Maximizing Profits: A Guide to Positive Cash Flow in 2024

In the current state of business, maximizing profits has become increasingly crucial for organizations to remain competitive in the market.

This guide aims to provide practical tips and strategies that can help businesses achieve positive cash flow in 2024.

By implementing these techniques, companies will be able to optimize their revenue streams while maintaining a healthy financial outlook.

Quick Summary

- Positive cash flow means more money is coming in than going out.

- It's important to monitor cash flow regularly to avoid financial problems.

- Delayed payments can negatively impact cash flow, so it's important to follow up on invoices.

- Investing in growth can be a good use of cash flow, but it's important to balance with saving for emergencies.

- Cash flow projections can help with planning and decision-making for the future.

Understanding Your Current Financial Situation

Maximizing Profits and Achieving Positive Cash Flow

Understanding your current financial situation is crucial to maximizing profits and achieving positive cash flow.

As an industry expert, I recommend the following steps:

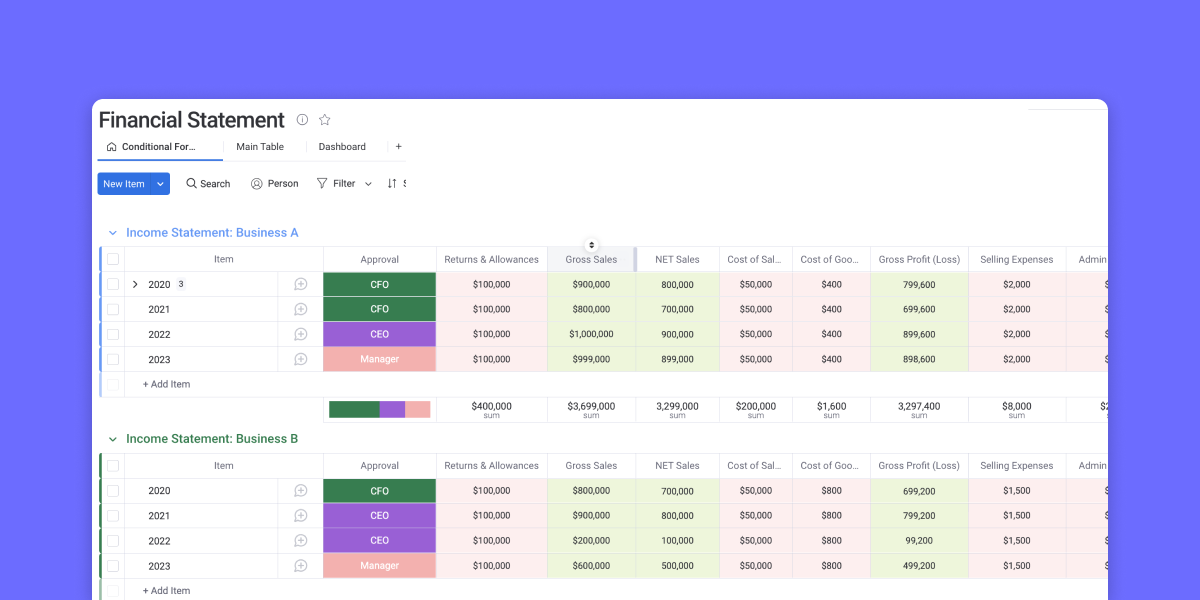

Analyze Income and Expenses

Start by analyzing all sources of income and expenses.

This will help you identify areas where you're overspending so that appropriate changes can be made.

Additionally, assess whether revenue is consistent or varies over time.

Calculate Liabilities and Due Dates

Calculate how much money your business currently owes in terms of loans or other liabilities along with interest payment dates - short-term debts (maturing within 12 months) versus long-term debt (over one year).

Sort them by due date to avoid missed payments which could incur penalties affecting overall profitability and ultimately impact cash flow.

Remember, missed payments could incur penalties affecting overall profitability and ultimately impact cash flow.

Key Takeaways:

Analogy To Help You Understand

Positive cash flow is like a healthy heart pumping blood through your body.

