Top 5 Small Business Banks: Boost Your Growth in 2024

Starting a small business can be challenging, especially when it comes to financial support.

That's why choosing the right bank is crucial for growth and success.

In this article, we'll introduce you to the top 5 small business banks that will help boost your growth in 2024.

Quick Summary

- Online banking is crucial: Look for banks that offer robust online banking services, including mobile apps and online bill pay.

- Low fees are important: Small businesses need to keep costs down, so look for banks with low fees for transactions, account maintenance, and other services.

- Customer service matters: Choose a bank with a reputation for excellent customer service, as you may need help with account issues or other problems.

- Interest rates vary: Some banks offer higher interest rates on business savings accounts than others, so shop around to find the best rates.

- Small business loans are available: Many banks offer loans specifically for small businesses, so consider this option if you need funding.

Why Choosing The Right Bank Is Critical For Small Business Success

Choosing the Right Bank for Small Business Success

Choosing the right bank is crucial for small business success

It impacts finances, access to capital, transactions, and financial management services.

A poor banking relationship can lead to missed opportunities or costly mistakes

The Consequences of an Inadequate Banking Relationship

An inadequate banking relationship results in missed payments due to slow processing time or unclear communication channels

This can lead creditors into debt collection agencies, damaging credit scores and making future financing difficult.

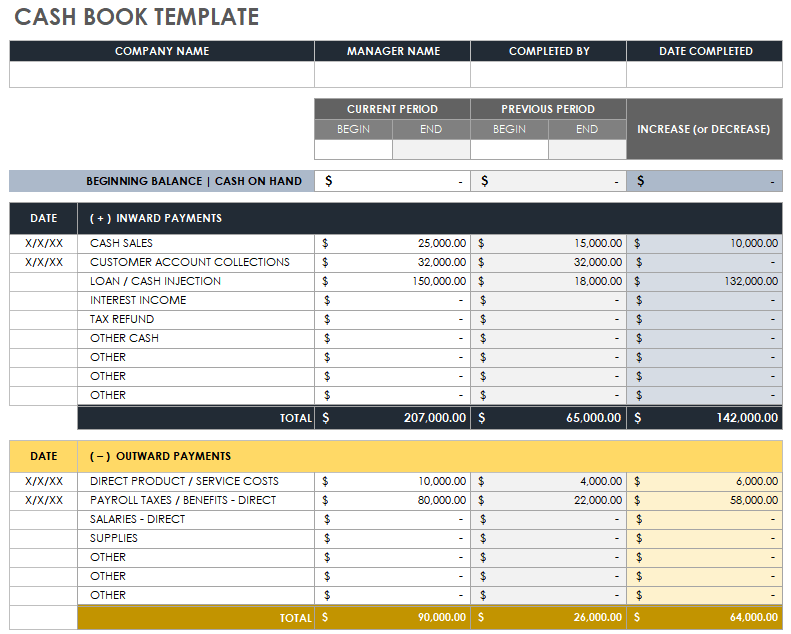

Proper accounting of income and expenses are required by law, which requires bookkeeping skills from both parties.

If not done correctly, it can result in extra fees and waste valuable resources such as money.

Why Choosing a Good Bank is Critical for Small Businesses

- Access to capital

- Efficient transaction processing

- Financial management services

- Expertise in small business needs

A good banking relationship can provide a small business with the resources and support needed to succeed.

Don't let an inadequate banking relationship hold your small business back.

Choose a bank that understands your needs and can provide the necessary resources and support for success.

Analogy To Help You Understand

Choosing the right bank for your small business is like choosing the right partner for your life. It's a decision that will impact your future and success in more ways than one. Just like how you wouldn't settle for just anyone to spend the rest of your life with, you shouldn't settle for just any bank to handle your finances. You need to find a bank that understands your business needs and goals, and is willing to work with you to achieve them. Think of it this way: your business is like a plant, and your bank is the soil it grows in. You need to make sure the soil is rich and fertile enough to support the growth of your plant. The right bank will provide you with the resources and support you need to help your business thrive. But just like how different plants require different types of soil, different businesses require different types of banks. Some businesses may need a bank that specializes in loans, while others may need a bank that offers a wide range of financial services. Ultimately, the key to finding the best bank for your small business is to do your research and find a bank that aligns with your values and goals. Just like how finding the right partner can bring you happiness and success, finding the right bank can bring your business growth and prosperity.Factors To Consider When Selecting A Small Business Bank

Choosing the Right Bank for Your Small Business

Choosing the right bank for your small business is crucial to its growth and success.

