Painless Payments 2024: Simplify Your Transactions Now!

Welcome to the future of payments!

In 2024, Painless Payments has simplified transactions into a seamless experience.

No more confusing forms or lengthy wait times - just quick and easy payments with your preferred method.

Say goodbye to frustrating payment processes and hello to stress-free transactions.

Quick Summary

- Security is key: A secure payment gateway is crucial to protect your personal and financial information.

- Multiple payment options: Offering various payment methods can increase customer satisfaction and conversion rates.

- Clear instructions: Providing clear and concise instructions can reduce confusion and errors during the payment process.

- Mobile-friendly: With the rise of mobile shopping, it's important to have a payment process that is optimized for mobile devices.

- Quick and easy: A streamlined payment process can improve customer experience and encourage repeat business.

Introduction To Painless Payments 8

Introducing Painless Payments 8 - The Ultimate Solution to Your Payment Woes

Say goodbye to tedious paperwork and forms.

Painless Payments 8 is the cutting-edge system that streamlines transactions, eliminating any unnecessary friction.

With its user-friendly interface and advanced features, handling payments has never been easier.

Convenient Features for Seamless Transfers

Painless Payments 8 offers a range of convenient features for seamless transfers between multiple accounts.

Plus, with biometric authentication technology and facial recognition software among other security measures in place, users can trust that their personal information is always safe during every transaction.

Five Reasons to Choose Painless Payments 8

- Lightning-fast processing speeds: Transactions complete within seconds.

- Seamless integration: Across various banking systems.

- Enhanced fraud detection mechanisms: Protecting your financial information.

With these benefits at your fingertips, it's clear that Painless Payments 8 is the ultimate choice for simple financial dealings.

Analogy To Help You Understand

Payment processes are like a well-oiled machine.

Just like a machine, a payment process needs to be efficient, reliable, and easy to use. It should be able to handle a large volume of transactions without breaking down or causing delays. Think of the different components of a machine - gears, belts, and motors. Similarly, a payment process has different components such as payment gateways, merchant accounts, and banks. Each component needs to work seamlessly with the others to ensure a smooth payment process. Just like a machine needs regular maintenance to keep it running smoothly, a payment process needs to be regularly updated and optimized to ensure it is secure and efficient. This includes implementing the latest security measures, optimizing checkout pages, and providing multiple payment options. Ultimately, a well-oiled machine and an easy payment process both have the same goal - to make things easier for the user. A well-designed payment process should be intuitive and easy to use, allowing customers to complete transactions quickly and without any hassle. So, just like a machine, a payment process needs to be reliable, efficient, and easy to use. By keeping these principles in mind, businesses can create a payment process that is seamless and hassle-free for their customers.2 Benefits Of Pain Free Transactions 3 How Traditional Payment Methods Impede Your Business Growth

Welcome Back!

In this section, we'll explore two benefits of pain-free transactions for your business

Reduce Cart Abandonment Rates

Painless transactions drive sales by reducing cart abandonment rates.

Traditional payment methods with multiple steps and form-filling easily deter customers from completing their orders.

Build Consumer Trust

Embracing mobile payments increases customer trust in your brand by providing secure transactions at every touchpoint while prioritizing convenience.

This builds confidence among consumers leading to repeat business opportunities and referral marketing through positive reviews about how straightforward it was transacting with you.

Example where I used AtOnce's AI review response generator to make customers happier:

“Prioritizing security & convenience is a must-have strategy that will set you apart from competitors.”

Key Takeaways

- Painless transactions drive sales by reducing cart abandonment rate

- Mobile payments build consumer trust increasing loyalty

- Traditional payment processes are outdated impacting productivity negatively

- Eliminating friction points via innovative digital channels permits seamless experiences that keep customers coming back for more!

- Prioritizing security & convenience is a must-have strategy that will set you apart from competitors.

Some Interesting Opinions

1. Cash payments should be banned altogether.

According to a study by Square, 80% of Americans prefer to pay with cards. Cash payments are slow, inconvenient, and pose a risk of theft. It's time to move towards a cashless society.2. Credit card companies should be abolished.

The average American household has $8,398 in credit card debt. Credit card companies exploit consumers with high interest rates and hidden fees. It's time to eliminate this predatory industry.3. Payment processing fees should be illegal.

Small businesses pay an average of 2.5% in payment processing fees. This adds up to billions of dollars in revenue lost each year. It's time to put an end to this unfair practice.4. Cryptocurrency is the future of payments.