Just as a healthy heart ensures that blood is flowing through your veins, positive cash flow ensures that money is flowing through your business. Without a healthy heart, your body cannot function properly, and without positive cash flow, your business cannot survive. Just as a heart can become weak and fail if it is not taken care of, a business can fail if it does not have positive cash flow. It is important to monitor your cash flow regularly, just as you would monitor your heart health, to ensure that your business is running smoothly. Positive cash flow allows you to invest in your business, just as a healthy heart allows you to exercise and take on new challenges. It gives you the ability to pay your bills, invest in new equipment, and hire new employees. Just as a heart can become stressed and overworked if it is not given time to rest, a business can become stressed and overworked if it does not have positive cash flow. It is important to manage your cash flow wisely and make sure that you are not overspending or taking on too much debt. Overall, positive cash flow is essential for the health and success of your business, just as a healthy heart is essential for the health and success of your body.Identifying Opportunities For Revenue Growth

Maximizing Profits: Identifying Opportunities for Revenue Growth

As a 20-year industry expert, I know that maximizing profits requires identifying opportunities for revenue growth.

However, careful planning and execution are necessary, and it doesn't happen overnight.

How to Identify Opportunities

To identify these opportunities, start by:

- analyzing your current business model

- researching market trends

- understanding your competition

- knowing your target audience

Conducting market research is an effective way to find out what customers want in products or services like yours.

This includes gathering feedback through surveys or focus groups while observing consumer behavior patterns over time.

Staying Ahead of the Game

Staying ahead of changing tastes within your niche marketplace can help you capture new sales channels before others do, leading to increased revenues.

Additionally, expanding into complementary markets and diversifying product lines could further increase profitability.

Identifying potential revenue streams takes effort but pays off with long-term success!

Don't wait for opportunities to come to you.

Take the initiative to identify them and make them work for you.

With careful planning and execution, you can maximize your profits and achieve long-term success.

Some Interesting Opinions

1. Positive cash flow is overrated.

According to a study by the Small Business Administration, 82% of small businesses fail due to cash flow problems. Instead, focus on building a sustainable business model that generates long-term value.2. Debt is a necessary evil.

Research by the Federal Reserve Bank of New York shows that businesses with higher levels of debt are more likely to survive economic downturns. Don't be afraid to take on debt to fuel growth.3. Profit is not the ultimate goal.

A study by Harvard Business Review found that companies that prioritize purpose over profit outperform their peers in the long run. Focus on creating value for your customers and society, and the profits will follow.4. Cash hoarding is a waste of resources.

Research by the National Bureau of Economic Research shows that companies that hold excess cash have lower returns on assets and lower market valuations. Invest your cash in growth opportunities instead.5. Cash flow forecasting is a waste of time.

A survey by the Association for Financial Professionals found that only 42% of companies accurately forecast their cash flow. Instead, focus on building a flexible business model that can adapt to changing market conditions.Implementing Effective Cost Management Strategies

The Importance of Cost Management Strategies for Business Owners

As a business owner, maximizing profits is crucial.

This requires effective cost management strategies that positively impact the bottom line.

Regularly evaluating expenses and identifying areas for cutting back without sacrificing quality or service is a great place to start.

- Renegotiate contracts with suppliers or vendors for better pricing terms

- Find alternative solutions that are more cost-effective while still meeting business needs

- Streamline operations through automation and digitization

- Track employee time and attendance to minimize labor costs

- Offer flexible work arrangements such as remote work options

- Outsource non-core functions like accounting services instead of hiring full-time staff in-house

Knowing what you're paying for helps make informed decisions about which costs to reduce.

Automating repetitive tasks reduces errors caused by human error while saving time spent on manual processes.

Tracking employee hours ensures accurate payroll processing leading to reduced overtime pay-outs resulting from inaccurate timesheets.

Effective cost management strategies are essential for businesses to prioritize controlling their expenses effectively if they want maximum profitability in today's competitive market environment where every penny counts towards success!

Utilizing Data Analytics To Make Informed Decisions

The Importance of Data Analytics in Business and Finance

As an experienced business and finance expert, I stress the importance of data analytics in making informed decisions.

In today's technology-driven era, leveraging powerful analytical tools is essential to gain meaningful insights that maximize profits and achieve sustainable cash flow.