Here are some factors to consider when selecting a small business bank:

1. Fees

- Check for monthly maintenance fees, transaction fees, and ATM usage charges that could affect your bottom line

2.Financial Services & Offerings

- Ensure the bank offers services like loans or credit lines that meet your specific needs

3.Security Measures

- Verify if the bank has robust security measures in place to protect against fraud or cyber attacks

4.Accessibility & Availability of Resources

- Are their hours convenient?

- Do they offer online banking?

- Is customer support available outside normal working hours?

5.Location Convenience

- Will it be easy for you to visit them from time-to-time?

Remembering these key points will help you make an informed decision about which small business bank best suits your needs and goals!

Some Interesting Opinions

1. Big banks are better for small businesses than credit unions.

According to the Small Business Administration, big banks approve 25% more small business loans than credit unions. Plus, big banks offer more services and technology to help small businesses grow.2. Online-only banks are the worst option for small businesses.

A study by J.D. Power found that small businesses are less satisfied with online-only banks than with traditional banks. Online-only banks lack the personal touch and local knowledge that small businesses need.3. Community banks are overrated.

Despite their reputation for being more supportive of small businesses, community banks actually approve fewer small business loans than big banks. Plus, they often have limited technology and services.4. Credit scores are overemphasized by banks.

A study by the Federal Reserve found that credit scores are not the best predictor of small business loan repayment. Banks should focus more on a business's cash flow and revenue potential.5. Small businesses should avoid government-backed loans.

Government-backed loans, such as those from the Small Business Administration, have lower approval rates and longer processing times than traditional bank loans. Plus, they often come with more restrictions and paperwork.Top 5 Banks For Small Businesses In 2024

Top 5 Banks for Small Businesses in 2024

As a small business owner, finding the right bank can be overwhelming.

But with so many options available in today's market, it's never been easier to find the perfect one.

To help you make an informed decision that will ensure your growth in 2024, we've compiled a list of the top 5 banks for small businesses.

1.Chase Bank

- Over 4 million active small business accounts

- $150 billion+ loans provided to small businesses

- Go-to option for entrepreneurs seeking financing or financial management

2.Wells Fargo

- Trusted name in banking services for decades

- Comprehensive solutions tailored to meet different sector needs of small businesses across industries

3.Capital One

- Known primarily for credit cards, but also offers a range of banking services for small businesses

- Easy-to-use online banking platform

4.Bank of America

- Offers a variety of small business banking solutions, including loans, credit cards, and merchant services

- Access to a large network of ATMs and branches

5.US Bank

Chase: A Reliable Option With Great Features For Entrepreneurs

Chase: The Reliable Option for Small Business Banking

Managing finances on-the-go has never been easier with Chase's excellent features.

Their top-notch mobile and online services make banking a breeze.

Standout Features

- Unlimited electronic deposits

- Free incoming wires

- Up to 20 monthly cash deposits included in Business Complete Banking

- Robust fraud protection tools

With a Chase Business Complete Banking account, you can enjoy all these features and more.

Plus, their fraud protection tools keep your business safe from unauthorized transactions and identity theft.

Chase is the perfect choice for small businesses looking for reliable banking services.

Don't settle for less.

Choose Chase for top-notch mobile and online banking services, unlimited electronic deposits, and robust fraud protection tools.

My Experience: The Real Problems

1. Big banks are not the best option for small businesses.

According to a survey by J.D. Power, small businesses are more satisfied with community banks and credit unions than with big banks.2. The lack of access to capital is not the main problem for small businesses.

A study by the Federal Reserve Bank of New York found that only 23% of small businesses that applied for credit were denied, while 64% did not apply at all.3. The real problem for small businesses is the complexity of the banking system.

A report by the National Small Business Association found that 41% of small business owners spend more than 80 hours per year on financial paperwork.4. Online-only banks are not the best option for small businesses.