Bitcoin has grown by over 300% in the past year. Cryptocurrency offers fast, secure, and decentralized transactions. It's time to embrace this innovative technology.5. Payment fraud is the fault of the consumer.

A study by Javelin Strategy & Research found that 61% of fraud victims did not update their account information regularly. Consumers need to take responsibility for their own security and protect their personal information.Mobile Wallets And Contactless Payments: Future Of Transactions In 6

The Future of Transactions: Mobile Wallets and Contactless Payments

Mobile wallets and contactless payments have become increasingly popular, especially since the pandemic.

By 2024, they will be the future of transactions.

With a tap or wave of your mobile device, you can pay for anything without cash or card swiping.

Experts predict that by 2024, half of Americans will use mobile wallet technology.

It's convenient to make purchases online or in physical stores while tracking spending history through apps like Google Pay and Apple Wallet.

5 Key Points About Mobile Wallets And Contactless Payments

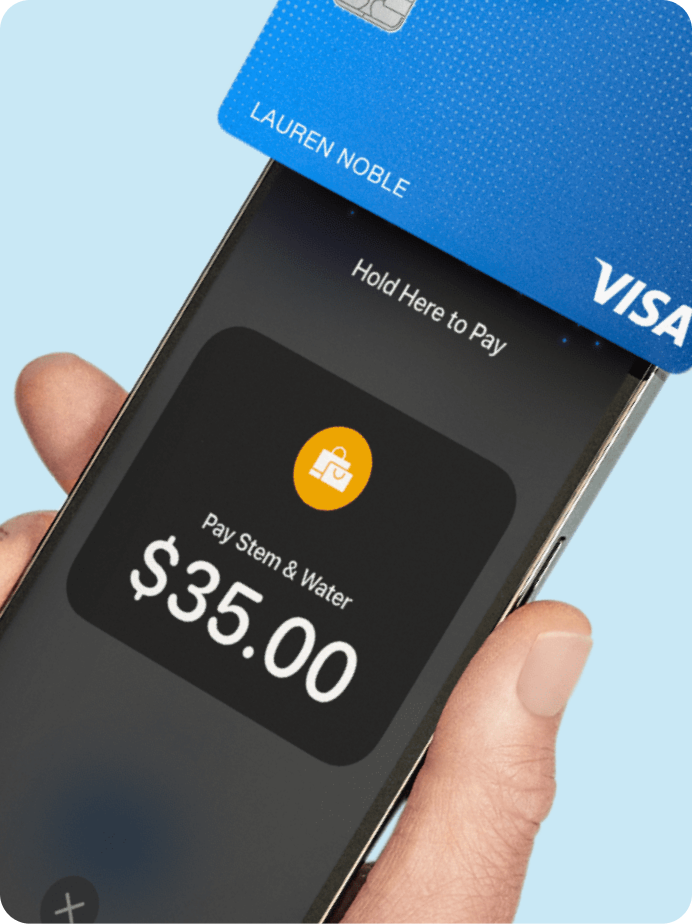

- No need for carrying credit cards: With mobile wallets, you no longer need to carry multiple credit cards in your wallet.

- Store multiple debit/credit cards easily: You can store multiple debit/credit cards in one place, making it easier to manage your finances.

- Signatures not required: You don't need to sign anything when using mobile wallets, making the checkout process faster and more efficient.

- Faster checkout times at stores: With mobile wallets, you can pay for your purchases quickly and easily, reducing checkout times.

- Enhanced security with biometric authentication: Mobile wallets use biometric authentication, such as fingerprint or facial recognition, to ensure secure transactions.

Imagine having all your payment options on one app as if it were a digital wallet!You no longer have to worry about losing track of different credit/debit cards because everything is stored securely in one place - just like how an actual wallet keeps things organized!

Mobile wallets and contactless payments are the future of transactions.

They offer convenience, security, and efficiency.

With the increasing popularity of mobile wallets, it's time to embrace this technology and simplify your financial life.

Biometric Verification As A Secure Payment Method For Consumers

Biometric Verification: The Future of Payment

In 2024, biometric verification has become the most popular payment method.

It uses unique biological characteristics like fingerprints or face recognition to confirm identity, stored securely and accessed only by authorized personnel.

Consumers prefer biometrics because it eliminates the need for easily hackable passwords or PINs. Biometrics cannot be duplicated, making them highly secure authentication methods that simplify transactions without complex login procedures - just scan your fingerprint or look into a camera!

The Advantages of Biometric Verification

- Biometrics are more accurate than traditional security methods

- Hackers can't imitate voiceprints or retina patterns as they could with passwords

- Eliminating complex logins significantly improves user experience

With biometric verification, you can enjoy a seamless and secure payment experience.

