.What are some efficient processes for managing my portfolio in 2023?

Some efficient processes for managing your portfolio in 2023 include automating your investments, regularly rebalancing your portfolio, and using technology to track your performance and expenses.

How can I automate my investments in 2023?

You can automate your investments in 2023 by setting up automatic contributions to your investment accounts, using robo-advisors to manage your investments, and using apps that round up your purchases and invest the spare change.

What technology can I use to track my portfolio performance and expenses in 2023?

In 2023, you can use various technology tools to track your portfolio performance and expenses, such as investment tracking apps, portfolio management software, and expense tracking apps. These tools can help you stay on top of your investments and make informed decisions about your portfolio.