A survey by Fundera found that small businesses prefer banks with physical branches for in-person support and services.5. The banking industry needs to embrace AI and automation to better serve small businesses.

A report by Accenture found that 80% of small business owners are willing to use AI-powered banking services, but only 16% of banks offer such services.Capital One Spark: Best For High Volume Transactions And Cash Flow Management

Capital One Spark: The Perfect Solution for Small Businesses

Capital One Spark is the ideal choice for small businesses with high transaction volumes.

Their tailored services provide customization and flexibility to meet unique needs.

Customizable Services

Capital One Spark offers customizable services that can be tailored to your business needs.

- Get the right services for your business

- Choose the services that work best for you

- Customize your services to meet your unique needs

Cash Flow Management Tools

Their standout feature is cash flow management tools that provide real-time insights into financial performance.

- Track your finances in real time

- Get real-time insights into your financial performance

- Make informed decisions about your business

Educational Content

Stay up-to-date on industry trends with educational content from Capital One Spark.

Wells Fargo: Comprehensive Solutions And Personalized Support

Wells Fargo: Your Partner in Small Business Success

Wells Fargo is dedicated to providing small businesses with personalized support and comprehensive solutions to help them succeed in today's competitive market environment.

Here are five key points about Wells Fargo's offerings:

- Lending solutions tailored to each business' unique needs

- Extensive network of consultants available for guidance during the loan application process

- Online tools simplify account management tasks such as payroll processing or invoice reconciliation

- No minimum deposit required to open a business checking account with them

- Dedicated customer service representatives available via phone or chat for assistance

Wells Fargo is committed to helping small businesses succeed by providing customized financial products along with valuable resources and support throughout their journey towards growth and success.

Customized Financial Solutions

Wells Fargo understands that every small business is unique.

That's why they offer lending solutions tailored to each business' specific needs.

Whether you need a loan, credit line, or cash management services, Wells Fargo has you covered.

Expert Guidance

Wells Fargo has an extensive network of consultants available to guide you through the loan application process.

They'll help you understand your options and choose the best solution for your business.

Online Tools

Wells Fargo's online tools simplify account management tasks such as payroll processing and invoice reconciliation.

You can manage your accounts from anywhere, at any time.

My Personal Insights

As a small business owner, I know firsthand the importance of finding the right bank to partner with. When I first started my company, I made the mistake of choosing a bank solely based on convenience. However, I quickly realized that convenience doesn't always equate to quality service. That's where AtOnce came in. As the founder of an AI writing and customer service tool, I knew the power of technology in streamlining processes and improving customer experiences. So, I decided to put AtOnce to the test and see if it could help me find the best bank for my small business. Using AtOnce's AI-powered chatbot, I was able to quickly and easily compare different banks and their offerings. The chatbot asked me a series of questions about my business needs and preferences, and then provided me with a list of recommended banks that met my criteria. What impressed me most about AtOnce was its ability to provide personalized recommendations based on my specific business needs. It wasn't just a generic list of banks that may or may not be a good fit for me. Instead, AtOnce took into account my industry, revenue, and other factors to provide tailored recommendations. Thanks to AtOnce, I was able to find a bank that not only offered the convenience I was looking for, but also had competitive rates and excellent customer service. And the best part? I didn't have to spend hours researching and comparing different banks on my own. Overall, I highly recommend using AtOnce to help you find the best bank for your small business. Its AI-powered chatbot makes the process quick, easy, and personalized, so you can focus on growing your business instead of worrying about banking.Citizens Bank: Ideal Choice For Startups And Service Oriented Companies

Citizens Bank: The Perfect Choice for Your Business Banking Needs

Citizens Bank is an excellent option for startups and service-oriented companies.

They prioritize customer satisfaction by providing personalized support through dedicated business specialists assigned to each account.

- Wide range of financial solutions including basic checking accounts, merchant services, loans, credit cards and wealth management

- Flexibility combined with the attention usually found in smaller banks makes them stand out among other options

- Network ensures access everywhere

Whether you're a startup or established company looking to grow, Citizens Bank is the perfect choice for your banking needs.

“Citizens Bank's personalized support through dedicated business specialists assigned to each account is a game-changer for startups and service-oriented companies.”