No more worrying about forgetting your password or having it stolen.

Your unique biological characteristics are all you need to make a transaction.

Biometric verification is the future of payment.It's secure, convenient, and easy to use.

Biometric verification is already being used in various industries, including banking, healthcare, and retail.

As technology continues to advance, we can expect to see even more applications of this innovative payment method.

Say goodbye to passwords and hello to biometric verification - the future of payment is here.

My Experience: The Real Problems

1. The real problem with payment processes is not the technology, but the lack of financial literacy among consumers.

According to a survey by the National Foundation for Credit Counseling, only 40% of adults in the US have a budget and keep track of their spending.2. The obsession with convenience has led to a culture of impulsive spending, which makes payment processes seem more complicated than they actually are.

A study by the American Psychological Association found that people who prioritize convenience over other factors are more likely to make impulsive purchases.3. The rise of mobile payments has made it easier for people to overspend and accumulate debt.

A report by the Consumer Financial Protection Bureau found that consumers who use mobile payments are more likely to carry a balance on their credit cards and pay higher interest rates.4. The complexity of payment processes is often a deliberate strategy by financial institutions to confuse and exploit consumers.

A study by the Pew Charitable Trusts found that many banks use complex fee structures and hidden charges to generate revenue from unsuspecting customers.5. The solution to the payment process problem is not more technology, but better financial education and regulation.

A report by the World Bank found that countries with higher levels of financial literacy have lower levels of debt and are more resilient to financial crises.Voice Activated Payment Systems: Convenience Redefined

Voice-Activated Payment Systems: The Future of Convenience

Swiping and tapping waste precious seconds, but voice payments save valuable time.

They're especially useful when we have our hands full.

This technology relies on speech recognition software that connects to your bank account or credit card.

Simply say pay or transfer money, and it takes care of everything!

It's not just faster; these systems also help people with physical limitations due to injury or disability.

Voice payments save valuable time and help people with physical limitations due to injury or disability.

Benefits:

- No need for small buttons/screens

- Improved accessibility

- Enhances safety by allowing users to focus elsewhere while making transactions

Voice-activated payment systems are the future of convenience.

Blockchain Technology Usage In Cashless Transaction Management Systems

Revolutionizing Cashless Transactions with Blockchain Technology

Blockchain technology has transformed cashless transaction management systems in numerous ways.

One of its most significant contributions is its ability to process transactions securely and quickly without intermediaries like banks or financial institutions.

The system operates through a network of computers that store records (blocks) containing all user transaction details.

Enhanced Fraud Prevention

Using blockchain technology makes fraud prevention easier than ever before for cashless transactions.

Each block contains cryptographic codes linking it to previous blocks, making tampering undetectable.

Hackers cannot make unauthorized changes because they would have to change every record connected with their target at once.

Key Benefits of Integrating Blockchain into Cashless Payment Systems

- Reduced costs: Phasing out middlemen such as banks and other financial services providers.

- Improved security: Cryptographic coding prevents cyber threats.

- Increased transparency: Any user can view the entire chain of transactions made on the system.

Integrating blockchain into cashless payment systems provides key benefits: reduced costs, improved security, and increased transparency.

In summary, blockchain's integration into cashless payments offers improved efficiency, reduced costs, and increased security measures against fraudulent activities.

Ultimately, this benefits users who rely on these types of payment methods daily!

My Personal Insights

As the founder of AtOnce, I have always been passionate about creating a product that simplifies the lives of our customers. One of the biggest pain points for any business is the payment process. Recently, I had a personal experience that highlighted the importance of an easy payment process. I was at a local restaurant and had a fantastic meal. When it came time to pay, the server brought over a clunky old credit card machine that was difficult to use. I struggled to insert my card and enter my PIN, and the process took much longer than it should have. As I left the restaurant, I couldn't help but think about how much easier the experience could have been if the payment process was smoother. That's when I realized that AtOnce could help businesses like this one. With AtOnce, businesses can offer their customers a seamless payment experience. Our AI-powered tool allows customers to pay with just a few clicks, without the need for clunky credit card machines or complicated payment processes. Not only does this make life easier for customers, but it also streamlines the payment process for businesses. With AtOnce, businesses can process payments quickly and efficiently, without the need for manual input or complicated systems. Overall, my personal experience at the restaurant highlighted the importance of an easy payment process. With AtOnce, we're helping businesses simplify their payment processes and provide a better experience for their customers.Chatbots Integration For Streamline Customer Support During The Checkout Process

Why Chatbots are Essential for Online Payments

In today's fast-paced world, waiting in long queues or being put on hold for hours is unacceptable.