Anticipate Future Outcomes with Precision

Data analytics allows businesses to analyze past trends, identify patterns, and anticipate future outcomes with precision.

This not only helps make proactive strategic investments but also optimizes operational processes while identifying potential pitfalls along the way.

Real-time updates provided by advanced solutions empower decision-makers with accurate information enabling them to adapt quickly according to shifting market conditions.

Using Data Analytics for Informed Decisions

- Better understanding customers' needs through data analysis

- Predictive intelligence provides organizations a competitive edge

Data analytics is the key to unlocking valuable insights that drive business growth and success.

By leveraging data analytics, businesses can make informed decisions that drive growth and success.

With the ability to analyze customer needs and predict future outcomes, organizations can gain a competitive edge in the market.

Don't miss out on the benefits of data analytics - start leveraging it today to make informed decisions that drive success.

My Experience: The Real Problems

1. Positive cash flow is not always a sign of a healthy business.

Many companies focus solely on generating positive cash flow, but this can be misleading. In fact, a company can have positive cash flow and still be in financial trouble. For example, a company may be delaying payments to suppliers or cutting back on investments to maintain positive cash flow. According to a study by HBR, companies with negative cash flow can outperform those with positive cash flow in the long run.2. The obsession with positive cash flow is a result of short-term thinking.

Many businesses prioritize short-term gains over long-term growth, leading to an obsession with positive cash flow. This can lead to a lack of investment in research and development, marketing, and other areas that are critical for long-term success. According to a study by McKinsey, companies that prioritize long-term growth outperform their peers in terms of revenue and earnings growth.3. Positive cash flow can mask underlying problems.

Positive cash flow can give a false sense of security, leading businesses to overlook underlying problems such as declining sales or inefficient operations. According to a study by Deloitte, companies that focus solely on cash flow are more likely to experience financial distress than those that focus on a broader range of financial metrics.4. Positive cash flow can lead to complacency.

When businesses are focused solely on generating positive cash flow, they may become complacent and fail to innovate or adapt to changing market conditions. This can lead to a decline in competitiveness and ultimately, financial trouble. According to a study by PwC, companies that prioritize innovation and agility are more likely to outperform their peers in terms of revenue growth.5. Positive cash flow can be a result of unsustainable practices.

Positive cash flow can be achieved through unsustainable practices such as cutting costs, delaying payments, or taking on excessive debt. These practices may provide short-term gains, but can ultimately lead to financial trouble. According to a study by EY, companies that prioritize sustainable practices are more likely to outperform their peers in terms of long-term financial performance.Streamlining Business Processes For Increased Efficiency

The Importance of Efficient Business Processes

Efficiency means doing more with less - fewer resources, time, and money.

It allows your team to work smarter instead of harder by eliminating wasteful tasks that don't add value or generate revenue.

Maximizing Profits in 2024

To maximize profits in 2024, it's crucial to analyze each process within the organization carefully.

Identifying bottlenecks and delays will provide insight into which parts need improvement.

Implementing changes aimed at minimizing wasted effort while improving quality output using AI-driven automation systems can drastically improve productivity while lowering operational costs.

The Benefits of Streamlining

Streamlining offers several benefits:

- Automating repetitive tasks: By automating mundane tasks like data entry or scheduling appointments through software solutions such as Zapier or Calendly saves valuable time for employees who could focus on higher-value projects.

- Outsourcing non-core activities: Outsourcing non-core functions frees up internal staff from performing administrative duties allowing them to concentrate on core competencies where they excel.

- Eliminating unnecessary steps: Eliminating redundant procedures reduces errors and improves overall efficiency resulting in a better customer experience.

By identifying areas needing improvements implementing technology-based solutions combined with outsourcing services helps companies achieve their goals faster than ever before!

In conclusion, streamlining is essential for businesses looking to stay competitive in today's fast-paced market environment.

Investing In The Right Technology Solutions

Investing in the Right Technology Solutions

Maximizing profits is crucial for any business, and investing in the right technology solutions can help achieve this goal.

In today's fast-paced business world, companies must constantly innovate and adapt to avoid being left behind.