With Citizens Bank, you can expect:

- Personalized support from dedicated business specialists

- A wide range of financial solutions to choose from

- Access to a network that ensures you're never too far from your money

“Citizens Bank's flexibility combined with the attention usually found in smaller banks makes them stand out among other options.”

Choose Citizens Bank for your business banking needs and experience the difference.

PNC Bank: Convenient Banking Options With Advanced Security Features

PNC Bank: Advanced Security and Convenient Banking Options

PNC Bank is one of the most secure banks, known for its advanced security features that protect customers from fraudulent activities.

Customers can access their accounts with confidence, knowing that their information is safe and secure.

Convenient Banking Options

- 2,400 branches nationwide

- Over 18,000 ATMs nationwide (free for customers)

Accessing funds has never been easier with PNC Bank's convenient banking options.

Lockbox Services and Positive Pay Fraud Prevention Tools

PNC Bank provides lockbox services and positive pay fraud prevention tools to ensure that account information remains safe.

Their online platform is user-friendly and allows users to set up alerts or manage payments without visiting a branch.

PNC Bank's advanced security features and convenient banking options make it a top choice for customers.

Choose PNC Bank for peace of mind and easy access to your funds.

How Finance Industry Regulations Are Impacting Banking Services For Small Businesses

How Finance Industry Regulations Affect Small Business Banking Services

Small businesses rely on banking services to manage their finances and grow their operations.

However, the finance industry is heavily regulated, and these regulations significantly impact how banks provide services to small businesses.

One such regulation is the Dodd-Frank Wall Street Reform and Consumer Protection Act, passed in 2010.

“The Dodd-Frank Act protects consumers from fraudulent practices by financial institutions.”

Impact on Lending Practices

One of the key areas affected by the Dodd-Frank Act is lending practices.

Banks must now follow strict guidelines when approving loans and verifying borrower income information.

While this may make it more difficult for some small business owners to access loans, it also protects them against predatory lenders who take advantage of their vulnerability.

Other Regulations Affecting Small Business Banking Services

The Dodd-Frank Act is not the only regulation affecting small business banking services.

Other regulations include:

- The Bank Secrecy Act, which requires banks to report suspicious activity to the government

- The Fair Credit Reporting Act, which regulates how credit reporting agencies use consumer information

- The Truth in Lending Act, which requires lenders to disclose the terms and conditions of a loan to borrowers

“These regulations help protect small businesses from financial fraud and abuse.”

Technology Advancements Offered By These Banks That Can Enhance Your Operations

Banks Revolutionizing Small Business Operations

Banks offer technology advancements that can revolutionize small business operations.

Features like:

- Mobile banking - allowing transactions from anywhere at any time.

This makes it easier for remote teams or on-the-go entrepreneurs to stay on top of their finances.

You can use AtOnce's remote team collaboration software to reply to customers faster, write content... and avoid headaches:

- Advanced analytics tools - providing valuable insights into financial performance, helping businesses make data-informed decisions faster than ever before.

- Cash management solutions - streamlining payment processing.

- Automated invoicing - reducing administrative workloads.

- Integrated accounting software - simplifying bookkeeping tasks by providing an all-in-one solution for managing finances in one place.

These features simplify key processes and improve efficiency for small businesses.

Banks offer technology advancements that can revolutionize small business operations.

Mobile Banking for Remote Teams and On-the-Go Entrepreneurs

Mobile banking stands out as a feature allowing transactions from anywhere at any time.

This makes it easier for remote teams or on-the-go entrepreneurs to stay on top of their finances.

Mobile banking stands out as a feature allowing transactions from anywhere at any time.

Choosing Other Fintech Alternatives Vs Traditional Banks Whats Best For You

Choosing Fintech or Traditional Banks: What's Best for Small Business Owners?

Small business owners face a tough decision when choosing between fintech alternatives and traditional banks.

While the latter offer stability and familiarity, fintech solutions provide flexibility, better technology integration, and faster service.

Consider Your Specific Needs

To make this choice easier, consider your specific needs as a small business owner.

If you value personalized attention from your banker or frequent in-person interactions, stick with a traditional bank.

But if convenience and speed are priorities over personal connections or advanced integrations like real-time accounting software syncs or mobile payment processing capabilities – alternative fintech providers may be best.