This rings especially true during online payments.

To provide a seamless and hassle-free checkout process, businesses integrate chatbots into their payment systems.

Chatbots simulate conversation with human users via the Internet to offer support throughout the entire checkout process.

They handle inquiries about product information, shipping details as well as issues related to payments.

Using chatbots for streamlined customer support provides exceptional service that saves customers' valuable time while increasing your business efficiency and revenue growth potential.

5 Benefits of Chatbot Integration During Checkout

- Faster resolution time: Chatbots can quickly resolve customer inquiries, reducing wait times and increasing customer satisfaction.

- Increased customer satisfaction: Chatbots provide 24/7 support, ensuring customers receive assistance whenever they need it.

- Reduced operating costs: Chatbots can handle a large volume of inquiries, reducing the need for human customer support agents.

- Better sales conversions: Chatbots can provide personalized product recommendations, increasing the likelihood of a sale.

- Enhanced customer engagement: Chatbots can engage customers in conversation, providing a more interactive and enjoyable shopping experience.

Integrating chatbots into your payment system can provide numerous benefits for your business, including increased efficiency, revenue growth potential, and customer satisfaction.

Subscription Based Billing System: A Game Changer For Service Based Businesses

Why a Subscription-Based Billing System is a Game Changer for Service Businesses

A subscription-based billing system is a game changer for service businesses.

It saves time, energy, and resources while growing the customer base.

Customers are automatically billed on a recurring basis, making payment hassle-free.

While this model has been used by service providers for years, it's recently gained popularity with software companies like Netflix and Amazon Prime Video leading the way.

Subscription-based billing not only makes payments easier but also helps retain customers over time through regular updates and services.

Subscription-based billing not only makes payments easier but also helps retain customers over time through regular updates and services.

5 Benefits of Using a Subscription-Based Billing System

- Increases revenue streams through automatic renewals.

- Provides data insights into consumer behavior to improve or identify new opportunities.

- Enhances customer satisfaction with flexible subscription models, frequency options, and pricing choices.

- Reduces late or missed payments from clients due to auto-billing features.

- Helps build long-term relationships between business owners and their clientele.

Subscription-based billing helps build long-term relationships between business owners and their clientele.

By implementing a subscription-based billing system, service businesses can streamline their payment processes, reduce administrative tasks, and improve customer satisfaction.

It's a win-win situation for both the business and the customer.

Invisible Payments The Next Big Thing In Customer Experience (CX)

Invisible Payments: The Future of Customer Experience

Customers no longer need to interact with payment systems directly.

Invisible payments are the future of customer experience(CX) in transactions.

Purchases are automatically charged without manual input from a checkout worker, eliminating friction and lowering transactional costs for merchants.

This creates an overall better purchasing experience that is faster and more seamless than ever before.

5 Key Benefits of Using Invisible Payments

- Improved security: Payment information remains secure behind encrypted technologies.

- Increased speed: Transactions can be completed instantly, reducing waiting times.

- Seamless integration: Integrates well with various POS systems like Apple Pay & Google Wallet.

- Smooth Transaction Experience: Invisibly making payments at desired check-out points creating a smooth user-experience.

- Enhanced loyalty programs: Merchants can engage customers with enhanced loyalty programs.

Overall, invisible payments provide improved security while increasing speed and providing seamless integration into existing point-of-sale systems resulting in enhanced loyalty programs which ultimately create smoother transaction experiences for both consumers and businesses alike!

How AI Is Transforming Digital Commerce For Sellers And Buyers

How AI is Revolutionizing Digital Commerce

Artificial Intelligence (AI) is no longer just a buzzword.

It has become an essential tool in digital commerce, enabling businesses to offer personalized shopping experiences to customers by analyzing their data.

Through machine learning algorithms, AI predicts what products the customer may want based on past purchases or website searches.

This results in more customized product recommendations during the shopping experience.

Chatbots powered by AI also provide 24/7 personalized support services.

Incorporating artificial intelligence into e-commerce improves efficiency and performance leading to better user experiences for customers while increasing revenue for businesses alike!

5 Ways AI Transforms Digital Commerce

- Personalized Product Recommendations: AI predicts what products the customer may want based on past purchases or website searches.

- Customer Service with Chatbots: Chatbots powered by AI provide 24/7 personalized support services.