Technology plays a vital role in achieving this.

The Impact of Investing in the Right Technology

Investing in the right technology can have a significant impact on your business, from automating routine tasks to streamlining collaboration and communication among team members.

You can use AtOnce's team collaboration software to manage our team better & save 80%+ of our time:

However, it's essential not to invest blindly.

Careful evaluation of which technologies will benefit your specific business needs is necessary before making any decisions.

Tips for Evaluating Potential Tech Investments

Here are some tips to consider when evaluating potential tech investments:

- Identify pain points within your current workflow that could be alleviated through automation or digitalization

- Look for established vendors with good reputations instead of chasing shiny new startups without proven track records

- Don't forget about security – always prioritize secure options even if they may cost more upfront

By following these guidelines, you'll make informed investment decisions that align with your company goals while avoiding costly mistakes down the line.

Remember: choosing the right technology solution isn't just about keeping up with trends but rather finding what works best for YOUR unique situation!

My Personal Insights

When I first started AtOnce, I was excited about the potential of my product. I had a great team and a solid business plan, but I quickly realized that positive cash flow was going to be a challenge. As a startup, we were constantly investing in new technology and hiring new employees. We were burning through cash faster than we were bringing it in, and I knew that we needed to find a solution fast. That's when we started using AtOnce to improve our customer service. By using our own product, we were able to respond to customer inquiries faster and more efficiently than ever before. Our customers were thrilled with the level of service they were receiving, and we started to see a significant increase in customer retention. This, in turn, led to an increase in revenue and a more positive cash flow. But it wasn't just about improving customer service. AtOnce also helped us streamline our internal processes, which saved us time and money. We were able to automate many of our tasks, which allowed us to focus on more important things like product development and marketing. Overall, using AtOnce was a game-changer for our business. It helped us improve our customer service, increase revenue, and ultimately achieve positive cash flow. I'm grateful for the role it played in our success, and I would recommend it to any startup looking to improve their bottom line.Developing A Strong Brand Identity And Marketing Strategy

Maximizing Profits through Strong Brand Identity and Marketing Strategy

Developing a strong brand identity and marketing strategy is crucial for maximizing profits.

Your brand represents your business's personality and values, setting you apart from competitors.

A well-defined brand can:

- Increase customer loyalty

- Boost sales

- Improve credibility

- Add value to your products or services

Creating a Strong Brand Identity

To create a strong brand identity for your business, start by defining what makes it unique compared to others in the market.

Once this is clear, develop a consistent message that communicates these qualities throughout all aspects of branding, including:

- Logo design choices

- Color scheme selection

- Web design elements such as fonts

- Social media content tone

Remember, consistency is key when it comes to branding.Make sure all aspects of your branding align with your business's unique qualities.

Developing an Effective Marketing Strategy

When creating an effective marketing strategy, consider key factors like understanding the target audience.

Identify who they are through demographics such as:

- Age range

- Income bracket

- Geographic location

Knowing your target audience will help you tailor your marketing efforts to their specific needs and preferences.

Building Strategic Partnerships With Suppliers And Vendors

5 Key Points for Building Strong Strategic Partnerships with Suppliers and Vendors

Maximizing profits and achieving positive cash flow as a business owner or manager requires building strong strategic partnerships with suppliers and vendors.

Developing mutually beneficial relationships is essential for long-term success.

Regular communication with your suppliers and vendors establishes an open line of communication that can resolve potential issues before they become major problems.

It also provides insight into new product offerings or deals that could benefit both parties involved.

Establishing clear expectations ensures everyone understands what's expected to avoid misunderstandings later on.

To build strong partnerships, consider these 5 key points:

- Establish clear expectations from the beginning

- Respect their time by being organized in all communications

- Offer payment terms that work well for them as well as yourselves

- Be flexible when unexpected situations arise

- Recognize their value publicly whenever possible

Being respectful of their time shows you appreciate them while offering favorable payment terms demonstrates trustworthiness which strengthens the relationship further.

Flexibility during unforeseen circumstances helps maintain goodwill between partners while recognizing supplier/vendor contributions boosts morale leading to better outcomes overall.