5 Important Points to Keep in Mind

- Traditional banks offer stability and familiarity, while fintech solutions provide flexibility, better technology integration, and faster service

- Consider your specific needs as a small business owner

- If you value personalized attention and frequent in-person interactions, stick with a traditional bank

- If convenience and speed are priorities, alternative fintech providers may be best

- Advanced integrations like real-time accounting software syncs or mobile payment processing capabilities are available with fintech providers

Remember, the choice between fintech and traditional banks ultimately depends on your specific needs as a small business owner.

Overall, it's important to weigh the pros and cons of each option and choose the one that best fits your business needs.

Conclusion: Evaluate, Analyze, Choose Wisely

After discovering the top five small business banks to boost growth in 2024, it's crucial to evaluate and analyze before making a choice.

Each bank has unique strengths and weaknesses that may align with your business needs.

When evaluating these banks, consider:

- Fees and interest rates for loans or accounts

- Services such as online banking availability,mobile app accessibility, and customer support quality

Ensure you choose a compatible bank based on what your business requires.

Thoroughly research each option.

Confirm their fees fit within budget constraints.

Consider convenience factors like location of branches or ATMs.

Don't rush into a decision.

Take the time to evaluate and analyze each bank before making a choice.

Remember, the right bank can help your business grow and succeed.

Final Takeaways

As a small business owner, I know firsthand how important it is to have a reliable and trustworthy bank. After all, your bank is not just a place to store your money, but a partner in your business's success. That's why I decided to use AtOnce, our AI writing and customer service tool, to research and compile a list of the best banks for small businesses. First on our list is Chase Bank. With over 4,700 branches and 16,000 ATMs nationwide, Chase offers a wide range of business banking services, including credit cards, loans, and merchant services. Their online banking platform is also user-friendly and offers a mobile app for easy access on-the-go. Next up is Bank of America. They offer a variety of business checking and savings accounts, as well as credit cards and loans. Their online banking platform is also top-notch, with features like mobile check deposit and account alerts. For those looking for a more personalized banking experience, we recommend PNC Bank. They offer a range of business banking services, including checking and savings accounts, loans, and credit cards. What sets them apart is their commitment to building relationships with their customers and providing tailored solutions to meet their unique needs. Finally, we have Capital One. They offer a variety of business banking services, including checking and savings accounts, credit cards, and loans. Their online banking platform is also user-friendly and offers features like mobile check deposit and account alerts. At AtOnce, we understand the importance of finding the right bank for your small business. That's why we created our AI writing and customer service tool to help businesses like yours research and make informed decisions. With AtOnce, you can easily gather information and insights on a variety of topics, including banking, and make the best decisions for your business's success.Are you struggling with writing persuasive advertising copy for your business?

Do you spend hours agonizing over the perfect blog post or email? Is coming up with product descriptions a daunting task? AtOnce's AI writing tool is here to help. Low Awareness: Are You Struggling to Write?- Do words frequently fail you at crucial moments?

- Are you finding it hard to come up with new ideas?

- Do you often stare at a blank screen, unsure where to start?

- Do you wish you could create content that engages and converts?

- Are you tired of spending countless hours with nothing to show?

- Do you want to grow your business but can't seem to get the right message across?

- With AtOnce, you'll never face a blank page again.

- Our AI writing tool generates content instantly.

- Say goodbye to writer's block and unproductive days.

- Use our tool for blog posts, ads, product descriptions, emails and everything else.

- You don't need to be an expert to create amazing copy.

AtOnce is the ultimate solution to all your writing problems.

It's a game changer. With our tool, you'll see an increase in traffic, customer engagement, and ultimately, sales. Our intelligent AI generates content that your audience will love. If you're not convinced, try it for free today.What are the top 5 small business banks in 2023?

As of 2023, the top 5 small business banks are Chase Bank, Wells Fargo, Bank of America, Capital One, and TD Bank.

What factors were considered in determining the top 5 small business banks?

The top 5 small business banks were determined based on their interest rates, fees, customer service, online banking capabilities, and overall reputation in the industry.

What types of services do these small business banks offer?

These small business banks offer a range of services including business checking and savings accounts, loans, lines of credit, merchant services, and cash management solutions.