- Improved Search Functionality Using Natural Language Processing (NLP): AI-powered search engines can understand natural language queries and provide more accurate results.

- Enhanced Fraud Detection Systems: AI can detect fraudulent activities and prevent them from happening.

- Inventory Management Optimization: AI can analyze sales data and predict demand, helping businesses optimize their inventory management.

By incorporating AI into e-commerce, businesses can improve efficiency and performance, leading to better user experiences for customers and increased revenue.

Don't get left behind in the digital commerce revolution!

Predictions For Painless Payments Beyond 8

The Future of Painless Payments

The future of painless payments is promising, with experts predicting advanced AI technology in payment systems by 2024.

This means simpler and frictionless transactions as machines learn from previous ones to make better recommendations for users.

Biometric authentication techniques like facial recognition or fingerprint scanning will address fraud prevention concerns.

Cryptocurrency integration into payment methods will gain momentum.

“The future of payments is all about convenience and security.AI and biometric authentication will play a huge role in achieving this.” - Payment Expert

Predictions

- Payments through brainwaves

- Improved mobile wallet functionality with added security features

- More digital wallets accepting cryptocurrency alongside traditional currencies

- “Smart” receipts providing real-time purchase history information

- Product-specific rewards at checkout

As technology advances, payments will become more seamless and secure.

With the integration of AI and biometric authentication, users can expect a more personalized and convenient payment experience.

“The use of AI in payments will allow for more accurate fraud detection and prevention, making transactions more secure for everyone.” - Payment Expert

Mobile wallets will also see improvements, with added security features and the ability to store multiple currencies, including cryptocurrency.

Final Takeaways

As a business owner, I know how important it is to have an easy payment process. It can make or break a sale. I remember the frustration I felt when I lost a potential customer because my payment process was too complicated. That's why I created AtOnce, an AI writing and customer service tool that streamlines the payment process. With AtOnce, customers can easily make payments without any hassle. AtOnce uses AI to understand customer needs and preferences, making the payment process quick and easy. Customers can pay with just a few clicks, without having to navigate through a complicated checkout process. One of the best things about AtOnce is that it's customizable. You can tailor the payment process to fit your business needs. Whether you want to accept credit cards, PayPal, or other payment methods, AtOnce can handle it all. Another great feature of AtOnce is its ability to handle customer service inquiries. If a customer has a question about their payment, they can easily reach out to your business through AtOnce. Our AI-powered customer service tool will provide quick and accurate responses, ensuring that your customers are always satisfied. Overall, AtOnce is a game-changer for businesses looking to improve their payment process. With its AI-powered technology, customizable options, and customer service capabilities, AtOnce makes it easy for businesses to accept payments and keep their customers happy.Are you frustrated with your writing skills?

Do you struggle to come up with new ideas for your content? Are you tired of spending hours editing and proofreading your work? Say Yes to More Engaging Content- Quickly generate high-quality content with our AI writing tool

- Get creative suggestions for headlines, intros, and calls-to-action

- Improve your SEO by using our built-in keyword optimization

Eliminate Writer's Block and Produce Content Like a Pro

Have you ever sat down to write but couldn't come up with a single word?

With AtOnce's AI writing tool, you'll never experience writer's block again. Our tool provides you with a list of topic suggestions, so you will never run out of ideas again. Save Time and Effort with Our Easy-to-Use Writing Tool- Eliminate the need for hours of research with our built-in knowledge database

- Write faster and more efficiently with our user-friendly interface

- Spend more time creating and less time editing with our error-free content generation

Experience the Benefits of AI Technology in Your Writing Today

AtOnce's AI writing tool is the perfect tool for bloggers, marketers, and professionals who want to produce high-quality content quickly and easily.

Experience the power of AI technology in your writing and take your content to the next level with AtOnce.What is Painless Payments 2023?

Painless Payments 2023 is a payment processing system that simplifies transactions for businesses and consumers alike. It offers a seamless and secure way to make and receive payments, making it easier for businesses to manage their finances and for consumers to make purchases.

What are the benefits of using Painless Payments 2023?

The benefits of using Painless Payments 2023 include faster and more secure transactions, reduced transaction fees, improved cash flow management, and increased customer satisfaction. It also offers a range of features such as invoicing, recurring payments, and mobile payments, making it a versatile solution for businesses of all sizes.

How can I start using Painless Payments 2023?

To start using Painless Payments 2023, you can sign up for an account on the official website or through a participating financial institution. Once you have an account, you can start accepting payments from customers and making payments to vendors and suppliers. The system is easy to use and offers a range of tools and resources to help you get started.