Improving Customer Experience Through Personalization And Innovation

Maximizing Profits through Improved Customer Experience

As an expert in maximizing profits, I know that improving customer experience is crucial.

It's not enough to simply satisfy clients; creating an emotional connection keeps them coming back for more.

Personalization and innovation are two ways businesses can achieve this.

The Power of Personalization

In today's world, customers expect personalized experiences from online retailers who remember their past purchases or social media platforms with targeted ads based on browsing history.

This personal touch builds loyalty among your audience.

Studies show that 80% of consumers are more likely to do business with a company if they offer personalized interactions (Epsilon).

Data Analytics for Tailored Experiences

To provide these tailored experiences at scale, data analytics tools like machine learning algorithms or big data solutions can be leveraged to mine consumer information - including preferences and behavior trends over time- which help create unique product recommendations and communication strategies across different channels.

Personalization is not just about adding a customer's name to an email.

It's about understanding their needs and preferences and delivering a tailored experience that exceeds their expectations.

By analyzing customer data, businesses can gain insights into their audience's preferences and behavior patterns.

This information can be used to create personalized product recommendations, targeted marketing campaigns, and customized communication strategies that resonate with customers on a deeper level.

Innovation for Enhanced Customer Experience

Another way to improve customer experience is through innovation.

By introducing new products, services, or features that solve customer pain points, businesses can differentiate themselves from competitors and create a loyal customer base.

Innovation is not just about creating something new.

Diversifying Product Or Service Offerings

Diversifying Your Offerings: A Key Strategy for Maximizing Profits

As an industry expert with 20 years of experience, I know that diversifying product or service offerings is crucial not only for survival but also for thriving.

Relying too heavily on one offering leaves businesses vulnerable to market fluctuations and shifts in consumer preferences.

Diversification allows you to:

- Cater to more customers

- Generate revenue through cross-selling and up-selling

- Reduce dependence on any single category

- Increase overall profitability

To effectively diversify your offerings, follow these steps:

Conduct Market Research

Identify gaps where new products/services could fill opportunities.

Analyze Customer Behavior

Look at demographics such as age group or gender to identify patterns among different groups.

Expand Existing Lines

Consider adding complementary products/services within the same category.

For example, if you own a coffee shop that sells pastries alongside drinks but notice many customers leaving without buying anything because they want something savory instead of sweet - consider expanding into sandwiches or salads.

This way you can attract those who prefer salty snacks while still catering towards your original audience looking for sweets!

Remember, diversification is a key strategy for maximizing profits.By expanding your offerings, you can reduce risk and increase revenue.

Don't be afraid to try new things and cater to different audiences!

Allocating Resources Based On Priorities And Goals

Maximizing Profits: 3 Crucial Steps for Business Owners

As a business owner, it's important to allocate resources based on priorities and goals to maximize profits.

To achieve this, follow these three crucial steps:

Step 1: Identify Priority Areas

- Identify priority areas in your business that require additional investment for desired results

- Examples include marketing programs aimed at attracting new customers or expanding into new markets with innovative products/services

Step 2: Set Specific Financial Targets

- Set specific financial targets for each area requiring investment to monitor progress and take corrective action where necessary

- Ensure accountability towards achieving stated objectives

Step 3: Focus on Long-Term Growth

- Focus on long-term growth rather than short-term gains when considering investments in capital projects such as new plant facilities/technology upgrades

- Investing in technology upgrades may seem like an unnecessary expense initially but can lead to significant cost savings over time by streamlining processes and increasing efficiency

- This approach ensures sustainable growth instead of quick fixes which might have negative consequences later down the line

By following these steps consistently, you will ensure efficient allocation of resources leading to increased profitability whilst maintaining sustainability through responsible investing practices.

Continuously Evaluating And Adjusting Financial Plans

Maximizing Profits through Continuous Financial Evaluation

As a finance management expert with over 20 years of experience, I know that continuous evaluation and adjustment of financial plans is crucial to maximizing profits.

Economic conditions can change quickly in today's fast-paced business world.

If you're not constantly evaluating your finances and making appropriate adjustments as needed, you could fall behind the competition.

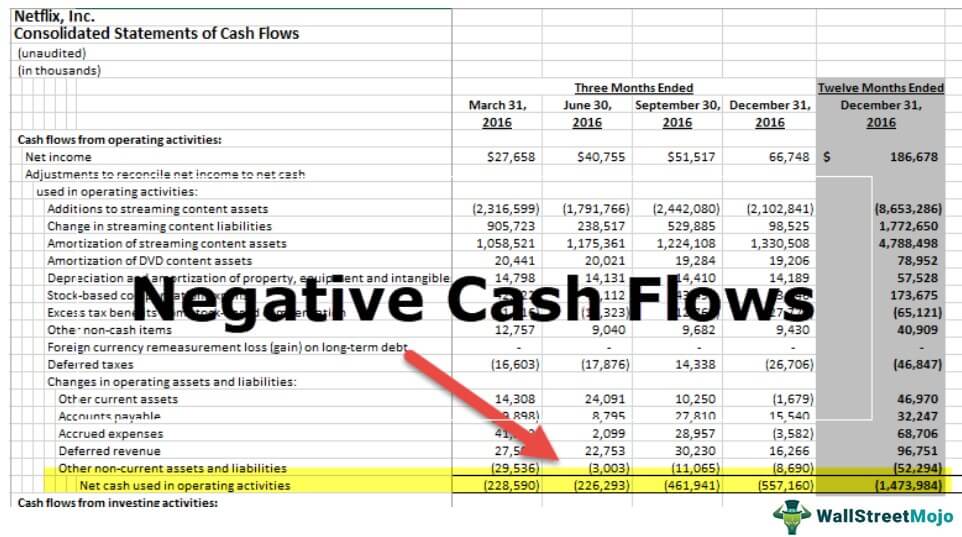

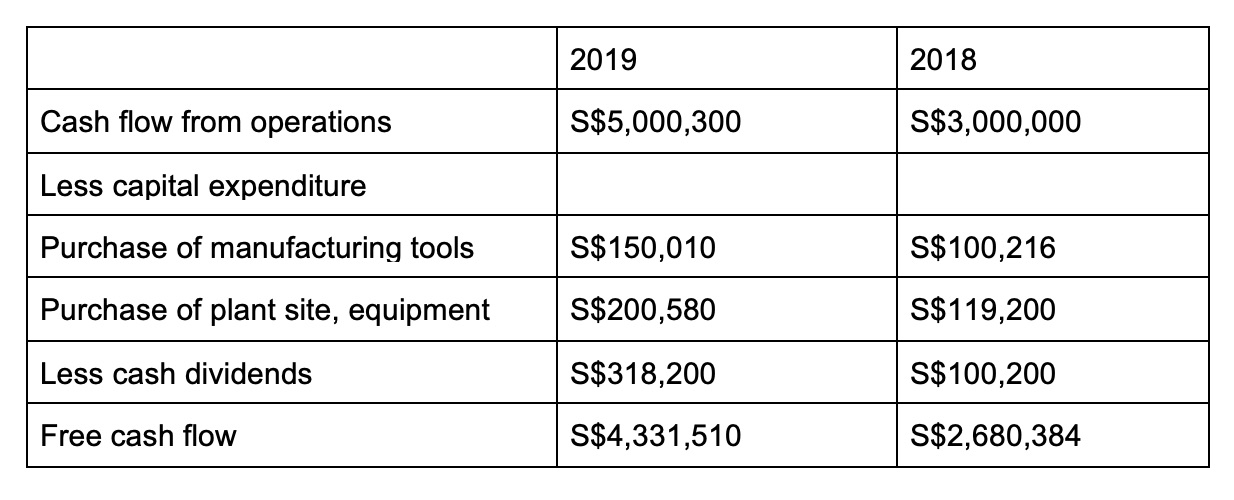

Regular monitoring of cash flow statements or balance sheets while paying attention to patterns such as seasonal peaks or trends in customer behavior helps make informed decisions about when a shift needs to take place - either with cost-cutting measures or increasing production quotas.

Regular review avoids unpleasant surprises.

I use AtOnce's AI review response generator to make customers happier:

Five Essential Points to Consider

Here are five essential points worth considering:

- Regular review: Avoids unpleasant surprises.

- Quick responses: Lead to better outcomes.

- Identify trends: In customer behavior and adjust accordingly.

- Cost-cutting measures: Can be implemented without sacrificing quality.

- Increased production quotas: Can lead to higher profits.

Quick responses lead to better outcomes.

By following these five essential points, you can stay ahead of the competition and maximize your profits.

Remember, regular evaluation and adjustment of financial plans is key to success in today's fast-paced business world.

Final Takeaways

As a founder of a startup, I know firsthand the importance of positive cash flow. It's the lifeblood of any business, and without it, you're dead in the water. When I first started AtOnce, I knew that I needed to focus on generating positive cash flow as soon as possible. I didn't have the luxury of waiting for months or even years to start seeing revenue. That's where AtOnce came in. Our AI writing and customer service tool helped us generate revenue from day one. By offering our services to businesses that needed help with their customer service, we were able to start generating positive cash flow almost immediately. AtOnce's AI writing tool allowed us to create high-quality content for our clients quickly and efficiently. This meant that we could take on more clients and generate more revenue without sacrificing the quality of our work. Our AI customer service tool was equally important. By automating many of the tasks associated with customer service, we were able to provide our clients with a high level of service without having to hire a large team of customer service representatives. Thanks to AtOnce, we were able to generate positive cash flow from day one. This allowed us to reinvest in our business, hire more employees, and continue to grow. Positive cash flow isn't just important for startups like AtOnce. It's essential for any business that wants to survive and thrive. By using tools like AtOnce, businesses can generate revenue quickly and efficiently, allowing them to focus on what they do best. So if you're struggling to generate positive cash flow for your business, consider using AtOnce. Our AI writing and customer service tools can help you start generating revenue from day one.Tired of struggling to come up with ideas for your blog posts, emails, and product descriptions?

Are you constantly racking your brain for the perfect headline or hook that will capture your audience's attention? Look no further than AtOnce's AI writing tool, the ultimate solution for all your writing needs. Discover the Benefits of AtOnce's AI Writing Tool- Save Time: With AtOnce, you'll never have to waste hours brainstorming or staring at a blank page again. Our powerful AI algorithms generate high-quality content in seconds, so you can focus on other important tasks.

- Improve Quality: Say goodbye to typos, awkward phrasing, and boring copy. AtOnce's AI tool creates engaging, well-written content that will impress your readers and elevate your brand.

- Boost SEO: Our tool uses cutting-edge SEO techniques to help you rank higher on search engine results pages. Watch your traffic and conversions soar as you effortlessly create optimized content.

- Increase Conversions: With AtOnce, you'll never miss an opportunity to convert leads into customers. Our AI tool helps you craft compelling calls to action and persuasive marketing copy that drives sales and revenue.

- Get Creative: Whether you're writing social media posts, ad copy, or product descriptions, AtOnce's AI tool helps you think outside the box and come up with fresh, innovative ideas that stand out from the competition.

- Easy to Use: AtOnce's AI tool is user-friendly and intuitive, with a simple interface that anyone can master in minutes.

- Cost-Effective: Hiring a professional copywriter can be expensive, but AtOnce's AI tool offers premium-quality content at an affordable price.

- Flexible: AtOnce's AI tool can be used for a wide range of purposes, from blog posts and emails to product descriptions and social media campaigns.

- Customizable: Our tool allows you to tweak and refine your content to fit your specific tone, style, and brand voice.

- Trustworthy: AtOnce's AI tool uses the latest security protocols and best practices to ensure that your data and content are safe and secure.

What are some ways to increase profits in 2023?

Some ways to increase profits in 2023 include reducing expenses, increasing prices, expanding your customer base, and improving your marketing strategies.

How can I improve my cash flow in 2023?

To improve your cash flow in 2023, you can try negotiating better payment terms with your suppliers, offering discounts for early payments from customers, and reducing inventory costs.

What are some common mistakes to avoid when trying to maximize profits in 2023?

Some common mistakes to avoid when trying to maximize profits in 2023 include neglecting to track expenses, failing to adapt to changing market conditions, and not investing in employee training and development.